Nvidia CEO says Chinese AI firms are filling the void left by US companies

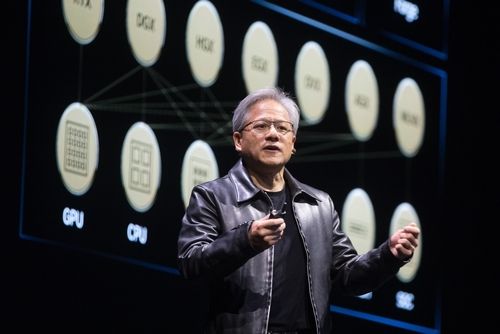

Huang even argued that Chinese tech has grown more advanced. He said, “The Chinese competitors have evolved,” adding that Huawei Technologies Co., despite US restrictions, has become “quite formidable.”

Nvidia’s Huang says Chinese companies are looking for chip manufacturing alternatives

Recently, the US government imposed restrictions on Nvidia’s H20 model exports to China, citing concerns of possible military use. The controls have so far cost the company $2.5 billion in the first quarter. For this quarter, the chip maker is expecting a loss of $8 billion.

During an earnings call on Wednesday, Huang called for the government to ease its restrictions. He contends that such restrictions should buttress American platforms rather than drive half of the world’s AI talent toward its rivals. In addition, he argued that the controls are not restraining China from leveraging cutting-edge AI tech but are instead pushing consumers to homegrown alternatives.

He believes its major clients like Tencent Holdings Ltd have been forced to shift to Huawei products since they cannot rely on their US suppliers.

Additionally, Huang clarified that the tech gap between China and America is progressively smaller, saying Chinese companies are “quadrupling capabilities every year.” He noted that Huawei’s newest AI chip rivals the performance of its H200, a top-tier offering until recently replaced.

Huang added, “You cannot underestimate the importance of the China market. This is the home of the world’s largest population of AI researchers.”

He emphasized that allowing Chinese open-source models like DeepSeek and Qwen to operate on Nvidia chips offers US companies important visibility in global AI development.

The Trump administration is considering export controls on EDA technologies to China

Aside from restrictions imposed on Nvidia, the Trump administration is considering more controls against Chinese exports. According to sources familiar with the matter, President Donald Trump directed software firms that design semiconductors to stop selling their services to Chinese groups.

The US Commerce Department reportedly issued letters to Cadence, Synopsys, and Siemens EDA asking them to halt the supply of their electronic design automation (EDA) technologies.

The Commerce Department has not confirmed whether it sent any letters to these companies. However, it claimed that it was assessing exports with strategic implications for China and, in the meantime, has, in some cases, either paused existing licenses or added new licensing conditions.

In a call with analysts, Synopsys CEO Sassine Ghazi claimed he had neither received a letter nor had any recent communication with the Commerce Department’s Bureau of Industry (BIS) and Security.

While policy changes are still uncertain, it’s clear that any move to cut off American software will disrupt Chinese businesses and chip consumers.

A former Commerce Department official even claimed that restricting chip and software designs to China is the “true choke point.” He added that they’ve been considering restrictions on EDA tools since the first Trump administration, but they were termed too aggressive.

Synopys owes the Chinese market 16% of its yearly revenue, while Cadence depends on the market for at least 12% of its revenue. Moreover, Synopsys still works with Nvidia, Qualcomm, and Intel for its software and hardware.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.