3 Red Flags for XRP in September That Could Derail a 2025 Price Rally

- Trump’s Greenland Tariff Suspension: Crypto Prices Rebound as Investors Weigh Rally Longevity

- When is the US President Trump’s speech at WEF in Davos and how could it affect EUR/USD

- Is Silver’s ‘Meme Moment’ Arriving? Surging Prices Mask Momentum Bubble Concerns

- Gold Price Forecast: XAU/USD gains momentum to near $5,050 amid geopolitical risks, Fed uncertainty

- Fed Rate Decision Looms as Apple, Microsoft, Meta and Tesla Q4 Earnings Draw Attention: Week Ahead

- Australian Dollar rises as employment data boosts RBA outlook

Despite many positive predictions for XRP’s price in 2025, several on-chain data points reveal a different picture. A broader perspective in September may help XRP investors manage risks more effectively.

Based on analyses of trusted data sources such as CryptoQuant, DeFiLlama, and Google Trends, three main warning signals have emerged.

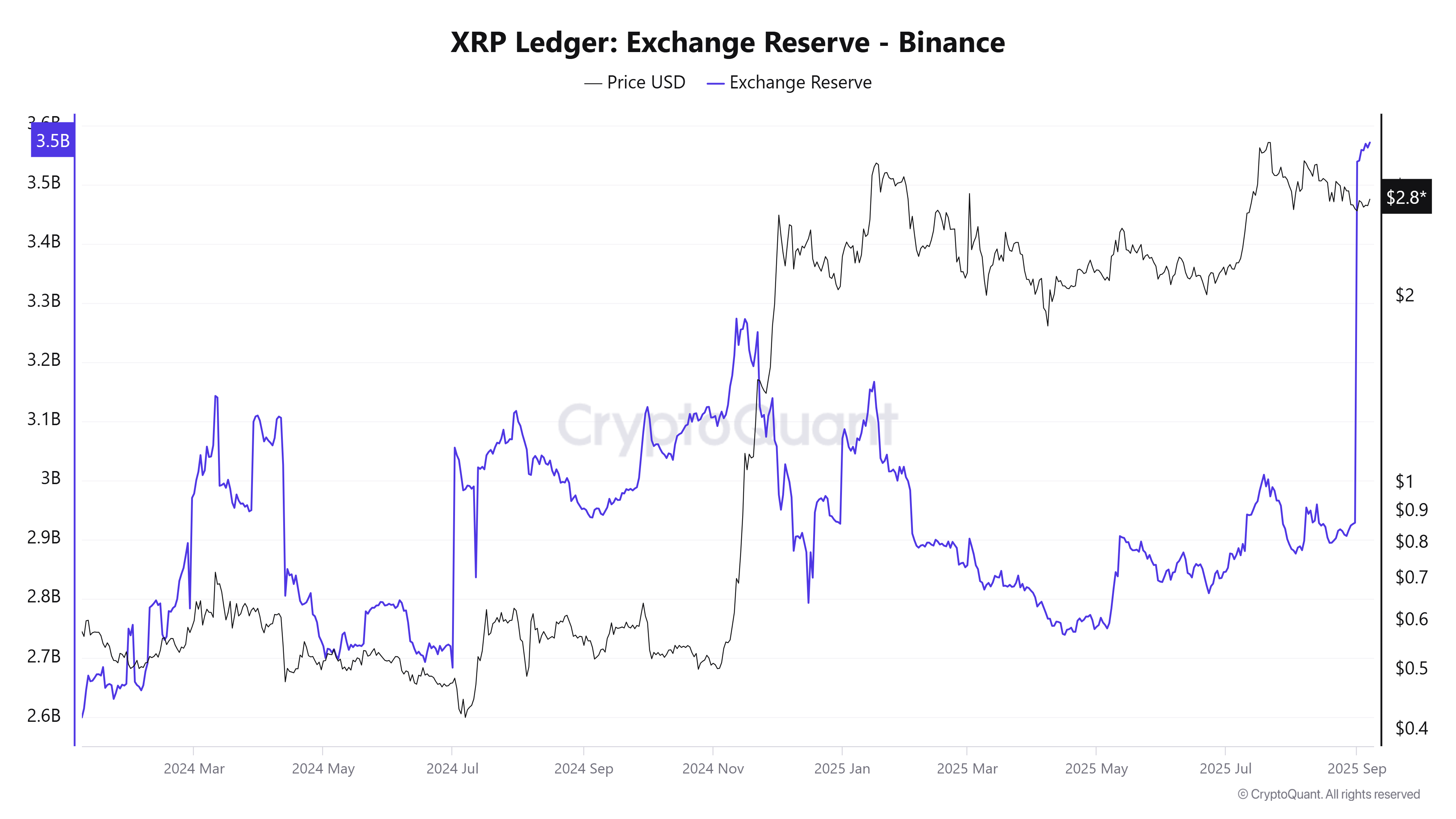

XRP Reserves on Binance Hit All-Time High in September

The first and most notable sign is the massive inflow of XRP into Binance. According to CryptoQuant, about 2.9 billion XRP was on Binance on August 31. By September 7, the figure had surged to 3.57 billion, marking the highest recorded level.

This means that approximately 670 million XRP have been transferred to Binance since the start of September. The inflows came after XRP’s price had dropped more than 25% from its July peak.

XRP Exchange Reserve. Source: CryptoQuant

