On Tuesday, institutional investors continued to pour capital into spot Bitcoin ETFs, marking the eighth consecutive day of inflows.

Total net inflows across all US-listed Bitcoin ETFs exceeded $170 million for the day, reinforcing the bullish sentiment that has gripped the market since last week.

Bitcoin ETFs Log 8th Straight Day of Inflows

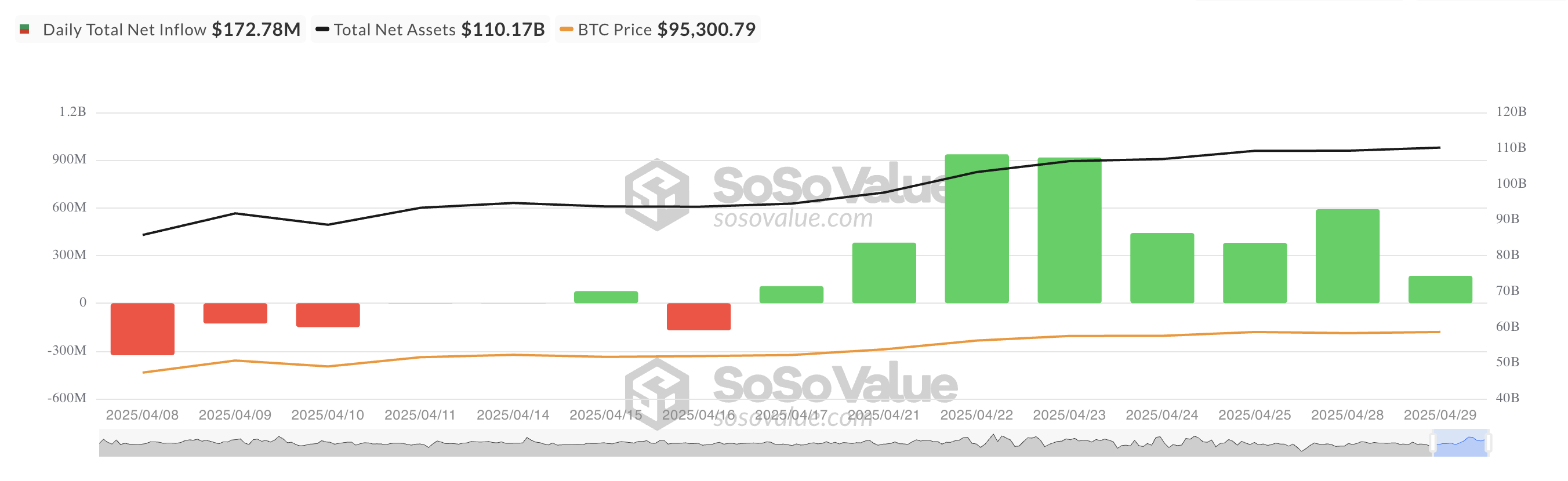

Yesterday, BTC-backed funds posted another net inflow, totaling $172.78 million. This signaled sustained confidence in the asset class.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

BlackRock’s iShares Bitcoin Trust (IBIT) once again led the pack, recording the highest daily inflow among all issuers. On Tuesday, the fund recorded a daily net inflow of $216.73 million, bringing its total historical net inflow to $42.39 billion.

IBIT has consistently dominated in recent sessions, reflecting BlackRock’s influence in the crypto ETF space and sustained institutional trust in its offerings.

Meanwhile, Bitwise’s spot Bitcoin ETF (BITB) recorded the highest net outflow among all issuers on Tuesday, with $24.39 million exiting the fund. Nevertheless, BITB’s total historical net inflows remain strong at $2.05 billion.

