Forex Today: US Dollar consolidates weekly gains as focus shifts to US confidence data

Here is what you need to know on Friday, July 18:

The action in financial markets remain relatively subdued early Friday and the US Dollar (USD) Index consolidates its weekly gains at around 98.50. In the second half of the day, Housing Starts and Building Permits data for June will be featured in the US economic calendar. Later in the American session, the University of Michigan will release the Consumer Sentiment Index for July.

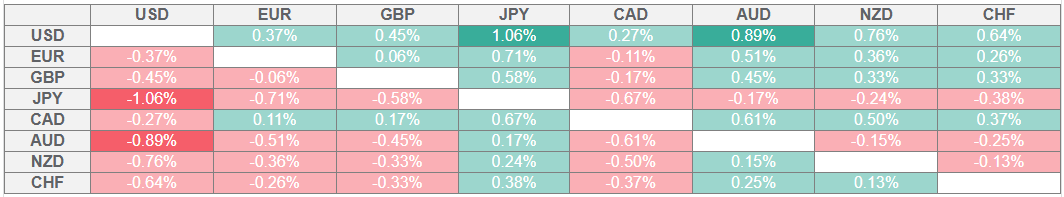

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD gathered strength against its rivals on the back of upbeat macroeconomic data releases on Thursday. Retail Sales in the US rose by 0.6% on a monthly basis in June, surpassing the market expectation for an increase of 0.1% by a wide margin, and weekly Initial Jobless Claims declined to 221,000 from 228,000 in the previous week. The USD Index gained more than 0.3% on the day and the S&P 500 and the Nasdaq Composite indexes both closed at new record highs, rising 0.55% and 0.75%, respectively.

Meanwhile, Federal Reserve (Fed) Governor Christopher Waller said late Thursday that he continues to believe that the Fed should cut its interest rate target at the July meeting, citing mounting economic risks and the strong likelihood that tariff-induced inflation will not drive a persistent rise in price pressures.

After touching its lowest level in three weeks below 1.1560 on Thursday, EUR/USD benefits from the modest USD weakness early Friday and trades in positive territory above 1.1600. The European economic calendar will feature Construction Output data for May.

GBP/USD clings to modest daily gains above 1.3400 after closing virtually unchanged on Thursday.

AUD/USD stages a rebound after posting large losses on Thursday and trades at around 0.6500 in the European session on Friday.

Following Wednesday's sharp decline, USD/JPY rose about 0.5% on Thursday. The pair holds its ground early Friday and edges higher toward 149.00.

Gold dropped below $3,310 in the early American session on Thursday but erased a large portion of its daily losses to close near $3,340. XAU/USD struggles to find direction early Friday and fluctuates in a narrow channel near $3,345.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.