Toncoin Jumps 8% Post-Pavel Durov Release, Yet TON Blockchain Outages Raise Concerns

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Gold declines to near $4,850 as low liquidity, easing tensions weigh on demand

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises above $4,950 as US-Iran tensions boost safe-haven demand

- Gold drifts higher to $5,000 on heightened US-Iran tensions

- Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP face downside risk as bears regain control

Toncoin (TON) experienced a significant price increase, climbing over 8% following the release of Telegram CEO Pavel Durov, who was recently indicted by French authorities.

However, ongoing struggles within TON blockchain, which has recently faced multiple outages, cloud this positive price movement.

Durov’s Release Comes with Strings Attached

A recent report revealed that Durov was released from custody on August 28 following a four-day detention. He was subjected to judicial supervision, obligated to post a €5 million bond (around $5.5 million), and barred from exiting France. Additionally, he is required to check in at a police station bi-weekly.

BeInCrypto reported that on August 24, French authorities arrested Durov at Le Bourget airport near Paris. The local authorities charged Durov with multiple offenses, including accusations of facilitating drug trafficking, organized fraud, and the distribution of pornographic content involving minors. The charges also cite his refusal to cooperate with law enforcement, withholding critical information necessary for legal investigations.

Read more: 6 Best Toncoin (TON) Wallets in 2024

In the latest developments, another report suggested that French authorities have also issued an arrest warrant for Nikolai Durov, his brother and co-founder of Telegram, in connection with the same investigation. The charges against Nikolai include complicity in the possession, distribution, and offering of pornographic images of minors in an organized group.

French Prosecutor Laure Beccuau noted that Telegram has featured in many investigations related to crimes such as minor exploitation, drug trafficking, and online hate speech. However, she criticized the platform for its “near complete” failure to cooperate with legal requests.

“That’s what led JUNALCO to open an investigation into the possible criminal responsibility of the messaging app’s executives in the commission of these offenses,” Beccuau said, as reported by Bloomberg.

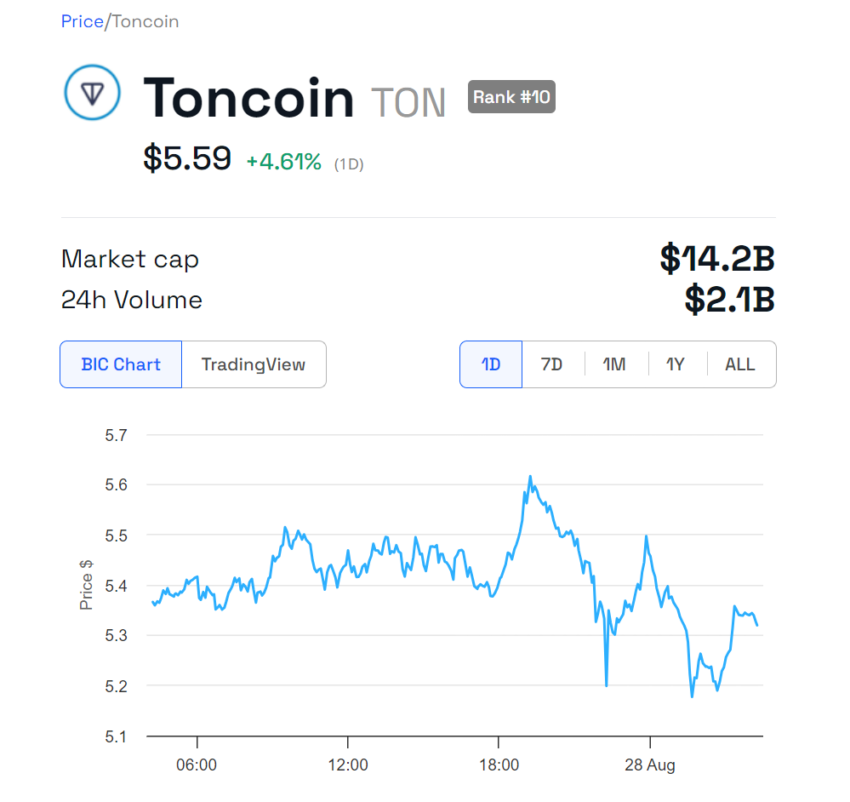

The news of Pavel Durov’s release immediately impacted Toncoin, the native token of The Open Network (TON) blockchain, which has a close association with Telegram. Shortly after the report of the release, Toncoin’s price surged from $5.31 to $5.75, marking an 8.3% increase within just 20 minutes.

However, this initial momentum quickly faded. Toncoin’s price has since stabilized around $5.58. Although there was a minor recovery, its current price still reflects a 14.7% decline over the past week.

TON Price Performance. Source: BeInCrypto

TON Blockchain Faces Technical Hurdles Despite Price Surge

Despite the brief market optimism, TON blockchain’s reliability has come into question due to recent outages. On August 27, the network stopped producing blocks for approximately seven hours.

While the blockchain resumed normal operations on August 28, another disruption occurred. According to Tonscan, the blockchain explorer for TON, the network stopped producing blocks again at 16:23 UTC.

The team attributed both outages to an overwhelming influx of transactions related to the newly launched DOGS meme coin. The surge in activity following DOGS token minting overwhelmed the network, leading to significant delays and interruptions in block production.

“TON Core is working on a solution. We will continue to update you on the situation as it evolves. User cryptoassets are not at risk,” TON Blockchain team assured on their X (Twitter) account.

Read more: 9 Best Blockchain Protocols To Know in 2024

As of the time of writing, TON blockchain appears to have resumed normal operations. Based on data from Tonscan, the network started producing blocks again after the second outage. Although the team has resolved these technical issues, the outages have raised concerns about the network’s ability to handle future surges in activity.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.