Ethereum’s rally above $3,100 fuels double-digit gains in Ethereum Name Service, bulls target $30

The Ethereum Name Service, an Ethereum-based identity layer, has posted a double-digit rise in the last 24 hours.

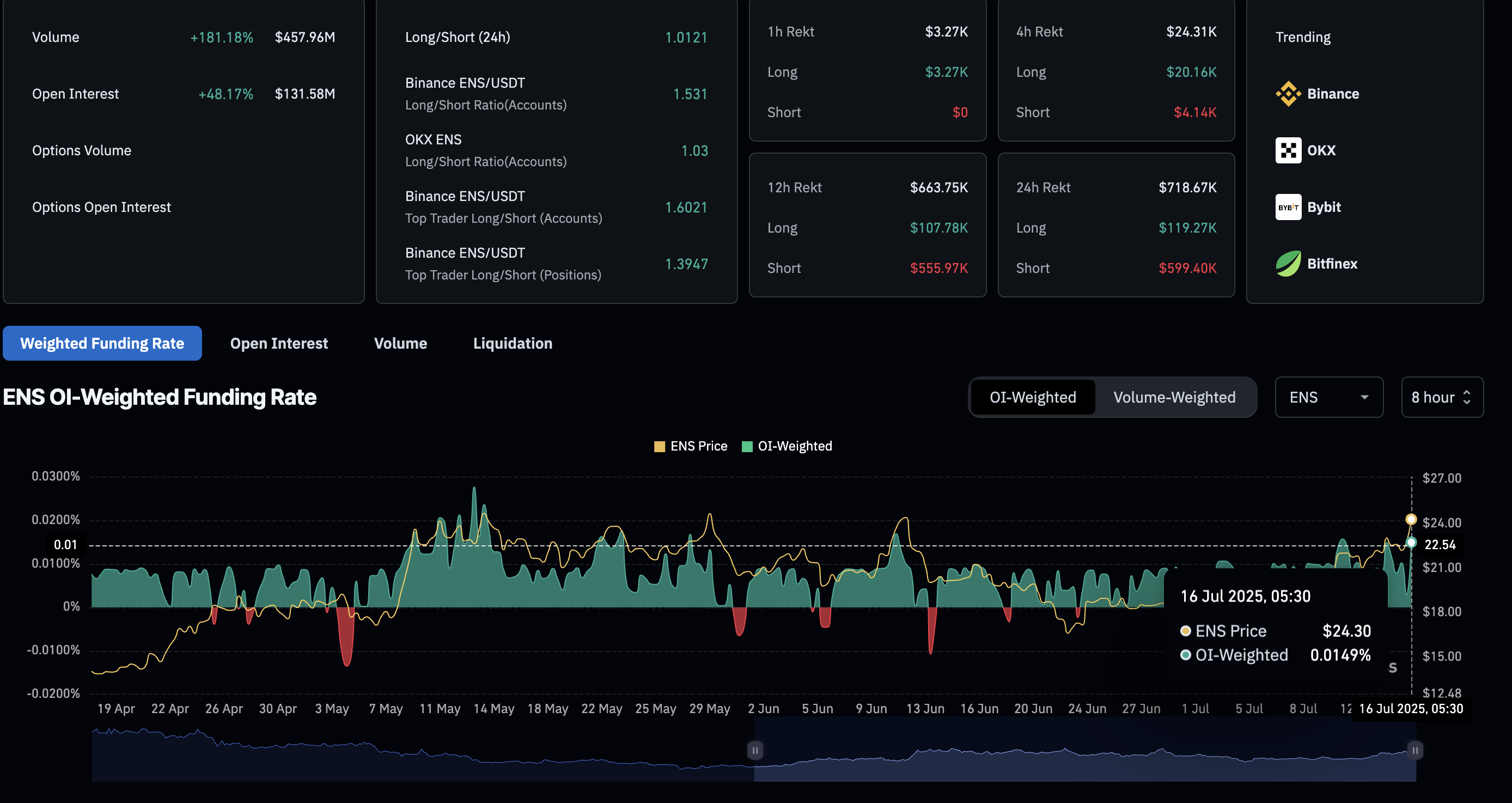

ENS Open Interest jumps nearly 50% to reach $131 million, signaling increased interest from derivative traders.

The ENS supply on exchanges reaches a record low, indicating a substantial decline in selling pressure.

Ethereum Name Service (ENS), a naming system based on Ethereum (ETH), edges higher by over 8% at press time on Wednesday, outpacing the broader crypto market with double-digit gains in the last 24 hours. With the bullish comeback of Ethereum surpassing the $3,100 mark, the ENS rally gains traction as part of its ecosystem, suggesting increased demand in the Web3 space.

Both derivatives and on-chain data flash bullish signals with increasing Open Interest and declining supply on exchanges aligning with the traders’ anticipation of an extended rally.

