Litecoin Breaks Under Parallel Channel: Analyst Predicts This Target

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

An analyst has pointed out how Litecoin has slipped under a parallel channel recently and could be set to see a move to this price level.

Litecoin Has Broken Under Parallel Channel Support

In a new post on X, analyst Ali Martinez has discussed about a parallel channel for Litecoin. The “parallel channel” refers to a pattern from technical analysis (TA) that forms when the price of an asset consolidates between two parallel trendlines.

There are three types of parallel channels, but in the context of the current topic, the one where the channel is parallel to the time-axis is of interest. In this pattern, the trendlines track successive highs and lows of roughly equal magnitude. That is, the asset is consolidating completely sideways when inside the channel.

The upper line of the parallel channel is likely to be a source of resistance for the price in the future, meaning that tops can occur there. Similarly, the lower level can be where bottoms take place.

If the asset manages to break past either of these barriers, however, then it may go on to see a continuation of trend in that direction. That is, an escape above the channel can be a bullish signal, while a fall under it can be a bearish one.

As mentioned before, there are other types of parallel channels as well. Namely, the ascending and descending versions. These occur when the trendlines have a slope to them. That is, when the price’s consolidation happens towards a net upside or downside. Naturally, the ascending channel forms when the slope is positive and the descending one when it’s negative.

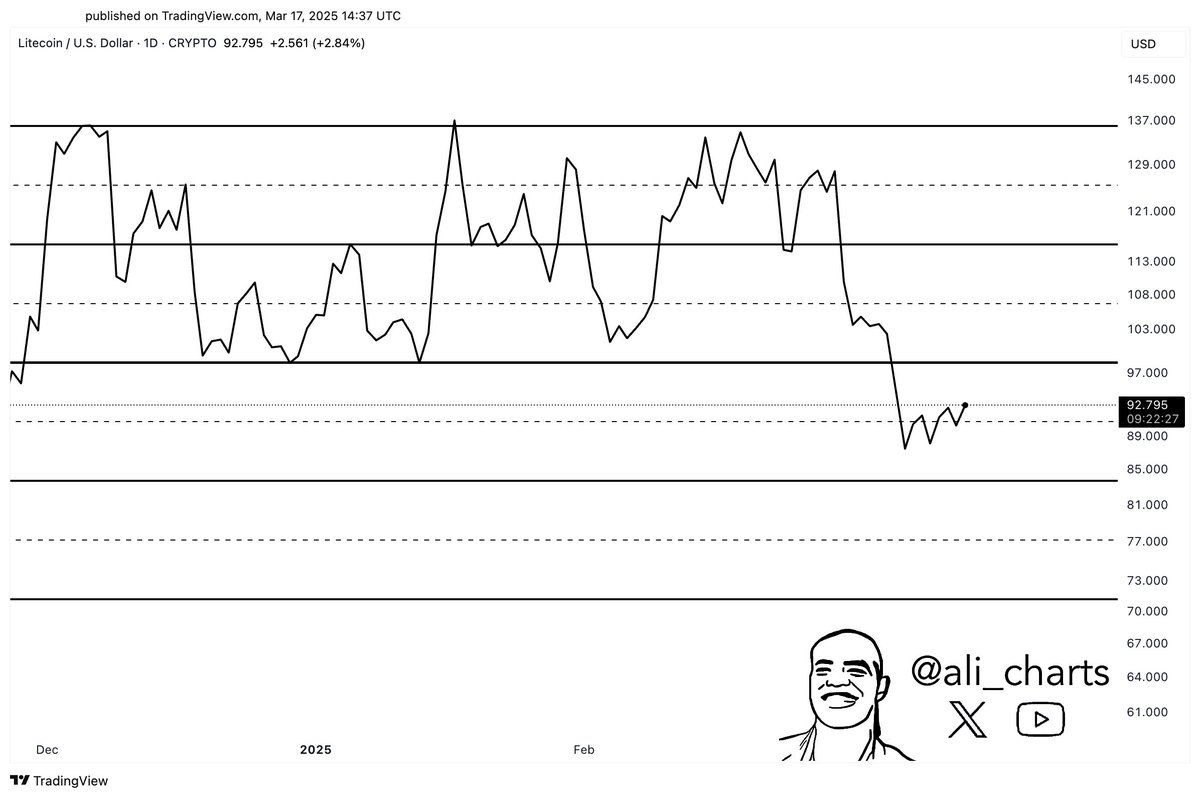

Until recently, the daily price of Litecoin was potentially trading inside a parallel channel. Here’s the chart shared by the analyst, that shows this pattern for the cryptocurrency:

From the graph, it’s visible that the recent bearish action in Litecoin has meant that its price has fallen under the parallel channel. If the pattern holds, this breakout would mean a bearish outcome for the asset.

Generally, moves emerging out of a parallel channel are of the same length as the height of the pattern itself. Based on this, the analyst has put a target for LTC. “Exiting this channel sets up a price move to $70,” notes Martinez.

Since the plunge under the lower trendline of the pattern has happened, Litecoin has been moving down. It only remains to be seen, though, whether the decline would extend to this price target or not.

LTC Price

Litecoin has suffered a drop of almost 6% in the last 24 hours, which has erased the earlier recovery and brought its price down to $88.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.