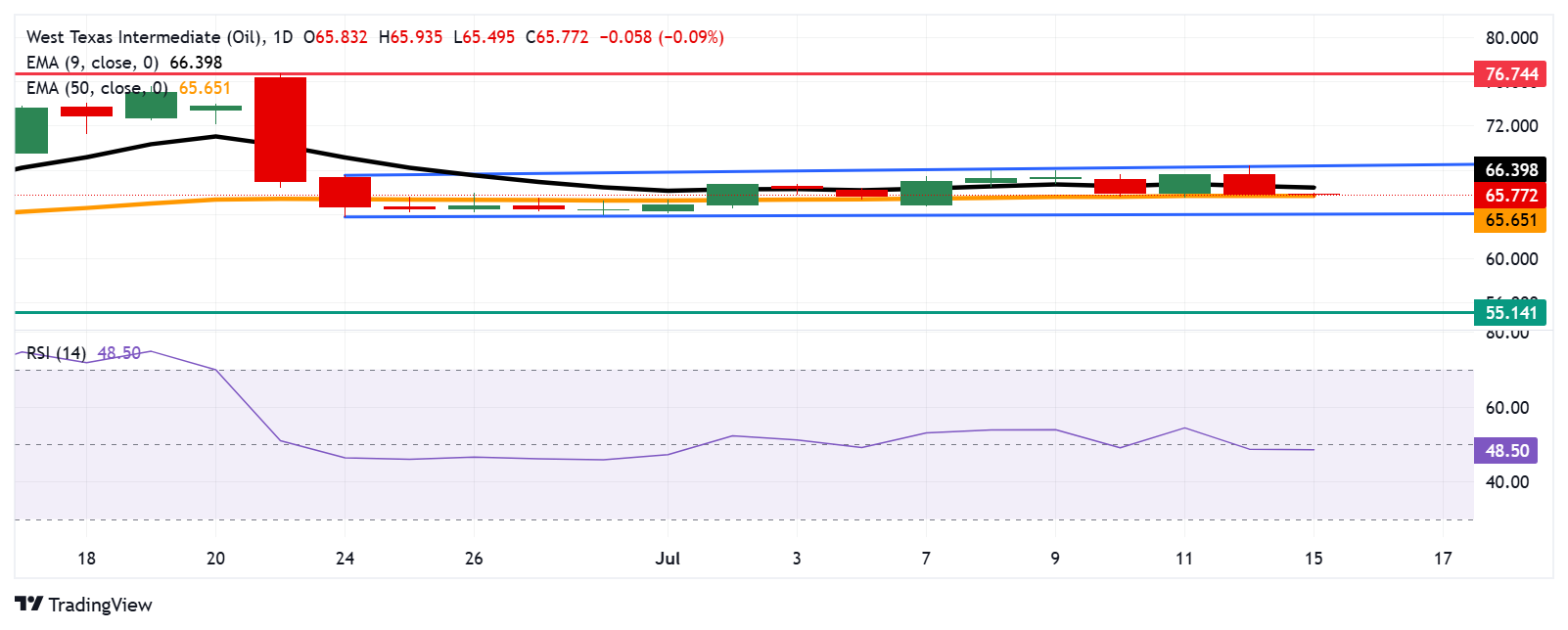

WTI price tests the immediate support at the 50-day EMA of $65.65.

The 14-day Relative Strength Index remains below the 50 mark, indicating that bearish momentum persists.

The nine-day EMA at $66.39 may act as a primary barrier.

West Texas Intermediate (WTI) Oil price extends its losses for the second successive session, trading around $65.80 per barrel during the European hours on Tuesday. The technical analysis of the daily chart suggests the price of the precious metal remains within a rectangular pattern, indicating a consolidation phase.

The 14-day Relative Strength Index (RSI) remains below the 50 level, suggesting a bearish bias is in play. Additionally, the Silver price is trading below the nine-day Exponential Moving Average (EMA), indicating potential weakening of short-term price momentum.

On the downside, the WTI price is testing the immediate support at the 50-day EMA of $65.65. A break below this level would weaken the medium-term price momentum and prompt the WTI price to approach the lower boundary of the rectangle around the psychological level of $64.00. A break below the rectangle would cause the emergence of the bearish bias and put downward pressure on the Oil price to navigate the region around the three-month low at $55.14, recorded on May 5.

The WTI price may find initial resistance around the nine-day EMA at $66.39. A break above the latter would improve the short-term price momentum and support the Oil price to approach the upper boundary of the rectangle around $68.50. A break above the rectangle would give rise to bullish bias and support the crude price to test the six-month high of $76.74, which was reached on June 23.

WTI: Daily Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.