The Bank of Japan Learns from the Fed’s Strategic Vagueness – Citing the Term: Underlying Inflation

TradingKey - Much like Federal Reserve Chair Jerome Powell, officials at the Bank of Japan (BOJ) have taken an ambiguous stance on further monetary policy adjustments. Despite meeting the prerequisite for rate hikes — inflation above the 2% target — the BOJ has maintained a relatively dovish posture, citing the vaguely defined concept of "underlying inflation."

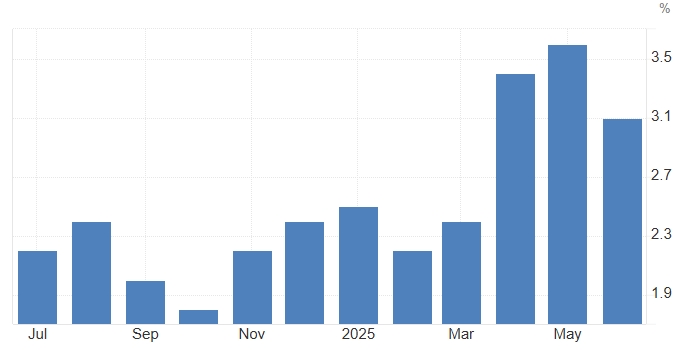

Data show that Japan’s June Tokyo core CPI (excluding fresh food) slowed to 3.1% year-over-year from 3.6%, while the core-core CPI (excluding both fresh food and energy) also eased from 3.3% to 3.1%. Both figures remain above the BOJ’s 2% inflation target.

Tokyo Core CPI YoY, Source: Trading Economics

Nonetheless, the BOJ is now placing greater emphasis on so-called "underlying inflation", a term it uses to describe inflation driven by domestic demand and wage growth rather than volatile categories like food and energy prices. However, the BOJ has yet to clearly define this metric, only stating that this version of inflation remains below its 2% target.

Former BOJ official Nobuyasu Atago said the central bank's approach is unprecedented and lacks a track record of successfully anchoring inflation expectations — which explains why it resorts to such vague terminology.

He added that this ambiguity complicates communication and makes it difficult for markets to understand the BOJ’s true intentions.

This kind of strategic vagueness bears a striking resemblance to how Fed Chair Powell has navigated recent congressional testimony. While emphasizing uncertainties around tariffs and the risk of inflation rebounding, Powell also hinted that inflation may not prove as persistent as feared, leaving room for earlier-than-expected rate cuts.

Analysts note that concerns over domestic consumption and global economic weakness have muddied the BOJ’s efforts to manage inflation expectations — a challenge Japan has struggled with for decades amid entrenched deflationary pressures.

BOJ Governor Kazuo Ueda acknowledged the difficulties in resetting inflation expectations and precisely measuring underlying inflation. The BOJ has succeeded in moving inflation away from zero, but has not yet anchored it at 2% — which is why the bank continues to maintain an accommodative monetary stance.

According to Reuters, although there is currently no single indicator to measure underlying inflation, the BOJ may refer to recalibrated metrics such as weighted median and mode inflation. These indicators are indeed still below 2%.

Additionally, medium- and long-term inflation expectations — currently between 1.5% and 2% — may also serve as a reference point for BOJ policymakers.

Divisions Within the BOJ

In reality, there is significant disagreement within the BOJ over how to interpret inflation trends. Some board members argue that for ordinary households, the rising costs of food and daily necessities are far more relevant than abstract concepts like underlying inflation.

For example, Japanese rice prices surged over 100% year-on-year in May, while in June, rice prices in Tokyo rose 89%, chocolate prices jumped 48%, and coffee bean prices increased by 50%.

Some BOJ members argue that across various measures, the underlying inflation rate is already very close to 2%.

The BOJ’s basic stance remains unchanged: as long as inflation stabilizes above 2%, the central bank will continue raising interest rates.

Most economists expect the BOJ to raise rates by 25 basis points as early as early 2026. Since launching its tightening cycle in 2024, the BOJ has raised rates three times, lifting the benchmark interest rate to 0.5%.