Gold Surpasses Euro as World's Second-Largest Reserve Asset: Will Prices Keep Rising?

- Tesla Stock Hits Record High as Robotaxi Tests Ignite Market. Why Is Goldman Sachs Pouring Cold Water on Tesla?

- Gold Price Hits New High: Has Bitcoin Fully Declined?

- Gold jumps above $4,440 as geopolitical flare, Fed cut bets mount

- U.S. November CPI: How Will Inflation Fluctuations Transmit to US Stocks? Tariffs Are the Key!

- US Q3 GDP Released, Will US Stocks See a "Santa Claus Rally"?【The week ahead】

- December Santa Claus Rally: New highs in sight for US and European stocks?

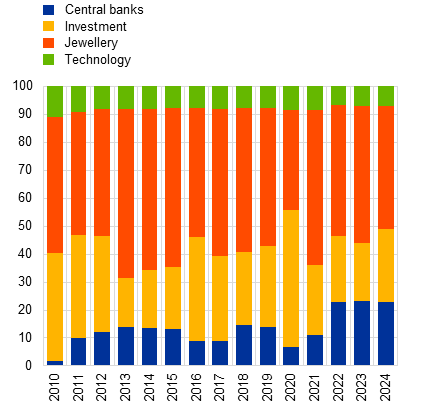

Central banks continue to accumulate gold at a record pace, pushing it past the euro to become the world's second-largest reserve asset.

In 2024, central banks bought more than 1,000 tonnes of gold, double the average annual purchases of the previous decade, the European Central Bank said in a report.

Central banks' gold holdings worldwide now stand at 36,000 tonnes, close to the all-time high of 38,000 tonnes reached during the Bretton Woods era in 1965. As gold prices hit record highs, gold's share of global foreign exchange reserves at market prices reached 20%, surpassing the euro (16%). Despite the increase in gold holdings, the U.S. dollar still accounts for the largest share of global holdings (46%).

Gold demand by sector(percentages), source: ECB

The outbreak of conflict between Russia and Ukraine in 2022, coupled with soaring inflation and expectations of rising interest rates, has caused a sharp surge in demand for gold and pushed prices higher. Since the beginning of 2024 alone, gold prices have increased by nearly 62% and hit an all-time high of $3,509.90 per troy ounce in mid-April 2025.

The ECB said survey data showed that two-thirds of central banks invested in gold to diversify their investments, while two-fifths invested in gold to protect against geopolitical risks. Gold is now more attractive for emerging and developing economies worried about over-reliance on the US dollar and the euro.

Data shows that Turkey, India, and China are at the top of the list of the largest gold buyers, accumulating more than 600 tons of gold since the end of 2021.

Central banks slow gold purchases, but demand remains strong

There are signs that central banks' purchases of gold have not stopped, but the pace is slowing. A World Gold Council report from ING showed that central banks' gold purchases in the first quarter of 2025 fell 33% from the previous quarter. China's desire to buy gold has slowed the most.

Ewa Manthey, a strategist at ING, believes that, given the still uncertain economic environment and the central banks' pursuit of a reliance on the US dollar, central banks may continue to increase their gold reserves.

In the first half of this year, the US government's unpredictable tariff policy has caused panic in the global market and pushed the price of gold to fluctuate at a high level. Given the uncertainty of Trump's policies, the unclear situation in Russia and Ukraine, and the tension in the Middle East, the demand for gold still has the potential to rise in the long run.

"Given the strong rise in gold prices, the momentum of gold purchases may slow down. But in the long run, the uncertain geopolitical background and the desire for diversified investment will support the accumulation of gold as a reserve." Janet Mui, a chartered financial analyst at Royal Bank of Canada, said, "As the United States wants to take a more isolationist approach in trade, it makes sense for the central banks of its major trading partners to diversify their reserves away from the US dollar."

The ECB report said that the future price of gold will mainly depend on whether the supply of gold can be maintained. The report pointed out that in the past few decades, the supply of gold has responded resiliently to the growth of demand, including the strong growth of above-ground stocks. "Therefore, if history is any guide, further increases in the official demand for gold reserves may also support further growth in global gold supply."

Read more

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.