Tesla Rises — Then Falls Back: Wall Street Loves the Robotaxi Story, But Fundamentals Tell Another Tale

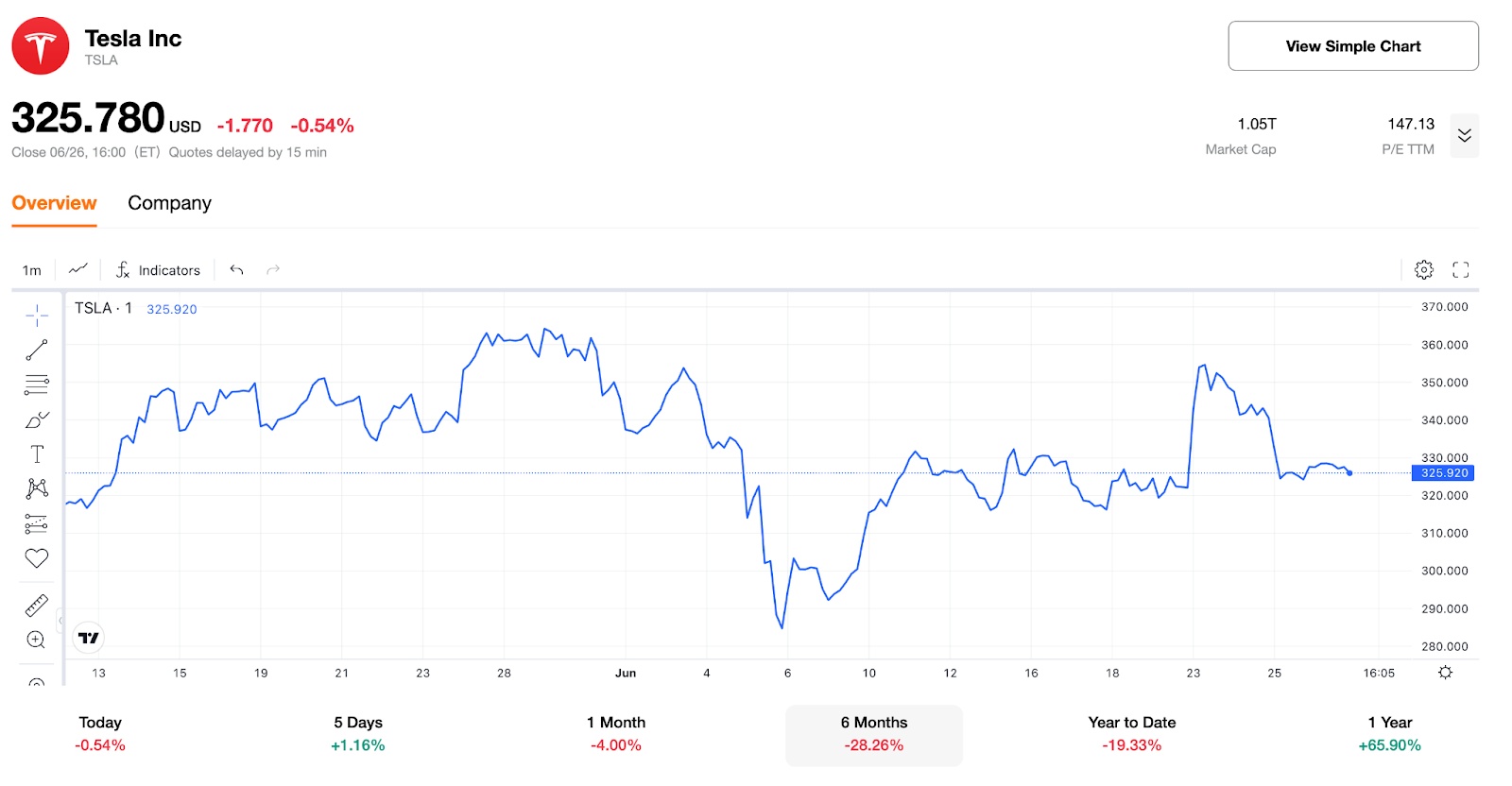

TradingKey - Tesla’s rally may have been short-lived — after its much-anticipated Robotaxi event in Austin last weekend, shares surged 8.23% on Monday , reaching a new three-week high and drawing strong positive sentiment from Wall Street. However, by June 26 , Tesla had already given back all of those gains, signaling growing investor caution.

Analyst Mickey Legg from Benchmark Company recently raised his price target on Tesla to $475 , maintaining a “Buy ” rating. His estimate ranks as the second-highest among analysts tracked by FactSet , just below Dan Ives of Wedbush Securities , who set a $500 target following the weekend auto industry conference.

Legg emphasized that Tesla is undergoing a significant transformation — shifting from being primarily an automaker to a high-tech automation and robotics company with strong manufacturing capabilities. He believes Tesla’s camera-based approach to full self-driving offers a notable cost advantage and better scalability , positioning the company for long-term leadership in AI-driven mobility.

