Chainlink (LINK) Price Breaks $11 Post-Fed Rate Cut: What’s Next

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

Chainlink’s (LINK) price has risen above $11 following the recent Fed rate cut. This increase has ignited fresh speculation about the coin’s short-term outlook.

In this analysis, BeInCrypto examines the factors contributing to the hike, the potential implications of the rate cut, and what traders can expect from LINK.

Chainlink Key Drivers Want More

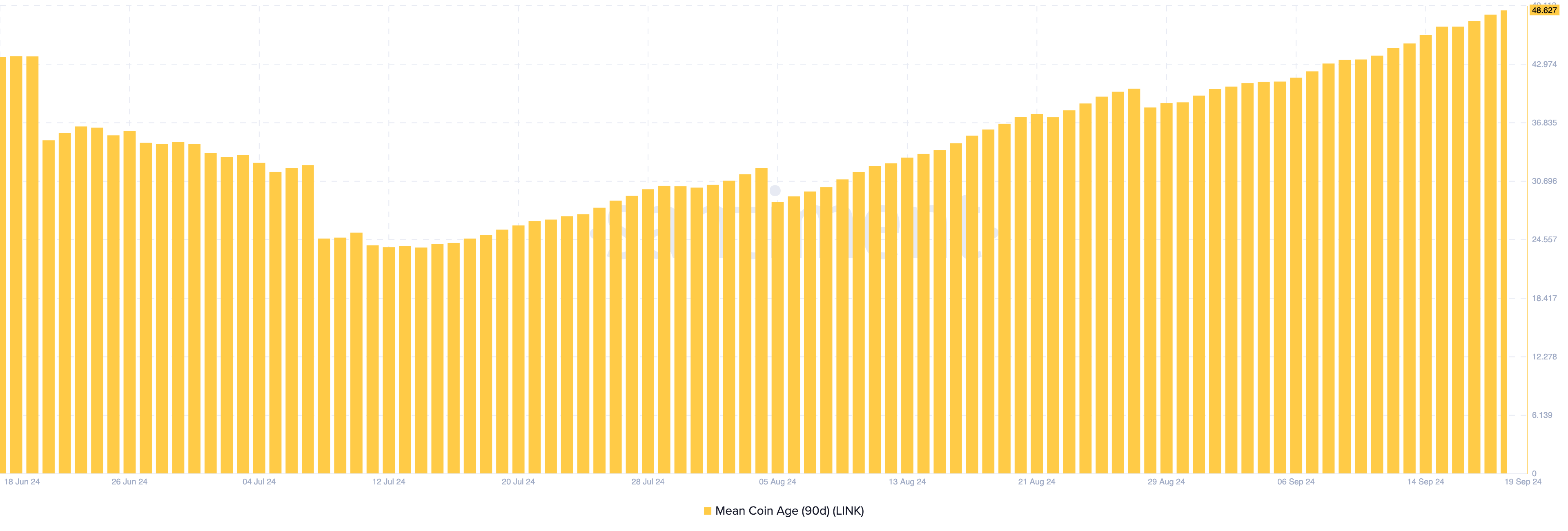

According to Santiment, alongside the recent rate cut, Chainlink’s 90-day Mean Coin Age (MCA) has risen. The MCA reflects the average age of tokens in circulation, with a low MCA suggesting that previously inactive tokens are being moved from cold wallets, potentially leading to a sell-off and putting downward pressure on the price.

Conversely, a rising MCA indicates that investors are holding onto their tokens and engaging less in trading activity, often signaling a long-term hold strategy. In Chainlink’s case, the spike in the MCA suggests that many investors are choosing to keep their LINK tokens dormant or moving them into self-custody, reducing selling pressure.

Read more: How To Buy Chainlink (LINK) and Everything You Need To Know

Chainlink 90-Day Mean Coin Age. Source: Santiment

Chainlink 90-Day Mean Coin Age. Source: Santiment

Beyond the rising coin age, the 4-hour LINK/USD chart reveals a surge in the Cumulative Volume Delta (CVD), a key indicator of market sentiment. Each bar on the CVD shows whether the market is dominated by buying or selling activity. Red bars signal selling pressure, which could drive the price down.

In LINK’s case, the chart shows five consecutive green bars, indicating sustained buying pressure. This suggests that the market’s demand for LINK is growing, potentially supporting the continuation of its uptrend.

Chainlink Cumulative Volume Delta. Source: TradingView

Chainlink Cumulative Volume Delta. Source: TradingView

LINK Price Prediction: Further Gains

The daily chart shows that Chainlink is holding strong at the $10.02 support level, which played a key role in its recent breakout above the $10.83 resistance. Currently, LINK is trading at $11.30, with no significant resistance in sight to halt the uptrend.

Using Fibonacci retracement levels to assess potential price targets, LINK’s next likely move could take it to $11.86, corresponding to the 38.2% Fibonacci level. If it breaks past this point, the next target could be around $12.98, a level that appears within reach given the current momentum.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

Chainlink Daily Analysis. Source: TradingView

Chainlink Daily Analysis. Source: TradingView

However, the cryptocurrency could experience a pullback if it fails to surpass $11.86. If that happens, LINK might drop to $9.25.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.