XRP Exchange Reserve. Source: CryptoQuant

Typically, a significant influx of tokens on exchanges indicates that investors might be getting ready to sell to realize profits or minimize losses.

BeInCrypto analysis highlights the $2.7–$2.8 range as a crucial support zone for XRP in September. A breakout from this level in either direction could define the trend for the next quarter.

The concentration of XRP on the world’s largest XRP volume exchange indicates that many investors are waiting for a decisive move. If the price rises, they may take profits. They could lock in previous gains or cut losses if it falls while waiting for a better entry.

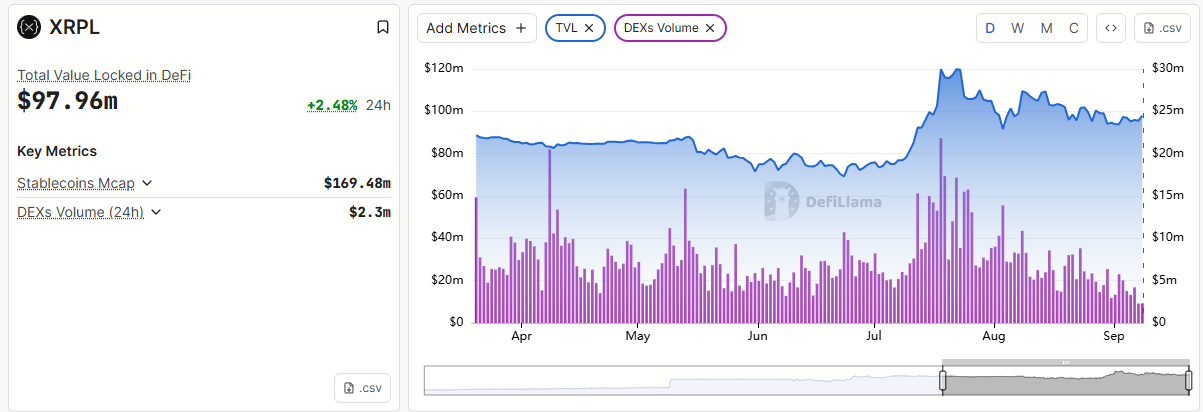

XRPL Ecosystem Weakens in September

The second concerning signal comes from the drop in Total Value Locked (TVL) on the XRP Ledger (XRPL), showing capital outflows from the ecosystem. DeFiLlama data reveals that XRPL’s TVL fell from $120 million to around $98 million over the past two months.

Total Value Locked And Volume of DEXs on XRPL. Source: DefiLlama

Total Value Locked And Volume of DEXs on XRPL. Source: DefiLlama

DEX trading volume on XRPL also declined in September, hitting just $2.3 million per day—the lowest since April. This marks a 90% drop compared to mid-July levels.

Even at its peak, XRPL’s TVL remained small compared to the billions of dollars secured in other DeFi protocols. The data suggests XRPL is losing traction in the DeFi space, leading to weaker trading activity.

