Better Artificial Intelligence (AI) Pick for 2026: Alphabet or Nvidia Stock?

Key Points

Meta Platforms may purchase Alphabet's TPUs.

Nvidia still owns the majority of the data center computing market.

Nvidia's 2026 growth rate is expected to be far greater than Alphabet's.

- 10 stocks we like better than Alphabet ›

Nvidia (NASDAQ: NVDA) was the gold standard of AI investing up until a few weeks ago. Now, that notion is being challenged by an unlikely source: Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Alphabet isn't what investors think of when they think about AI computing hardware, but recent developments may be pushing Alphabet in that direction.

Furthermore, Alphabet has other AI endeavors that could push it over the edge to make it a better stock pick than Nvidia. However, Nvidia still expects monster growth that Alphabet can only dream of. Which company makes for the better investment in 2026? I think it depends on your appetite for risk.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Alphabet and Nvidia are starting to compete

Traditionally, Alphabet and Nvidia haven't been competitors. Nvidia supplied its graphics processing units (GPUs) that can be used to train artificial intelligence models and run other computing workloads in a cloud computing environment, and Alphabet bought them. However, Alphabet started developing an alternative to GPUs a while back: tensor processing units (TPUs).

In a head-to-head match where these computing units have to run multiple workload types, Nvidia's GPUs would win hands down. However, if you had a very specific workload and that's the only workload these computing units saw during their lifespan, TPUs would win and have the benefit of being lower-priced.

This may make TPUs attractive for some use cases, but not all of them. That's why Alphabet only used TPUs for internal use or made them available to rent through Google Cloud. But that may be changing. Recently, Alphabet and Meta Platforms were in the headlines on reports that Alphabet was considering selling TPUs to Meta. This would mark the first time that TPUs were made available for outside purchase, and investors started to wonder if this could be a major crack in Nvidia's business model.

However, I don't think Nvidia investors have anything to worry about. Nvidia's GPUs are still the top choice for many companies, even if they're expensive. In Nvidia's results for its fiscal 2026 third quarter, CEO Jensen Huang noted that the company is "sold out" of cloud GPUs. That quote provides some important context when comparing Alphabet and Nvidia, as it may indicate that Meta had to turn to alternative computing sources because it couldn't obtain the computing power it desired from Nvidia.

If that's the case, then Nvidia investors have nothing to worry about. But if Alphabet starts selling its TPUs openly (there haven't been any confirmed reports that it's actually going to do this), and Nvidia starts losing business to it, then Nvidia investments could be in trouble.

I think Nvidia will be fine over the long term. After all, there is a massive computing market available.

The data center buildout will reach extreme levels by 2030

By 2030, Nvidia projects that global data center capital expenditures will reach $3 trillion to $4 trillion annually. That's a monster number, and if it pans out, there will be plenty of room for companies like Nvidia and Alphabet to thrive selling computing hardware. While that may seem like an outlandish projection, investors must realize that Nvidia knows more than the average investor because it can see orders already placed years in advance. Nvidia could be wrong on the actual dollar figure, but it's likely right in the trend.

This indicates monster growth for Nvidia, and Wall Street analyst projections back this up. For fiscal year 2027 (ending January 2027), they expect Nvidia to deliver 48% revenue growth to $316 billion. Contrast that with Alphabet's projection of 14% growth to $454 billion, and it's clear that Nvidia is expected to have a far more successful 2026 than Alphabet is.

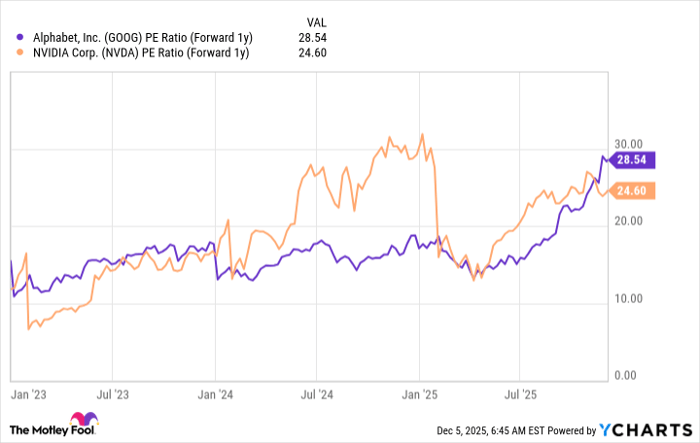

Furthermore, Alphabet's stock is actually more expensive than Nvidia's when you value the stocks using next year's projected earnings.

GOOG PE Ratio (Forward 1y) data by YCharts. PE = price-to-earnings.

I think this makes Nvidia the better stock pick for 2026, but if Nvidia starts to lose significant market share to another competitor or Alphabet, don't be surprised if Alphabet is the better performer. Furthermore, if the AI hyperscalers don't announce record-setting data center capital expenditures for 2027 after setting records each of the previous years, Nvidia's stock may struggle.

It all boils down to whether the AI data center buildout continues. If it does, Nvidia will be a top pick. If it doesn't, Alphabet is a far better investment option.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Keithen Drury has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.