EUR/USD extends losses as the USD is boosted in a risk-relief rally.

The market has welcomed a US court decision to block trade tariffs.

In Europe, weak macroeconomic figures keep acting as a headwind for the Euro recovery.

EUR/USD is trading with moderate losses, around 1.1275 at the time of writing, after bouncing up from 1.1213 lows on the back of a significant US Dollar (USD) jump, following a US court ruling against trade tariffs.

The three judges from the US Court of International Trade have voted unanimously against US President Donald Trump’s sweeping trade tariffs, as they consider that the exclusive authority to regulate commerce resides with Congress.

The news has boosted risk appetite, triggering significant rallies on the US Dollar and sending Asian Stock markets higher. Eurozone and Wall Street futures are also pointing to a positive opening.

Investors have welcomed the court ruling. Trump’s tariffs had fuelled concerns that higher inflationary pressures and a weaker economic outlook would pose a headache to the Federal Reserve (Fed), as the minutes of the last monetary policy meeting revealed.

The US Government, however, appealed the sentence quickly, which suggests that a lengthy process will follow. This might halt the relief rally at some point, but so far, the positive market mood has reversed the “Sell America” trade.

Euro PRICE Today

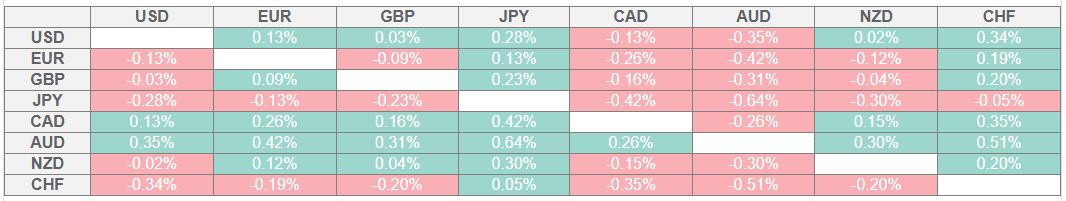

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The Dollar jumps as a US court blocks trade tariffs

The US Court of International Trade has invalidated with immediate effect Trump’s “Liberation Day” tariffs and instructed the administration to issue orders reflecting the ruling within the next ten days. The government appealed the sentence, questioning the court’s authority.

The US Dollar Index (DXY), which measures the value of the Greenback against six major currencies, has returned above the 100.00 psychological level and is trading about 1.8% above last week’s lows.

The news on levies has also prompted investors to pare back Fed easing hopes. Futures markets are now pricing an average of 42 basis points of interest rate cuts this year, down from 50 earlier this week.

On Wednesday, the Minutes of the last Federal Reserve meeting reflected the central bank’s concerns about the risks of stagflation. Such a scenario would force the Fed to prioritize one of its two mandates: promoting employment or fighting inflation, which would deteriorate investors’ confidence in the US Dollar and other US assets.

Eurozone macroeconomic data failed to inspire on Wednesday. German Unemployment Rate remained steady at 6.3% despite a higher-than-expected increase in layoffs. France’s Nonfarm Payrolls declined to -0.1% against expectations of 0%, and Consumer Spending rose well below forecasts, 0.3% against 0.8%.

In the US calendar today, the second estimation of the first quarter’s GDP and several Fed speakers will provide some fundamental background for the US Dollar ahead of Friday’s all-important Personal Consumption (PCE) Price Index release.

Technical analysis: EUR/USD is on a negative trend, with support at 1.1215 in play

EUR/USD is going through a bearish correction after last week’s impulsive rally. The pair broke and confirmed below the ascending channel’s bottom, before finding some support at the May 20 low at 1.1215.

Price action is showing a mild recovery, yet with technical indicators well within bearish territory on the 4-hour chart. Upside attempts are likely to be challenged at a previous intraday support in the 1.1285 area and the reverse trendline, now at 1.1315.

Below the mentioned 1.1215 support area, the next targets are 1.1130 (May 16 low) and 1.1065 (May 12 low).

EUR/USD 4-Hour Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.