Leverage Cools in the Bitcoin Market

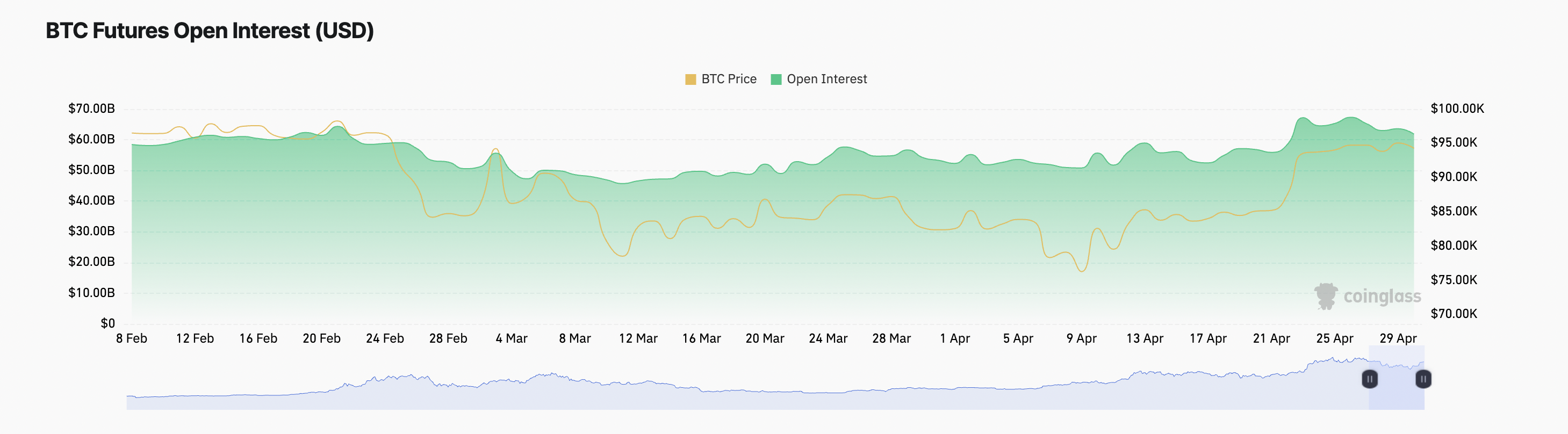

Open interest (OI) in the Bitcoin futures market has seen a modest decline today. This suggests a degree of cooling among leveraged positions, as some traders are closing out positions.

BTC Futures Open Interest. Source: Coinglass

It stands at $61.81 billion at press time, plunging by 3% over the past 24 hours. During that period, BTC’s price noted a 1% uptick.

When an asset’s price rises while open interest falls, traders take profits or de-risk, suggesting caution despite the uptick. This trend points to a lack of conviction in BTC’s rally, with fewer participants willing to take on new leveraged positions.

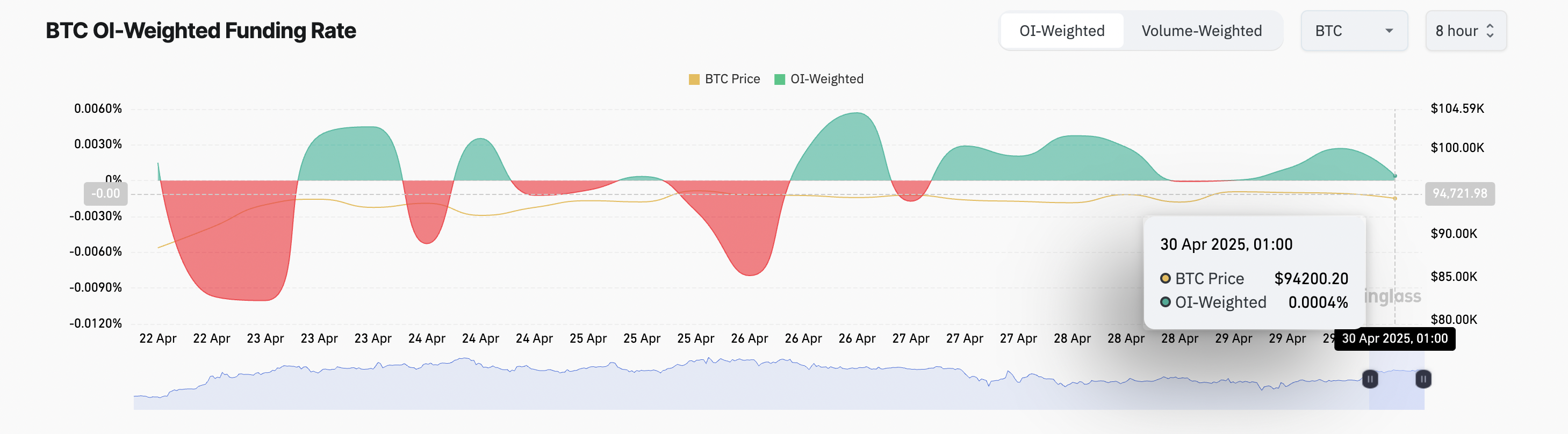

However, broader market sentiment remains optimistic. BTC’s funding rate is currently at 0.004%, indicating that long positions are still willing to pay to maintain leverage.

