USD/CHF struggles to hold the fresh over-a-decade low around 0.8000 on US Dollar’s continued underperformance.

Investors worry that Fed Powell’s replacement on the grounds of contrarian view with Trump will put Fed’s credibility in danger.

The SNB anticipated a 1%-1.5% growth GDP growth for the current year.

The USD/CHF pair trades with caution near an over-a-decade low around 0.8000 during the Asian session on Friday. The Swiss Franc pair struggles to find ground as the US Dollar (USD) continues to face selling pressure amid worries over the autonomous status of the Federal Reserve (Fed) and uncertainty surrounding the completion of the 90-day tariff deadline on July 9.

During Asian trading hours, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades cautiously near a fresh three-and-a-half year low around 97.00.

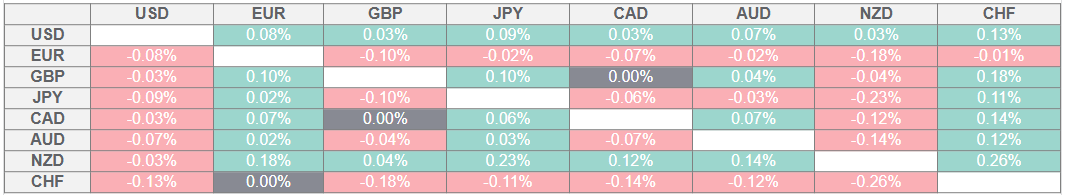

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The safe-haven appeal of the US Dollar has diminished significantly as United States (US) President Donald Trump lashes out on Fed Chair Jerome Powell again this week for not supporting monetary policy expansion and officials have confirmed that the President will select Powell’s successor by the Summer, Wall Street Journal (WSJ) reported.

Such a scenario raises concerns over the credibility of the Fed, assuming that decisions of Trump’s contender will be biased towards his economic agenda.

Meanwhile, investors are also concerned over the completion of 90-day tariff deadline on July 9 as Washington has not closed major bilateral deals with whom it does a majority of business, such as the Eurozone, China, and Japan.

In Friday’s session, investors will focus on the US Personal Consumption Expenditure Price Index (PCE) data for May, which will be published at 12:30 GMT.

In the Swiss region, the Q2 Swiss National Bank (SNB) Quarterly Bulletin showed that the economic growth will be impacted by global trade risk. The central bank expects the Gross Domestic Product (GDP) growth in a range between 1% and 1.5% for the year as a whole.

Last week, the SNB brought interest rates to 0% to counter cooling inflationary pressures and kept the door open for pushing them in the negative territory if downside price pressures risk still persist.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.