ENS Open Interest jumps nearly 50%

CoinGlass’s data shows a 48% increase in ENS Open Interest (OI) over the last 24 hours, reaching $131.58 million. An increase in OI refers to heightened capital inflow in the derivatives market, suggesting a boost in traders’ interest.

A spike in OI-weighted funding rate to 0.0149% in the last 8 hours, from 0.0028%, reflects the bullish incline in traders’ interest. Bulls pay the positive funding rates to offset the imbalance in swap and spot prices.

The massive shakeout of short positions of $599.40K in the last 24 hours, compared to $119.27K of long positions, suggests a bullish inclination in the active positions. Adding credence to the bullish imbalance, the long/short ratio is at 1.0121. Typically, a ratio above 1 refers to a greater number of active longs compared to short positions.

ENS Derivatives. Source: Coinglass

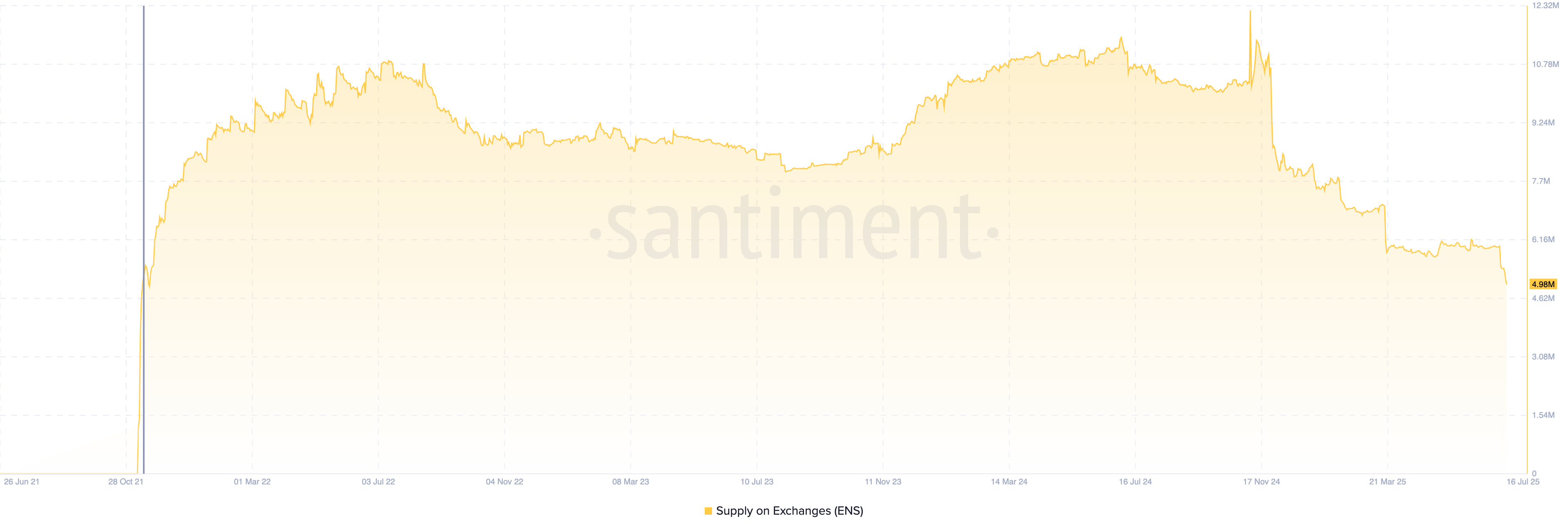

Declining ENS supply on exchanges hit a record low

Santiment data shows a decline in the ENS supply available on exchanges, reaching 4.99 million tokens — the lowest since November 14. Based on the demand-supply correlation, the declining ENS supply could fuel the rising demand, extending the bullish run.

ENS supply on exchanges. Source: Santiment

ENS targets $30 breakout amid rising bullish momentum

ENS prints its fourth consecutive bullish candle on the daily chart on Wednesday, reclaiming the $26 level after five months. The recovery run accounts for a 41% rise so far in July, targeting the $30.29 resistance, last tested on February 3.

A decisive close above this level could push the uptrend towards $34.51, last tested on February 1, followed by the year-to-date high at $38.57.

A rising trend in the 50-day Exponential Moving Average (EMA) is on the verge of surpassing the 100-day EMA, which is considered a buy signal as short-term growth exceeds the medium-term trend.

The Moving Average Convergence/Divergence (MACD) and its signal line are rising higher in positive territory, indicating a bullish trend is in motion. An uptrend in histogram bars above the zero line suggests increased momentum.

The Relative Strength Index (RSI) reads 78 on the daily chart, indicating overbought conditions on the back of growing buying pressure.

ENS/USDT daily price chart.

However, if ENS fails to uphold momentum, a bearish turnaround could retest the $24.88 level, marked by the daily close on February 9.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.