XRP lose steam, risks 20% decline despite Donald Trump's presidential executive order

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

XRP investors realized over $500 million in profits in the past 48 hours.

Short-term holders are responsible for most of the selling activity following CME's clarification on XRP futures.

XRP could decline nearly 20% to $2.62 as bulls show signs of exhaustion.

Ripple's XRP declined 3% in the early trading hours on Friday as on-chain and technical indicators signify that bulls are losing steam.

XRP short-term holders show weakness, books over $500 million in profits

XRP showed no signs of recovery despite the positive developments of US President Donald Trump signing an executive order to establish a Presidential Working Group on digital assets.

The market weakness could stem from disappointments after the Chicago Mercantile Exchange (CME) clarified that it hasn't decided to launch futures contracts for XRP, according to Fox Business's Eleanor Terrett.

The news sparked a wave of negative sentiment across the XRP community, which has been anticipating the launch to validate potential Securities & Exchange Commission (SEC) approval of XRP ETFs.

As a result, the token continued its consolidation, with investors realizing $500 million in profits in the past 48 hours.

XRP Network Realized Profit/Loss. Source: Santiment

The realized profits stem from potential selling activity from short-term holders, as indicated by slight upticks across the 90-day, 180-day and 365-day Dormant Circulation.

XRP 90, 180 and 365-day Dormant Circulation. Source: Santiment

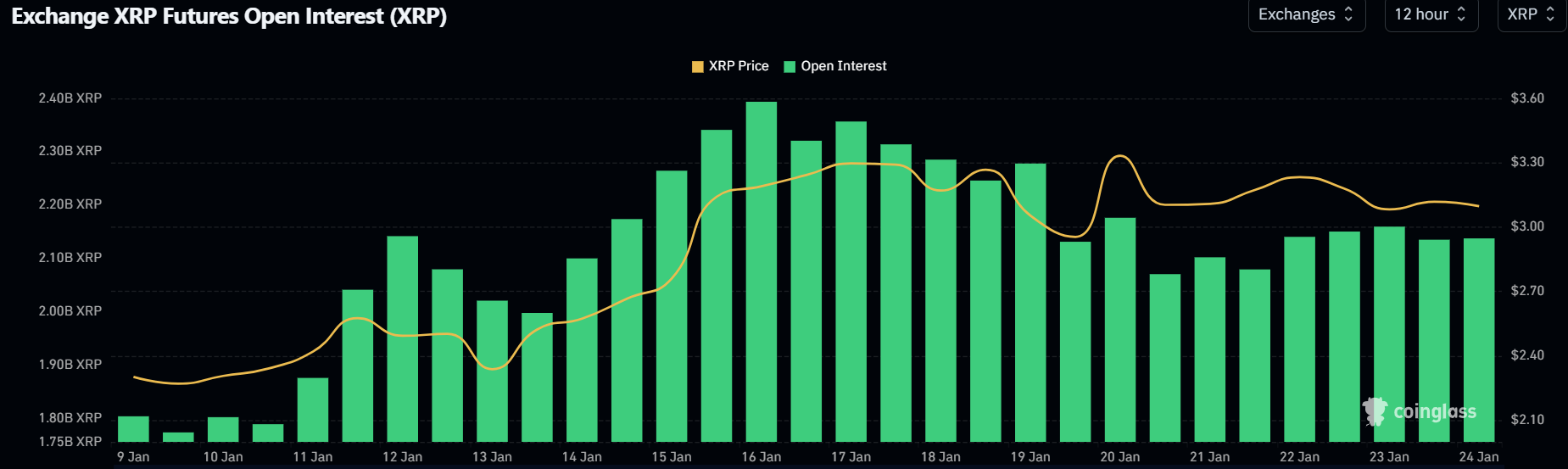

Additionally, XRP's open interest (OI) growth has stalled in the past few days, declining from an all-time high of 2.34 billion XRP to 2.14 billion XRP. Open interest is the total amount of outstanding contracts in a derivatives market. A decline in OI suggests traders are closing their positions.

