US dollar index fluctuates! What will be its future trend?

Market Review

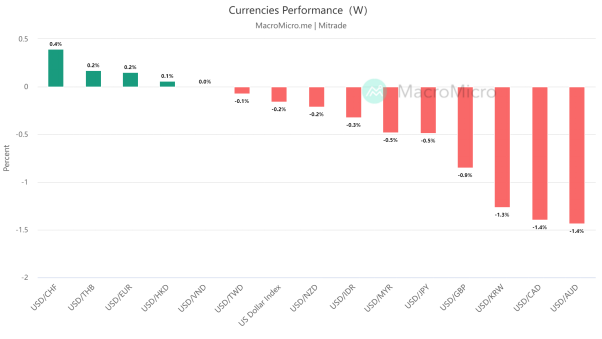

Last week (5/29-6/2), the US dollar index fell 0.2%, while most non-US currencies rose.

【Source: MacroMicro Date2023/5/29-2023/6/2】

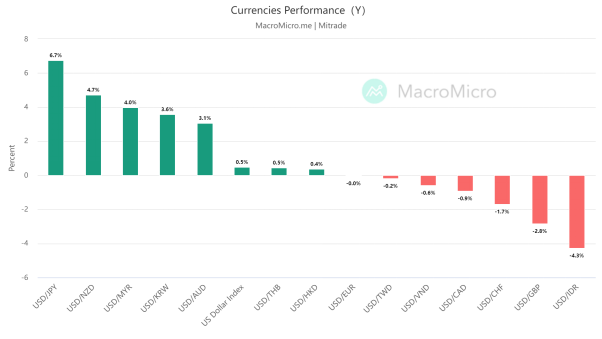

【Source: MacroMicro Date2023/1/1-2023/6/2】

1.What will be the future trend of the US Dollar Index as it experiences fluctuations?

Last week, the US dollar index fell slightly by 0.2% and showed a fluctuating trend. Looking back from 2023 to now, the US dollar index has risen slightly by 0.5% and has also been performing in a fluctuating manner, fluctuating between the range of 100 to 106.

【Source: TradingView 】

Whenever the market approaches the lower boundary of the range, the US dollar index will initiate a phased rebound. Why is this so?

There are two main reasons. Firstly, the uncertain interest rate cycle of the Federal Reserve. The resilience of the economy and inflation has prolonged the Fed's interest rate cycle and suppressed expectations of a rate cut in the second half of the year. Currently, the market expects at least one more round of interest rate hikes, and fluctuations in interest rate expectations will affect US bond yields, thereby impacting the US dollar.

Secondly, non-US economies have been weaker than expected. European economic data has been poor, especially with Germany's GDP contracting for two consecutive quarters. In contrast, the US economy has been better than previously expected, and global capital has been selectively pursuing US assets, supporting the resilience of the US dollar.

Mitrade analyst:

There is a possibility of another interest rate hike by the Federal Reserve in the second half of the year, and the significant issuance of debt following the debt ceiling agreement will provide short-term support for the US dollar. However, in the medium to long term, as the US economy slows down and interest rate hikes come to an end, the US dollar index will once again enter a downward trend, with an expected dip below 100 within the year.

2.The euro remained flat against the US dollar, with hopes of regaining strength in the second half of the year

In the first half of 2023, the euro initially rose and then fell against the US dollar, with a net change of 0 and ultimately ending flat. Since May, with the weakening of economic data in the eurozone and the strengthening of economic data in the United States, previous euro longs have taken profits, leading to a continuous downward trend in the euro since May.

Will the euro return to strength in the future? Our view remains unchanged: Yes.

The European Central Bank (ECB) maintains a relatively hawkish stance, driving market expectations for higher interest rates and supporting the euro to remain strong for most of the second half of the year.

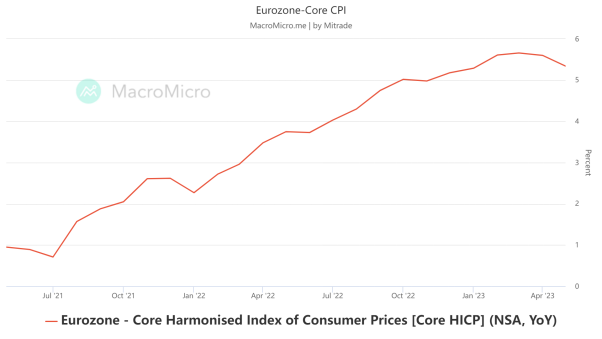

The core inflation in the Eurozone remains high, and wage growth has reached a historical high, which supports the ECB to continue its rate hike pace at the next two meetings and further narrow the German-US interest rate differential, thereby supporting the euro.

【Source: MacroMicro 】

Mitrade analyst:

The trend of EUR/USD exchange rate is expected to be volatile in the second half of the year, but in the medium to long term, given that the European Central Bank's interest rate hike cycle lasts longer than that of the Federal Reserve, the EUR/USD exchange rate will generally show an upward trend with fluctuations.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.