Prediction: This Will Be AMD's Stock Price by 2030

Key Points

Advanced Micro Devices has stood in the shadow of much larger rival Nvidia.

However, new partnerships have thrust AMD back into a competitive position.

The chipmaker has some ambitious goals it aims to fulfill in the period ahead.

- 10 stocks we like better than Advanced Micro Devices ›

Advanced Micro Devices (NASDAQ: AMD) has been an OK investment since 2023. It has mostly failed to capitalize on one of the biggest computing buildouts we've ever experienced, causing it to lose out to its peers like Nvidia (NASDAQ: NVDA). Since 2023, AMD's stock is up a still impressive 235%, while Nvidia's stock is up over 1,100%.

However, that could turn around as some of AMD's technology is deployed by more AI hyperscalers. AMD has recently unveiled incredible growth targets over the next five years that represent a massive acceleration of data center computing unit sales. Should their projections pan out, the stock could be a monster winner, making it one of the best stocks to buy now and hold over the next five years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

But just how high can AMD's stock climb? Let's take a look.

Image source: Getty Images.

AMD is more diversified than Nvidia

Part of the reason AMD has underperformed its peer is that its business isn't as concentrated in artificial intelligence as Nvidia's. During Q3, $51.2 billion of Nvidia's $57 billion in total revenue came from data center-related sales. AMD's Q3 revenue included $4.3 billion in data center revenue, out of its $9.2 billion total.

Because AMD is less concentrated in the data center segment, it has missed out on some of the massive growth driven by the incredible AI data center spending. However, part of that was its own fault. While it's debatable whether Nvidia or AMD's graphics processing units (GPUs) are better, the software that controls them isn't. Nvidia's CUDA software was far better than AMD's ROCm. This made Nvidia's ecosystem far more attractive than AMD's, leading many companies to choose Nvidia's products over AMD's.

However, AMD has been improving its software platform, and its use has increased. While it will be some time before we know if these improvements have allowed AMD to gain ground on Nvidia, management's projections sure indicate that it will.

AMD has bold projections for the next five years

Recently, AMD's management announced its long-term strategy and growth targets. Headlining this announcement was a 60% compound annual growth rate (CAGR) in its data center division. Its other divisions are only expected to grow at a 10% pace, resulting in company-wide growth of about 35%.

Any company that can grow revenue at a 35% pace over five years is likely to be a wonderful investment. But just how much could AMD's stock rise if this pans out? First, we need to set an end valuation. I think 30 times earnings is a reasonable level, especially for a company growing that quickly.

Over the past 12 months, AMD has generated $32 billion in sales. So, if its 35% growth rate comes to fruition, AMD's sales should total about $155 billion. For reference, Nvidia's sales over the past 12 months totaled $187 billion, so even after an impressive five-year run, it would still be smaller than its chief rival.

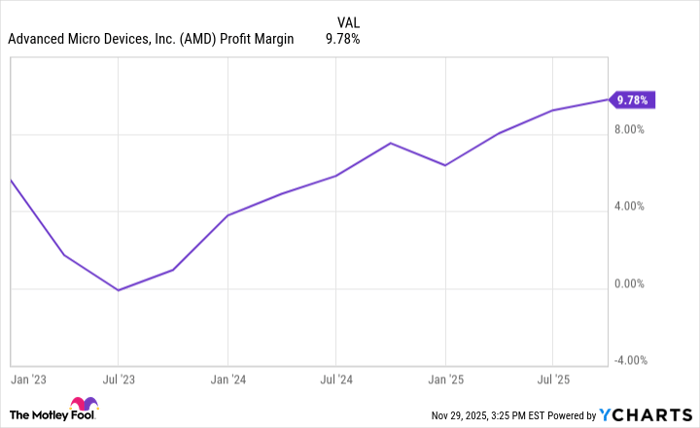

Next, we need to determine what AMD's profit margin will be. AMD's margins have risen steadily over the past few quarters, but are still nowhere near what Nvidia's are (around 50%).

AMD Profit Margin data by YCharts

I don't think those margin levels are realistic for AMD, but achieving a 25% margin is doable. Should AMD convert 25% of sales into profits, that would yield $39 billion in profits. At a 30 times earnings multiple, that equates to a market cap of $1.16 trillion. That would give AMD a stock price of above $700 per share or about a triple in five years.

Multiple items could adjust this price estimate up or down. If AMD receives a higher multiple or its profit margin is higher, it could exceed the $ 700-per-share price target. On the flip side, if AMD fails to improve its profit margin from today's levels, the stock could disappoint investors.

Should AMD's stock rise to $700, it will be an excellent return in a short time frame. If AMD does it, it will be a top stock to own. There's no guarantee of success, but with AI spending trending higher, AMD appears to be a great investment option.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $589,717!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,111,405!*

Now, it’s worth noting Stock Advisor’s total average return is 1,018% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.