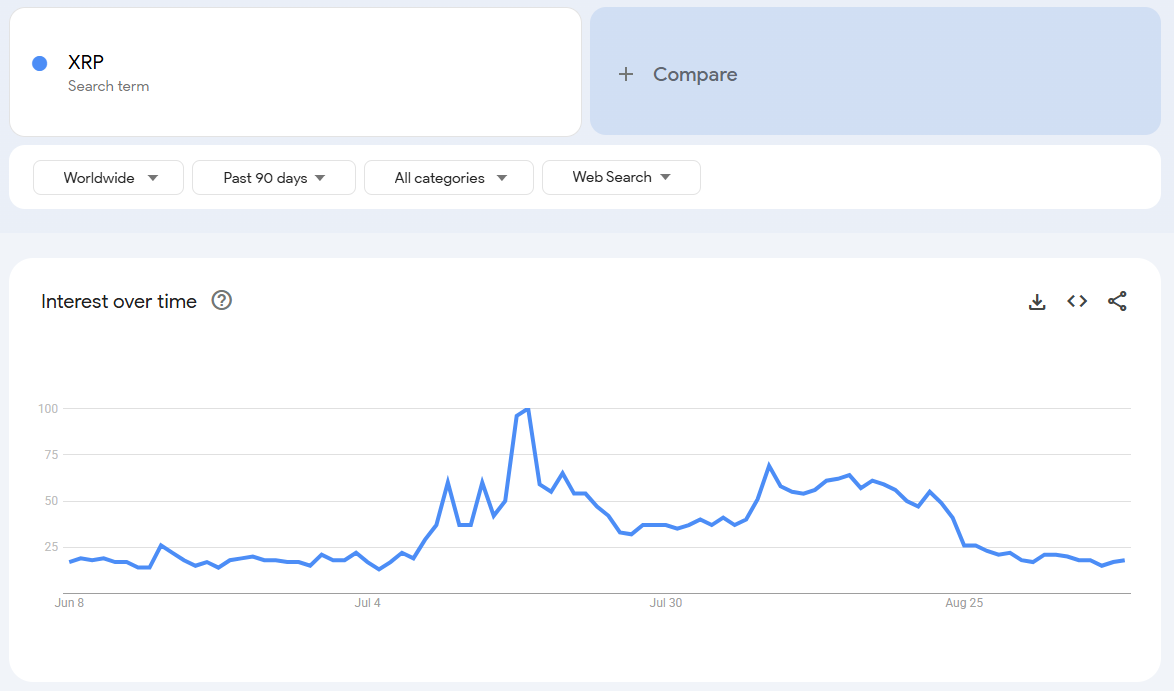

Google Trends Reflect Declining Interest in XRP

The third sign is a sharp decline in community interest, measured by Google Trends. Over the past two months, the interest index for XRP dropped from a peak of 100 to just 19.

Similarly, the keyword “XRP ETF” has seen a substantial decrease, dropping from 100 points to only 9 points in just the past month.

XRP on Google Trends. Source: Google Trends.

XRP on Google Trends. Source: Google Trends.

Google Trends reflects global searches for the keyword “XRP,” which is often a leading indicator of retail and media attention.

In the past, coins like Dogecoin and Shiba Inu experienced explosive growth fueled by strong social media and search interest. In contrast, XRP now appears to be entering a quiet phase.

This decline in attention could suppress trading volume, leaving XRP more vulnerable to sharp price moves triggered by whales or macroeconomic factors such as Fed interest rates.

Technical Analysts Offer a Different View

Despite weak on-chain signals and fading interest, technical analysts remain optimistic about XRP. Their confidence is rooted in chart patterns and support levels.

For example, many analysts argue that XRP broke out of a descending triangle pattern last weekend, signaling the start of a new rally.

Others point out that XRP has consolidated around the $2.7–$2.8 support range for months, suggesting strong accumulation that could fuel a breakout toward year-end.

XRP Price Scenario Until The End of 2025. Source: Gordon

XRP Price Scenario Until The End of 2025. Source: Gordon

“XRP has been consolidating at these prices for MONTHS. We will teleport to $6.00 and we will love it,” investor Gordon predicted.

As a major altcoin with significant market liquidity, XRP’s price movements often influence overall sentiment among altcoin investors.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.