In a recent note, Piper Sandler also reaffirmed its bullish stance, stating that the Robotaxi has the potential to reshape the future of the automotive industry and reinforce Tesla’s technological edge.

Still, not all voices are optimistic. This week, UBS slightly raised its price target to $215 but kept its “Sell ” rating intact. The firm argued that although projects like Robotaxi and the Optimus humanoid robot point toward a promising future, these expectations are already largely priced into the stock, increasing the risk of a valuation correction.

It's also worth noting that Tesla faced executive turnover on April 26 , when Omead Afshar , head of global automotive operations, reportedly left the company. Meanwhile, Tesla reported a year-over-year profit drop of 71% in Q1 , with deliveries hitting their lowest level in two years — both of which raise concerns about execution quality and strategic focus.

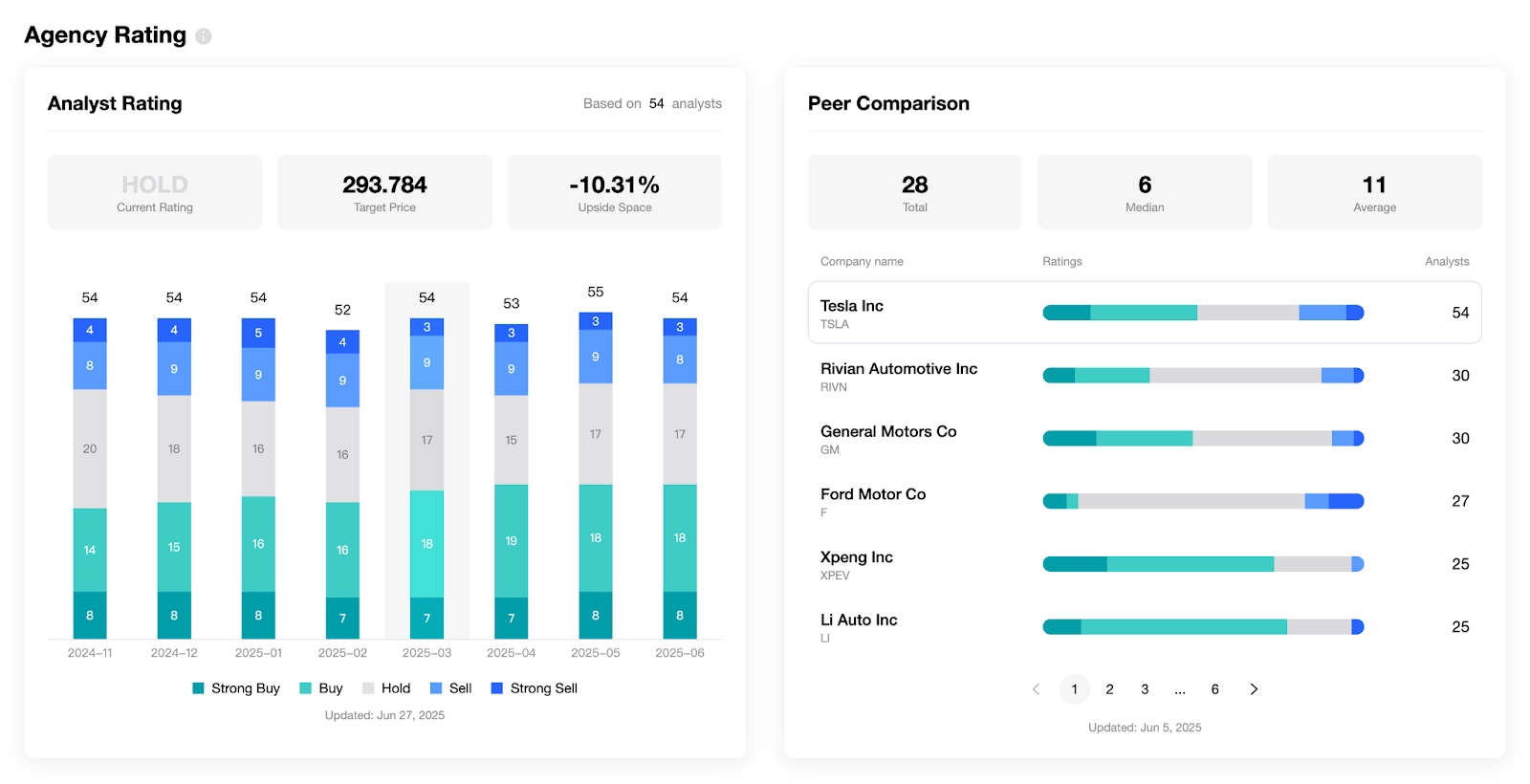

According to data tracked by TradingKey , the average analyst price target for Tesla stands at $293.8 , significantly below current trading levels. This wide gap indicates that investors should remain cautious, as large deviations between consensus estimates and actual prices can signal overvaluation or excessive optimism.

[Click here to preview institutional investor holdings and sentiment on Tesla]