XRP Open Interest. Source: Coinglass

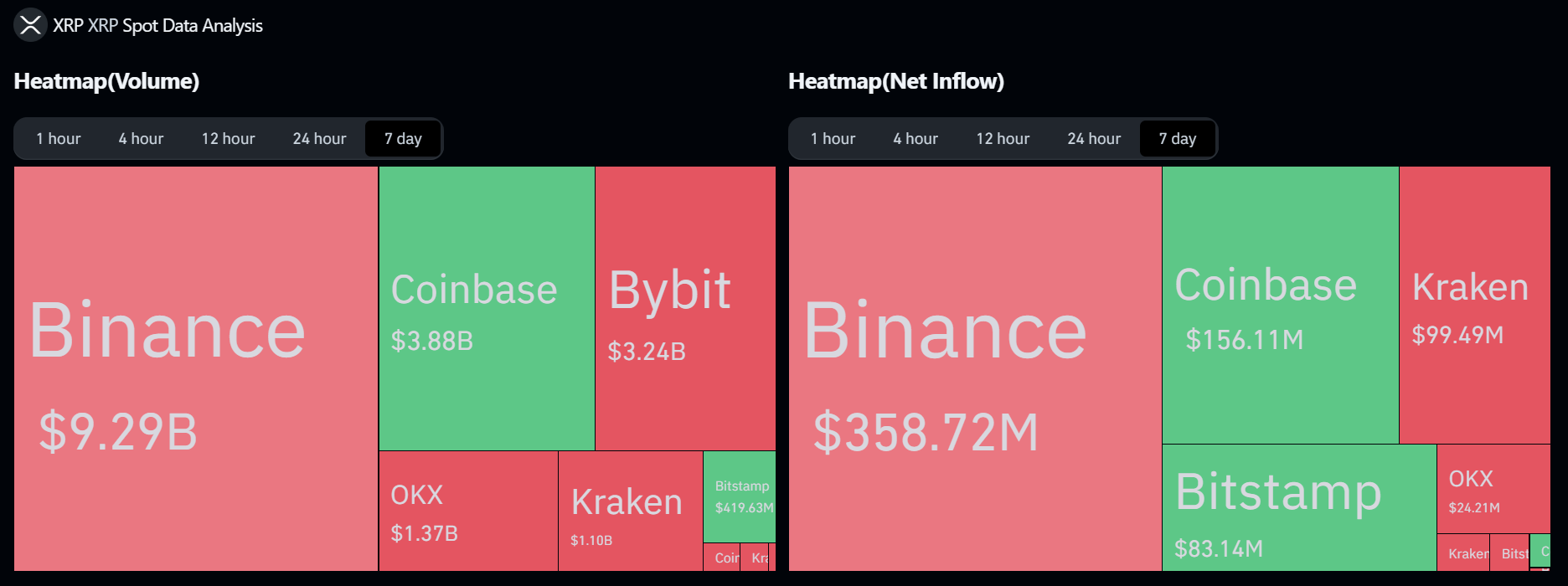

Despite the decline in OI, XRP bulls are still in control of its spot market, following increased net outflows across Binance and Kraken in the past week. Coinbase and Bitstamp, however, saw inflows.

XRP Exchange Flows. Source: Coinglass

Net outflows in crypto exchanges signify buying activity is dominant, and vice versa for net inflows.

XRP risks 20% decline following weakening bullish momentum

XRP sustained $10.06 million in liquidations in the past 24 hours, per Coinglass data. The remittance-based token saw long and short liquidations worth $7.69 million and $2.37 million, respectively.

