A lot is a standardized unit of measurement used to quantify the size of a trade or position. Knowing what a lot is and how lot sizes are determined is crucial for effectively managing risk and executing trades.

This article will delve into the definition of a lot, explain how to calculate profits and losses through lots in trading on financial markets, especially the Forex market, and discuss how traders can leverage this knowledge to make more informed investment decisions.

1. What is a Lot?

A "lot" is a standard unit used for measuring the trading amount in various financial markets. For example:

In the London gold market, 1 lot is equal to 100 ounces of gold.

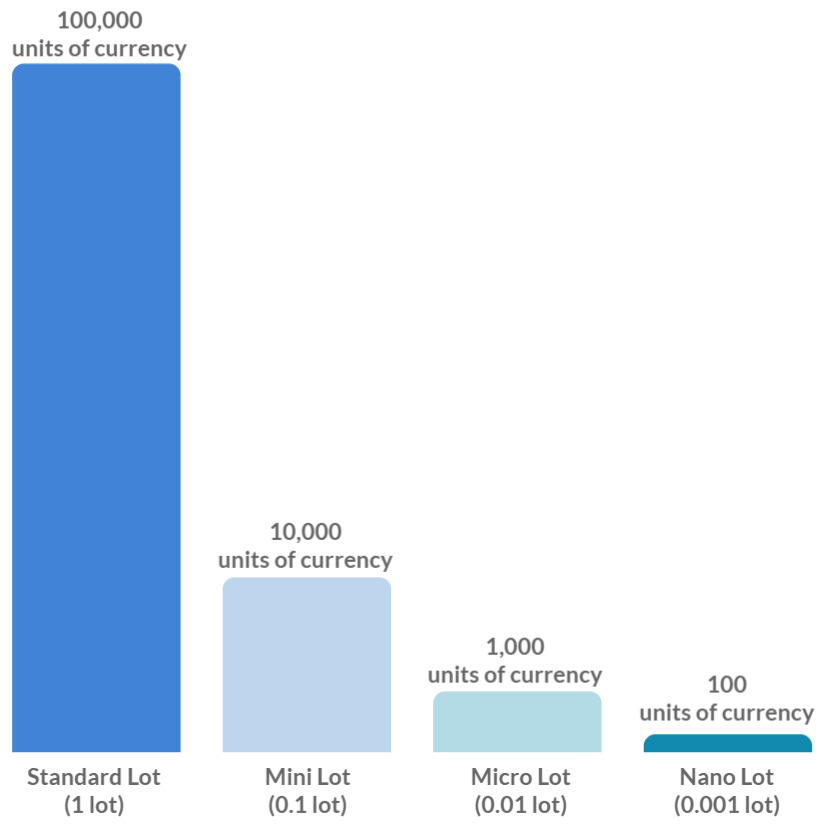

In the foreign exchange (FOREX) market, 1 lot typically represents 100,000 units of the base currency, rather than 100,000 units of a specific fiat currency like the US dollar.

So, if your base currency in the FOREX market is the US dollar, 1 lot would represent $100,000. Similarly, if your base currency is the Euro, 1 lot would represent €100,000.

Some brokers may display the trading quantity in terms of lots, while others may show the actual currency unit.

The change in the relative value between two currencies is measured in "pips", which represent an extremely small percentage of a currency's value. To capitalize on these minute changes in value, traders need to transact in large trading volumes to see significant changes in their profit or loss.

For currency pairs where the US dollar (USD) is the quoted currency, a standard lot of trading volume (typically 100,000 units of the base currency) will result in a $10 change in value for every 1-pip movement in the exchange rate.

EUR/USD

| Trading Volume | Currency Price | Change in Pip | Profit/Loss in Currency |

| 1 Lot (100,000 EUR) | 1.38869 | 1.38879 (change of 1pip) | 10USD |

For currency pairs that are quoted with the US dollar (USD) as the first currency, or are not quoted against the USD, such as USD/JPY or EUR/GBP, the formula to calculate the pip value will differ.

Here is a table to compare the pip value for different lot sizes of EUR/USD and USD/JPY:

| Currency Pair | Currency Closing Price | PIP Value Per | ||||

|---|---|---|---|---|---|---|

| 1 Unit | Standard Lot | Mini Lot | Micro Lot | Nano Lot | ||

| EUR/USD | Any | $0.0001 | $10 | $1 | $0.1 | $0.01 |

| USD/JPY | 1USD = 80JPY | $0.000125 | $12.5 | $1.25 | $0.125 | $0.0125 |

If other currency pairs are not included in the table, how to know the pip value of them? The answer is the pip value is calculated using the following formula:

Pip Value=One Pip/Exchange Rate×Lot Size

If the EUR/JPY at an exchange rate of 162.48

Pip Value= 0.01/162.48×100,000 = 6.15 (less than 10)

2. How do I calculate the profits and losses in trading?

When calculating profits and losses in trading, you need to consider the spread between the ask and bid prices.

Suppose the current exchange rate for EUR/CAD is 1.49880, with the bid (sell) and ask (buy) prices quoted as 1.49880/1.49890. If you prepare to buy 1 standard lot (100,000 units) of the currency pair EUR/CAD, you will be working with the ask (buy) price of 1.49890.

A few hours later, the price moves to 1.49990, and you decide to close your trade. The new quote for EUR/CAD changes to 1.49990/1.50000. To close the trade, you must sell, which means you will take the bid price of 1.49990.

The difference between 1.49890 and 1.49990 is 0.0010, or 10 pips. Using our formula from Section 1, we calculate profits as follows:

Pip value =(0.0001/1.49990)×100,000= 6.667 per pip

Profit=6.667 per pip×10 pips= 66.67

3. Do you need to calculate the lot size yourself?

When trading, you typically don't need to manually calculate the lot size yourself. Your trading platform should provide you with the necessary information upfront.

When placing a trade, your platform should clearly display the available lot size options, such as standard, mini, micro, and nano. This allows you to select the appropriate lot size for your trade.

To determine the overall size of your position, you can multiply the size of a single lot by the number of lots you've bought. Your trading platform should make this calculation and display the total position size for you.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

4. Summary

In the forex market, a lot refers to the standardized unit of trading. The most common lot sizes are standard lots (100,000 units of the base currency), mini lots (10,000 units), and micro lots (1,000 units).

The lot size determines both the value of each pip (the smallest price change) and the overall size of the trade. Traders need to understand lot sizes and how they impact pip values in order to properly manage risk and position sizing in their forex trading. Lot size is a crucial component of forex trading that affects the potential profit and loss of each trade.

5. FAQs about Lot sizes

What is the relationship between Lot size and trading capital?

The Lot size should be proportional to the trader's available trading capital. It's generally recommended to risk no more than 1-2% of your account balance per trade. This helps ensure the Lot size is appropriate for your account size and risk tolerance. Traders with smaller accounts should use smaller Lot sizes to avoid over-leveraging their positions.

What factors should be considered when choosing a Lot size?

When determining the appropriate Lot size, traders should consider their account size, risk tolerance, and trading strategy. Larger Lot sizes allow for greater potential profits but also carry higher risk. Smaller Lot sizes reduce risk but may limit potential gains. Choosing the right Lot size is essential for effective position sizing and proper risk management.

What is leverage, and how does it impact lot sizing?

Leverage allows traders to control larger positions with a smaller amount of capital. It’s expressed as a ratio (e.g., 1:100). Higher leverage increases the potential profit but also magnifies risk. Explain how leverage affects lot sizing and the importance of using it wisely.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.