Ethereum Price Forecast: ETH eyes $4,000 as SharpLink Gaming expands ATM facility to $6 billion

- U.S. November Nonfarm Payrolls: What Does the Rare "Weak Jobs, Strong Economy" Mix Mean for U.S. Equities?

- Tesla Stock Hits Record High as Robotaxi Tests Ignite Market. Why Is Goldman Sachs Pouring Cold Water on Tesla?

- U.S. November CPI: How Will Inflation Fluctuations Transmit to US Stocks? Tariffs Are the Key!

- AUD/USD remains depressed below mid-0.6600s; downside seems limited ahead of US NFP report

- December Santa Claus Rally: New highs in sight for US and European stocks?

- When is the BoJ rate decision and how could it affect USD/JPY?

SharpLink Gaming filed an amendment to increase its ATM facility by $5 billion for more ETH acquisition.

The amendment comes after BitMine disclosed that its ETH holdings crossed the $1 billion mark.

Nasdaq filed for BlackRock to integrate staking into its Ethereum ETF.

ETH could stretch its rally to $4,000 to complete the target of a bullish pennant.

Ethereum (ETH) briefly surged to $3,500 on Thursday after SharpLink Gaming (SBET) filed an amendment to increase its At-The-Market (ATM) facility by $5 billion. The amendment follows asset manager BlackRock's filing to integrate staking into its iShares Ethereum Trust (ETHA), which pulled in a record $500 million in net inflows on Wednesday.

SharpLink, BitMine, and BlackRock steal the spotlight following record inflows into ETH ETFs

Nasdaq-listed SharpLink Gaming filed a prospectus supplement on Thursday to increase its At-The-Market (ATM) facility with Alliance Global Partners (AGP) from $1 billion to $6 billion. The amended agreement will see the company use nearly all of its potential proceeds from the offering to expand its Ethereum treasury.

"With this Prospectus Supplement, we are increasing the total amount of Common Stock that may be sold under the Sales Agreement to $6 billion, comprising up to $1 billion under the Prior Prospectus and an additional $5 billion under this Prospectus Supplement," the filing states.

SharpLink, which has grown its stash to over 280,000 ETH, isn't the only treasury company enhancing its ETH acquisition strategy.

Former Bitcoin miner BitMine Immersion Technologies (BMNR) stated that its ETH treasury has crossed above 300,000 ETH, worth more than $1 billion at the time of publication. The company, which has Peter Thiel's Founders Fund as a key shareholder, said that its holdings are now worth over 300% more than the initial $250 million private placement it raised earlier in the month.

In the past two months, several publicly traded companies have pivoted toward an ETH treasury, including Bit Digital, BTCS, and GameSquare. These companies have stated a similar strategy of increasing shareholders' ETH per share through yield from staking their holdings and price appreciation.

Since the end of May, ETH treasury firms have accumulated over 700,000 ETH in their reserves, according to data from the StrategicETHReserve website.

Meanwhile, Nasdaq filed with the Securities and Exchange Commission (SEC) on Thursday to allow BlackRock to integrate staking into its iShares Ethereum Trust (ETHA).

"The Blackrock filing today won't have a final deadline until ~April 2026, but we think staking will likely be approved by at least Q4 '25," noted Bloomberg analyst James Seyffart in an X post on Thursday.

Several Ethereum ETF issuers, including Fidelity, Grayscale, and Bitwise, have filed for staking inclusion in their products over the past few months and are awaiting the SEC's decision.

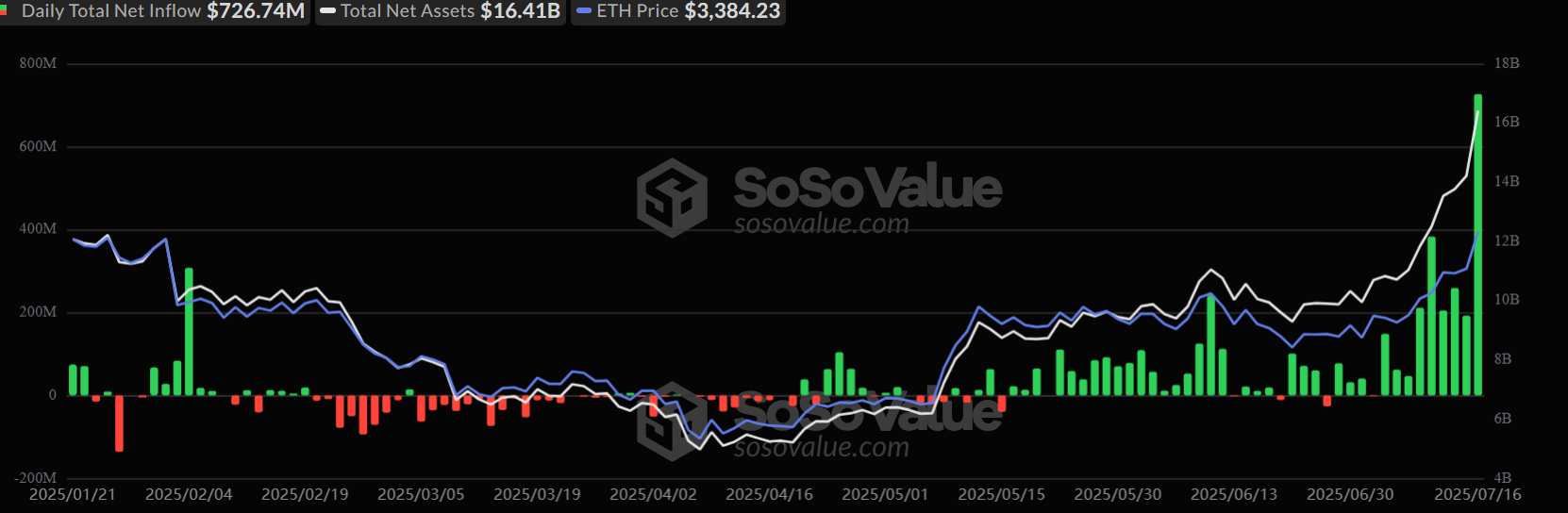

BlackRock's filing comes after the fund attracted a record inflow of nearly $500 million on Wednesday, propelling the broader US spot Ethereum ETF category to its largest daily inflow of $726.74 million, per SoSoValue data. Since mid-April, the products have pulled in over $4 billion in net inflows, underscoring ETH's growing appeal among institutional investors.

Ethereum ETF Inflows. Source: SoSoValue

Ethereum Price Forecast: Can ETH hit $4,000?

Ethereum experienced $177.47 million in futures liquidations in the past 24 hours, according to Coinglass data. The total amount of long and short liquidations is $77.35 million and $100.11 million, respectively.

After rallying over 35% since July 8 and surging above a symmetrical triangle and an ascending right-angled broadening wedge, ETH tested the key resistance near $3,470. A firm move above the resistance could see ETH stretch its uptrend toward $3,570 to complete the target of the ascending broadening wedge.

ETH/USDT daily chart

Further up, the top altcoin could continue its rally toward the $4,000 target, which is obtained from a broader bullish pennant pattern that dates back to May 8. However, it has to clear key hurdles at $3,570 and $3,740 for such a move to materialize.

On the downside, ETH could find support at key levels, including $3,220, an ascending trendline, the 14-day Exponential Moving Average (EMA), and the $2,850 level.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are in their overbought regions, indicating heightened bullish momentum. Overbought conditions in the RSI and Stoch often precede a pullback after a strong rally.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.