XRP validates bullish pennant as lawyer weighs in on SEC's appeal against Ripple

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

XRP's strong resilience against the wider crypto market decline was strengthened by increased buying activity across retail and institutional investors.

SEC's delay in filing opening brief in appeal over Ripple vs SEC ruling is a normal occurrence in litigation processes.

XRP could rally to a new all-time high above $4.50 but faces a key resistance hurdle at $2.90.

Ripple's XRP maintained a green outlook on Monday, rising more than 4% in the past week while other assets experienced a decline. Despite the positive price momentum, a retired securities lawyer noted that the Securities and Exchange Commission's (SEC) delay in submitting its opening brief for the appeal against Judge Analisa Torres' Ripple vs SEC ruling is common during litigation.

XRP investors continue buying activity as lawyer sheds light on SEC's appeal

XRP investment products globally recorded over $41 million in inflows last week, per CoinShares.

The inflows helped the remittance-based token to show resilience last week despite the lackluster performance of other top crypto assets. On the weekly timeframe, only XRP trades in the green among the top 20 cryptocurrencies by market capitalization.

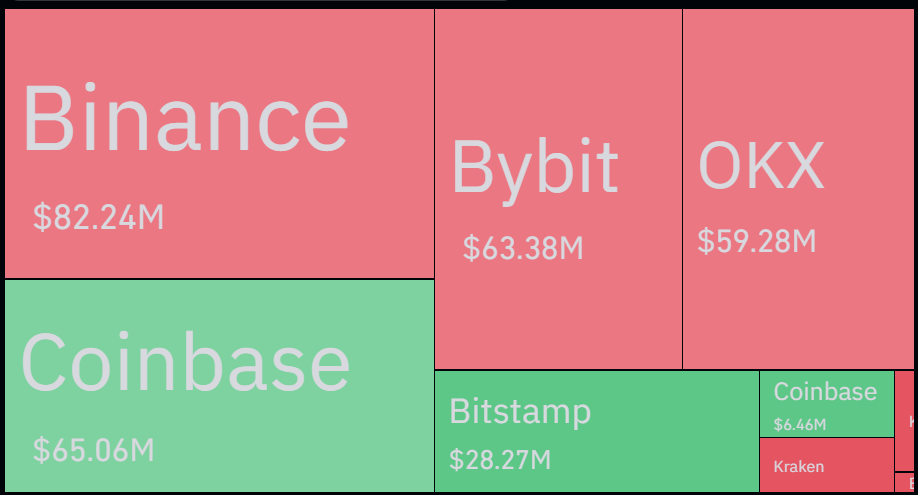

The price performance is supported by XRP net outflows across top exchanges. Unlike crypto ETFs, outflows in exchanges signify rising bullish momentum and vice versa for a decline. In the past week, exchanges like Binance, Bybit and OKX have recorded XRP outflows of $82 million, $63 million and $59 million. However, US-based XRP investors seem more cautious in their behavior as Coinbase recorded over $65 million in inflows.

XRP Exchange Net Flows. Source: Coinglass

Meanwhile, attention has turned to the January 15 deadline for the SEC to file its opening brief for its appeal against Judge Analisa Torres's final ruling in the Ripple vs SEC case. While XRP community members have suggested that the agency may not continue with the appeal since it has failed to file an opening brief in the past three months, retired securities lawyer Marc Fagel suggests otherwise.

In an X post on Monday, Fagel clarified that it's normal for lawyers to delay filing a brief until it's due.

"In 30 years of litigation, the number of times I saw a lawyer (private or public sector) file a brief before it was due was roughly zero," wrote Fagel. "That's not the SEC; that's just litigation."

He also added that a new SEC administration could vote to dismiss the appeal even if the agency files a brief on January 15, but it would be a "highly unusual move."

SEC Chair Gary Gensler and Commissioner Caroline Crenshaw are expected to depart the agency on January 20 following Donald Trump's presidential inauguration. Trump has nominated former pro-crypto SEC Commissioner Paul Atkins to take over the reins from Gensler.

XRP could rally more than 80% after breaking above bullish pennant

XRP has seen $20.83 million in futures liquidations in the past 24 hours, with liquidated long and short positions accounting for $13.55 million and $7.28 million, respectively, per Coinglass data.

Over the weekend, XRP broke above the upper boundary of a bullish pennant that has been developing since the beginning of December.

If XRP sustains the breakout and holds the pennant's upper boundary as a support level, it could rally above $3.55 to set a new all-time high near $4.5 in the coming weeks.

XRP/USDT 8-hour chart

However, it has to clear the $2.90 resistance hurdle — its highest price in the past six years.

A decline into the pennant could see XRP test its lower boundary support line near the $2.00 psychological level.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their neutral levels, indicating dominant bullish momentum.

A daily candlestick close below the $1.96 support level will invalidate the bullish thesis.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.