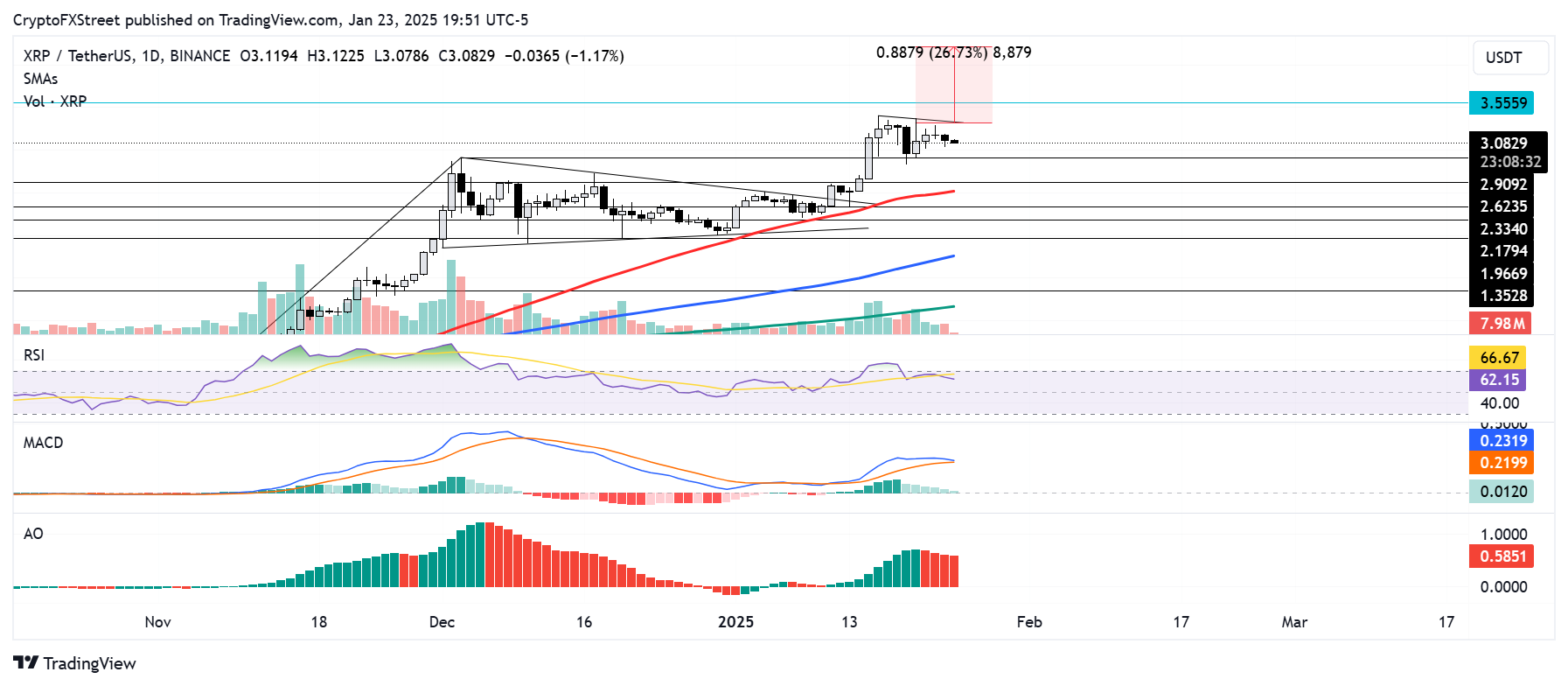

XRP's bullish strength is showing signs of weakness after posting a doji or indecision candlestick on Wednesday. This candlestick shows that an asset's opening and closing prices are almost the same, indicating a potential trend reversal.

Following the candlestick, XRP experienced a 3% pullback, corresponding with growing market sentiments of a bullish exhaustion.

XRP/USDT daily chart

This aligns with the Moving Average Convergence Divergence (MACD) and Awesome Oscillator (AO) histograms which have posted consecutive lower lows above their neutral levels — indicating weakening bullish momentum.

If XRP sustains a decline below the $2.90 level, it could decline to find support at $2.62 near the 50-day Simple Moving Average (SMA).

However, a rally above a descending trendline resistance extending from January 16 will invalidate the bearish thesis and send XRP to a new all-time high above $3.55.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

[01.51.37, 24 Jan, 2025]-638732780363981789.png)

[01.51.43, 24 Jan, 2025]-638732780898110509.png)