EUR/USD trades lower on positive US data and weak Eurozone confidence numbers.

The risk-on mood following Trump’s decision to delay tariffs on Europe has favoured the US Dollar rather than the Euro.

The Euro is under growing bearish momentum, with 1.1260 support in focus.

EUR/USD is trading lower, around 1.1306 at the time of writing, for the second consecutive day in the early European session on Wednesday. The US Dollar (USD) is appreciating across the board, favoured by upbeat data and easing trade concerns.

Investors welcomed a significant recovery in US Consumer Confidence, which had been deteriorating during the previous six months. The survey revealed that the percentage of Americans expecting a recession in the coming months also declined.

These figures offset the decline in April’s US Durable Goods Orders, which highlights the negative impact of US President Donald Trump’s chaotic tariff policy on business and manufacturing.

Beyond that, market sentiment remains buoyed by Trump's decision to delay levies on Eurozone products. The US Dollar Index (DXY) has bounced about 1% from one-month lows, as fears of a new front in the trade war and its potential impact on global economic growth have eased.

In the Eurozone, US Consumer Confidence data failed to impress, and European Central Bank’s (ECB) member François Villeroy suggested that the bank has more room to cut interest rates. This added negative pressure on the Euro.

Euro PRICE Today

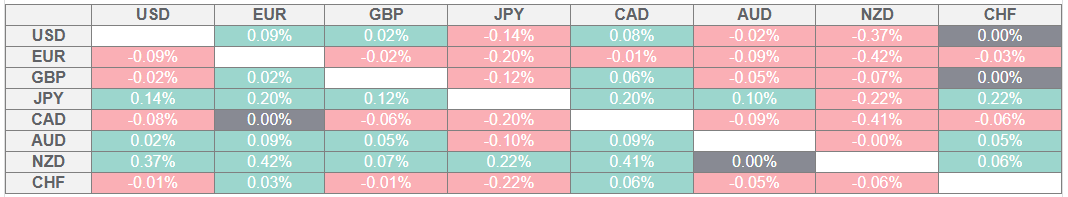

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Canadian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The Euro suffers against a firmer US Dollar

US Conference Board’s Consumer Confidence Index improved to 98.0 in May, up from 85.7 in April. The survey showed improved expectations for income, business conditions, and employment, while fears of a recession in the next 12 months receded.

US Durable Goods Orders headline figure, on the other hand, declined by 6.3%, on the back of falling aircraft demand. April’s numbers came slightly better than the 7.9% fall anticipated by the market, failing to dent the US Dollar’s recovery.

In Europe, the German GFK Consumer Confidence Survey showed a mild improvement to -19.9 from the previous -20.8, but still remains at extremely low levels.

The Eurozone Consumer Confidence remained unchanged at -15.2. The Economic Sentiment Indicator and Industrial Confidence data are improving moderately, but not enough to provide any significant support to the Euro.

The focus today will be on the release of the minutes from the last Federal Reserve (Fed) meeting, which might provide further clues about the central bank’s next monetary policy steps.

Technical analysis: EUR/USD broke trendline support and eyes the 1.1260 level

EUR/USD is correcting lower after last week’s impulsive rally. The pair´s reversal has extended below the bottom of the ascending channel, and bears are eyeing support at 1.1255, the May 22 low, ahead of the May 19 lows at 1.1220.

On the upside, the pair might retest the reverse trendline, now at 1.1345, before extending lower. Above here, the next resistance is located at the May 27 and 26 highs,1.1400 and 1.1420, respectively.

EUR/USD 4-Hour Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.