Australian Dollar loses ground due to rising expectations of RBA’s rate cut in May

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

The Australian Dollar remains under pressure as the US Dollar strengthens, supported by signs of easing US-China tensions.

China’s move to exempt certain US imports from its 125% tariffs has sparked some optimism for better trade relations.

The Federal Reserve is in its blackout period ahead of the May 7 Federal Open Market Committee meeting.

The Australian Dollar (AUD) extends loses for the second successive session on Monday. The AUD/USD pair is under pressure as the US Dollar (USD) strengthens amid signs of easing tensions between the US and China.

China exempted certain US imports from its 125% tariffs on Friday, according to business sources. The move has fueled hopes that the prolonged trade war between the world's two largest economies might be drawing to a close.

However, Reuters cited a Chinese embassy spokesperson on Friday, who firmly denied any current negotiations with the US, stating, "China and the US are not having any consultation or negotiation on tariffs." The spokesperson urged Washington to "stop creating confusion."

The AUD also faces headwinds as expectations are mounting that the Reserve Bank of Australia (RBA) will deliver another 25-basis-point rate cut in May, as economic uncertainties deepen and concerns over the global trade environment intensify.

Australian Dollar falls as US Dollar gains ground amid easing US-China concerns

The US Dollar Index (DXY), which measures the USD against six major currencies, gains ground for the second successive day, trading near 99.60 at the time of writing. The Federal Reserve (Fed) is in blackout mode ahead of its May 7 Federal Open Market Committee (FOMC) meeting.

US Agriculture Secretary Brooke Rollins said on Sunday, as reported by Reuters, that the Trump administration is holding daily discussions with China regarding tariffs. Rollins emphasized that talks were ongoing and that trade agreements with other countries were also "very close."

Michael Hart, President of the American Chamber of Commerce in China, remarked that it's encouraging to see the US and China reviewing tariffs. Hart noted that while exclusion lists for specific categories are reportedly in the works, no official announcements or policies have been released yet. Both China’s Ministry of Commerce and the US Department of Commerce are currently gathering input on the matter.

The US Department of Labor (DOL) reported on Thursday that initial applications for unemployment benefits rose for the week ending April 19. Initial Jobless Claims increased to 222,000, slightly above expectations and up from the previous week’s revised figure of 216,000. Meanwhile, Continuing Jobless Claims declined by 37,000, falling to 1.841 million for the week ending April 12.

US Treasury Secretary Scott Bessent acknowledged on Wednesday that current tariffs—145% on Chinese goods and 125% on US goods—are unsustainable and must be lowered for meaningful dialogue to begin.

National Economic Council Director Kevin Hassett, President Trump's chief economic adviser, stated that the US Trade Representative (USTR) has 14 meetings scheduled with foreign trade ministers. Hassett also noted that 18 written proposals have been received from these ministers. According to Hassett, China remains open to negotiations.

Westpac forecasted on Thursday that the Reserve Bank of Australia (RBA) would lower interest rates by 25 basis points at its upcoming May 20 meeting. The RBA has adopted a data-driven approach in recent quarters, making it difficult to predict its actions beyond the next meeting with confidence.

A Beijing official reiterated on Thursday that no "economic and trade negotiations" with US were underway and stressed that the US must "completely cancel all unilateral tariff measures" to pave the way for talks.

China's Finance Ministry stated on Friday that global economic growth remains sluggish, with tariffs and trade wars continuing to undermine economic and financial stability. The ministry urged all parties to enhance the international economic and financial system through stronger multilateral cooperation, per Reuters.

Australian Dollar remains below 0.6400; resistance appears near nine-day EMA

The AUD/USD pair is trading around 0.6390 on Monday, with the daily chart showing a bullish bias. The pair continues to hold above the nine-day Exponential Moving Average (EMA), while the 14-day Relative Strength Index (RSI) remains firmly above the 50 level, suggesting sustained upward momentum.

On the upside, immediate resistance is seen at the recent four-month high of 0.6439, posted on April 22. A decisive break above this level could pave the way for a rally toward the five-month high at 0.6515.

Initial support is aligned at the nine-day EMA of 0.6367, followed by stronger support near the 50-day EMA at 0.6305. A sustained drop below these levels would weaken the bullish setup and could lead to deeper losses, with the March 2020 low near 0.5914 coming into view.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

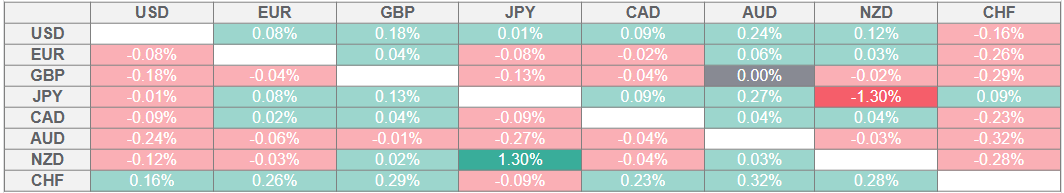

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.