BTC Funding Rate. Source: Coinglass

The funding rate is a periodic payment between long and short traders in perpetual futures contracts, used to keep the contract price aligned with the spot market. When the funding rate is positive, longs are paying shorts, indicating that more traders are betting on the price going up, a sign of bullish market sentiment.

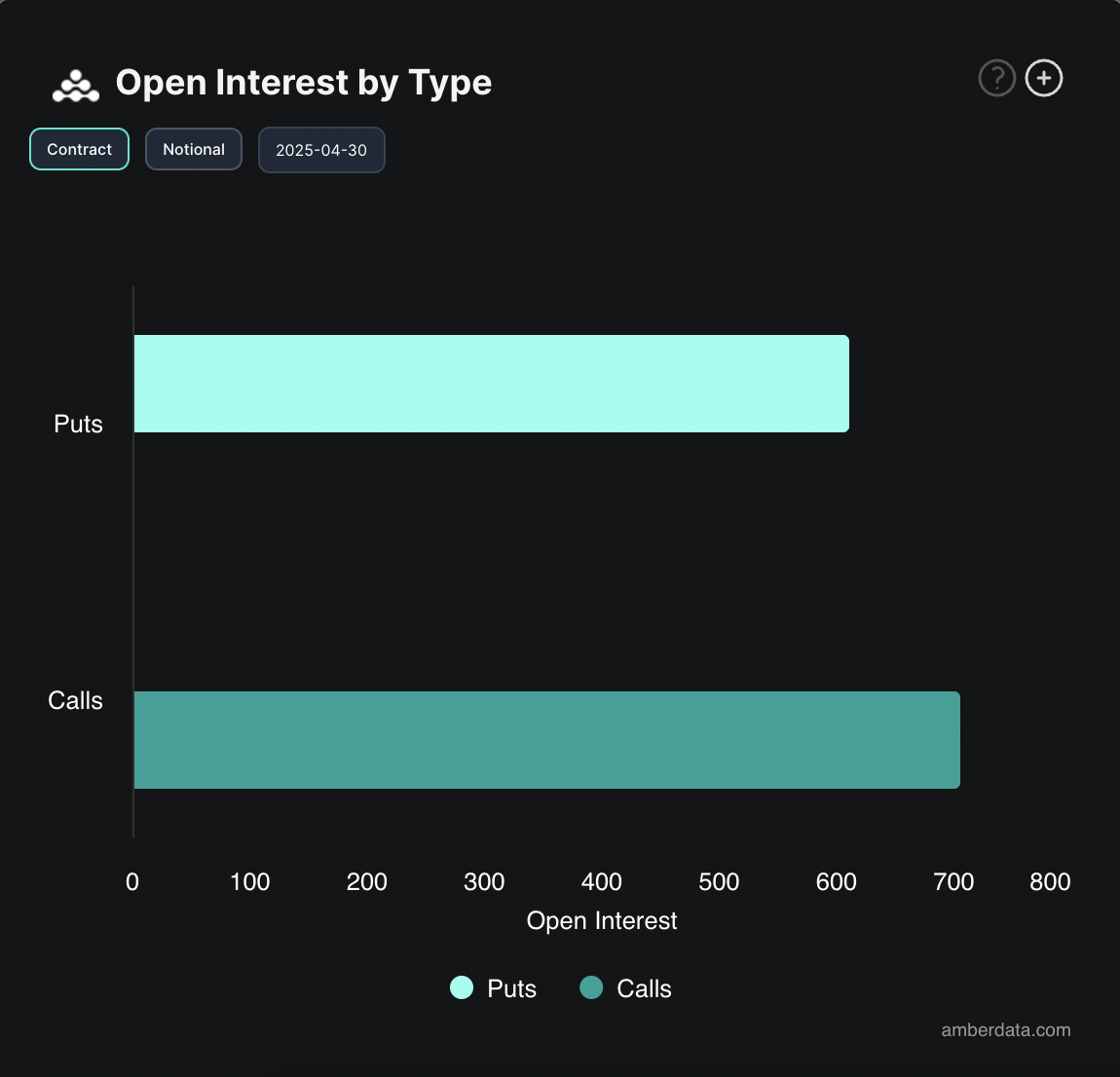

Moreover, the increase in call option volume suggests that traders are positioning for further upside in the coin’s price.

Bitcoin Options Open Interest. Source: Deribit

While derivatives activity shows minor signs of uncertainty, the persistent inflows into spot Bitcoin ETFs point to a market still leaning bullish in the near term.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.