Australian Dollar dips as RBA rate cut signals easing inflation trends, cooling employment

- Trump’s Greenland Tariff Suspension: Crypto Prices Rebound as Investors Weigh Rally Longevity

- When is the US President Trump’s speech at WEF in Davos and how could it affect EUR/USD

- Gold nears $4,700 record as US–EU trade war fears ignite haven rush

- Fed Rate Decision Looms as Apple, Microsoft, Meta and Tesla Q4 Earnings Draw Attention: Week Ahead

- US-Europe Trade War Reignites, Bitcoin’s $90,000 Level at Risk

- Australian Dollar rises as employment data boosts RBA outlook

The Australian Dollar depreciated as the RBA decided to cut interest rates for the third time in 2025.

Australia’s Wage Price Index rose 0.8% QoQ, as expected.

US Consumer Price Index rose 2.7% YoY, while the annual core CPI climbed by 3.1% in July.

The Australian Dollar (AUD) declines on Wednesday after registering gains in the previous session. The AUD/USD pair remains subdued following the release of Wage Price Index data for the second quarter. The Aussie Dollar faces challenges after the Reserve Bank of Australia (RBA) cut rates for the third time in 2025, indicating easing inflation and modest cooling in labor market conditions.

Australia’s Wage Price Index rose 0.8% quarter-over-quarter in the second quarter, as expected. The reading came below the previous 0.9% increase. Meanwhile, the annual reading came at a 3.4% increase, above the expected 3.3% rise.

The RBA delivered a 25 basis points (bps) interest rate cut, as widely expected, bringing the Official Cash Rate (OCR) to 3.6% from 3.85% in August. RBA Governor Michele Bullock stated that current forecasts suggest cash rates may need to be reduced to ensure price stability. However, Bullock emphasized the Board’s meeting-by-meeting approach and refrained from making any commitments on rate moves should financial markets experience a bout of volatility.

The downside of the AUD/USD pair could be restrained as the US Dollar (USD) weakened after the release of mixed Consumer Price Index (CPI) data from the United States (US). The AUD also draws support as the Trump administration postponed the implementation of sweeping tariffs on China for an additional 90 days, just hours before the previous agreement between the world’s two largest economies was set to expire.

China also decided to suspend additional tariffs on US goods for the same period, following Trump’s executive order extending the tariff truce. It is essential to note that any changes in the Chinese economy could impact the Australian Dollar, as China and Australia are close trade partners.

Australian Dollar loses ground as US Dollar steadies following recent losses

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is holding ground after registering nearly 0.5% losses in the previous session and trading around 98.10 at the time of writing.

The US Consumer Price Index (CPI) climbed 2.7% year-over-year in July, matching the 2.7% increase seen in the prior month, and came in below the expected 2.8% increase. Meanwhile, the annual core CPI rose by 3.1% in July, compared to the 2.9% rise seen in June, above the market consensus of 3%.

Markets are now pricing in approximately 94% odds of a Fed rate cut at the September meeting, up from 86% a day ago, according to the CME FedWatch tool.

Fed Governor Michelle Bowman stated on Saturday that three interest rate cuts are likely to be appropriate this year. Bowman added that the apparent weakening in the labor market outweighs the risks of higher inflation to come.

Federal Reserve Bank of San Francisco President Mary Daly said last week that the Fed still has some ground to cover on its fight with inflation pressures despite overall progress. Daly highlighted that the Fed may be forced to act soon without having the full picture.

Boston Fed President Susan Collins and Fed Board of Governors member Lisa Cook cautioned that persistent uncertainty remains a major obstacle to effective policy transmission and challenges the central bank’s ability to manage interest rates efficiently.

The National Bureau of Statistics of China reported on Saturday that China’s Consumer Price Index (CPI) year-over-year was unchanged in July following a 0.1% increase in June. The figure came in above the market consensus of -0.1%. Meanwhile, the Producer Price Index (PPI) declined 3.6% YoY, against the expected decline of 3.3% and the previous 3.6% decline.

The RBA’s monetary policy statement noted that inflation has continued to moderate. The outlook remains uncertain. It reaffirmed that maintaining price stability and full employment remains the top priority.

Australian Dollar pulls back toward nine-day EMA support near 0.6500

AUD/USD is trading around 0.6520 on Wednesday. Technical analysis on the daily chart suggests a prevailing bullish bias as the pair remains within the ascending channel pattern. Additionally, the pair is still remaining above the nine-day Exponential Moving Average (EMA), signaling that short-term momentum is strengthening. The 14-day Relative Strength Index (RSI) is positioned at the 50 level, suggesting a neutral market bias. Further movement will indicate a clear directional trend.

On the upside, the AUD/USD pair may target the upper boundary of the ascending channel around 0.6580. A successful breach above the channel could reinforce the bullish bias and support the pair to explore the area around the psychological level of 0.6600, followed by the nine-month high at 0.6625, which was recorded on July 24.

The AUD/USD pair could test its immediate support at the nine-day EMA of 0.6511, followed by the 50-day EMA at 0.6501 and the ascending channel’s lower boundary around 0.6490. A break below this crucial support zone would weaken the short- and medium-term price momentum and put downward pressure on the pair to test the two-month low of 0.6419, recorded on August 1, followed by a three-month low at 0.6372, recorded on June 23.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

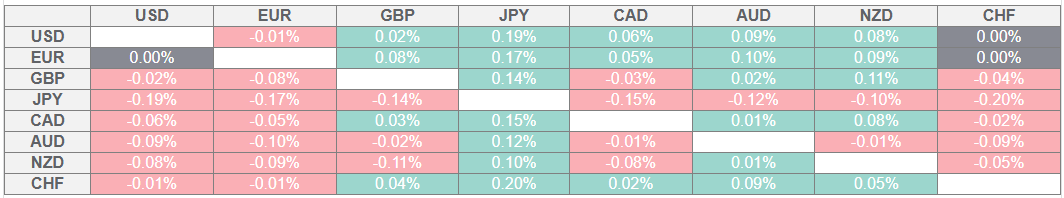

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.