USD/CAD trades near 1.3800 after pulling back from weekly highs as Oil prices rise

USD/CAD loses ground as the Canadian Dollar receives support from improved crude Oil prices.

WTI price advances amid easing tariff risks and expectations of tighter supply.

A US federal court has blocked Trump to impose broad "Liberation Day" tariffs from taking effect.

USD/CAD loses ground after registering gains in the previous two consecutive sessions, trading around 1.3820 during the European hours on Thursday. The pair depreciates as the commodity-linked Canadian Dollar (CAD) receives support from improved crude Oil prices.

West Texas Intermediate (WTI) Oil price extends its gains for the second successive day, trading around $62.60 per barrel at the time of writing. Crude Oil prices receive support from improving market sentiment from reduced tariff risks and prospects of tighter supply.

The latest CPI report showed headline inflation fell in Canada mainly due to a carbon tax cut, but core inflation rose, which is closely gauged by the Bank of Canada (BoC). Therefore, traders remain uncertain on whether the Bank of Canada will deliver another rate cut next week. Canada’s Gross Domestic Product Annualized for the first quarter, due on Friday, will be observed to gain insights into the Canadian economy.

Additionally, the USD/CAD pair depreciates as the US Dollar (USD) retreats from weekly high of 100.53 marked on Thursday. The US Dollar Index (DXY), which measures the value of the Greenback against six major currencies, is trading around 100.00 at the time of writing. Traders likely await the preliminary US Q1 Gross Domestic Product (GDP) data, Personal Consumption Expenditures Prices QoQ, and Initial Jobless Claims, scheduled to be released on Thursday.

The US Dollar received support as halting of US President Donald Trump's "Liberation Day" tariffs from taking effect by a federal court. A three-judge panel at the Court of International Trade in Manhattan ruled Trump of lacking the authority and declaring the executive orders issued on 2 April unlawful.

The Trump administration, on April 2, announced higher duties on imports from countries with large trade surpluses, such as China and the European Union, with introducing a 10% baseline tariff on most goods entering the US. Trump appears unlikely to back down as posted on his social media app Truth Social that he is on a "Mission from God".

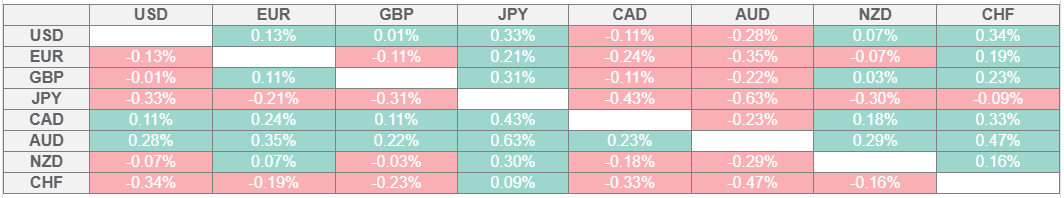

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.