The term "pip" is a fundamental concept in trading, particularly in the forex market, and a key element that every trader should understand. In this article, we will delve into the meaning of a pip, how to calculate it, and its practical application in everyday trading activities.

By understanding pips, traders can make informed decisions, accurately calculate their trades, and effectively manage their investment strategies. Whether you're new to trading or looking to deepen your expertise, this article will provide valuable insights into the role of pips in the dynamic world of forex trading.

1. What is a pip with examples

The unit of measurement to express the change in value between two currencies is called a “pip”, also referred to as a price interest point. According to forex market convention, a pip is the smallest whole unit price move that an exchange rate can make.

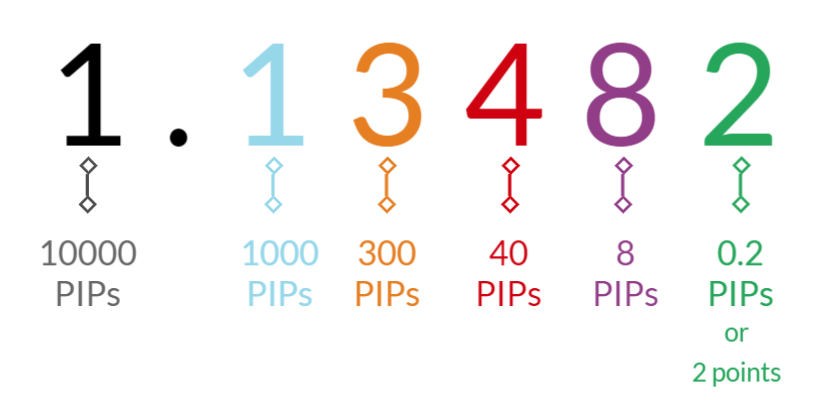

Most currency pairs are priced out to four decimal places and a single pip is in the last (fourth or second) decimal place.

There are also brokers that quote currency pairs beyond the standard “4 and 2” decimal places to “5 and 3” decimal places, like Mitrade. These are referred to as fractional pips, also called “points” or “pipettes.”

fig 1. For currency pairs and quotes displayed to 5 decimal places

Suppose the price of EUR/USD was 1.13452. After a price movement, if the price of EUR/USD is now 1.13482, it changes by 0.00030, 30 points or 3 pips (from 1.13452 to 1.13482).

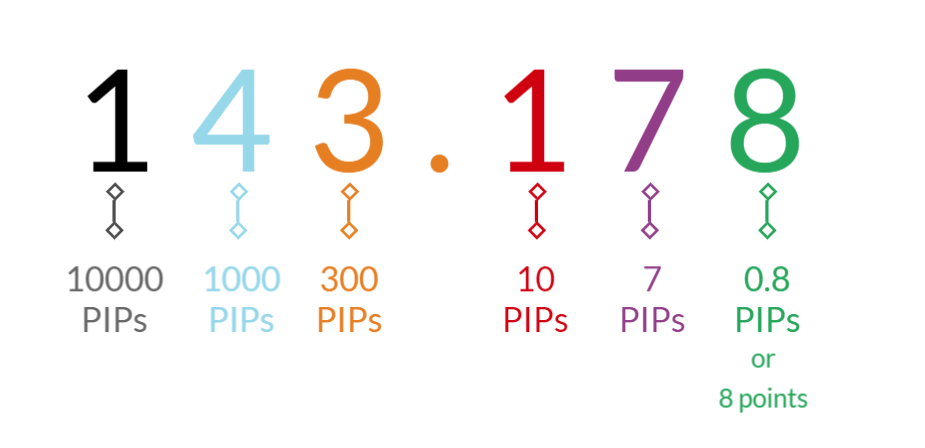

fig 2. For currency pairs and quotes displayed to 3 decimal places

There are also currency pairings with 3 decimal places such as USD/JPY. Suppose the price of USD/JPY was 143.118 and after a price movement, if the price of USD/JPY rose to 143.178, it changed by 0.60, 60 points or 6 pips (from 143.118 to 143.178).

Here are some more examples of the pip values for various major forex pairs (Using the data from Mitrade):

Forex pairs | Pip values | Examples |

GBP/USD | 0.00001 | If the exchange rate moves from 1.29078 to 1.29050, it has changed 2.8 pips. |

USD/CHF | 0.00001 | If the exchange rate moves from 0.89138 to 0.89213, it has changed 7.5 pips. |

AUD/USD | 0.00001 | If the exchange rate moves from 0.66160 to 0.66922, it has changed 76.2 pips. |

USD/CAD | 0.00001 | If the exchange rate moves from 1.37856 to 1.37622, it has changed 23.4 pips. |

EUR/GBP | 0.00001 | If the exchange rate moves from 0.84163 to 0.84056, it has changed 10.7 pips. |

EUR/JPY | 0.001 | If the exchange rate moves from 168.919 to 168.927, it has changed 0.8 pips. |

2. How to read pip on trading screen

Reading pips on a trading screen is essential for understanding price movements and making informed trading decisions. Here's a step-by-step guide on how to read pips on a trading screen:

Example:

Figure 3: USD/CAD price chart (Source: Mitrade)

Figure 3 shows the USD/CAD forex pair's price chart, where we can see the exchange rate and its change over time compared to the opening price in the top right corner.

The open price: 1.37856

The current price: 1.37832

=> Change: 1.37856 - 1.37832 = 0.00024 or 2.4 pips

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

3. How to calculate the value of a PIP

The calculation of the value of a pip depends on the three elements:

1. Currency Pairing / Instrument

2. Volume of Trade

3. Currency Price

Any minute changes on the above mentioned factors can cause a change in the calculation on the value of a pip and the trade.

Example 1: USD/CAD (US dollar against Canadian dollar)

A trader opened a long position (buy trade) of 50,000 dollars on the pair USD/CAD at price of 1.3050. Subsequently, the price rose, and the trader closed his trades, profiting 50 pips. Assuming the traders’ base currency is denominated in USD, here are the steps to calculate the profit/loss.

(1) Determine the value of one pip using the quote price (CAD | Canadian Dollar):

Volume of Trade x 1 pip = Dollar Value (Quote) / pip

50,000 x 0.0001 = 5CAD/pip

(2) Calculate the value of one pip by using base currency (USD | US Dollar):

Value 1 pip based on quote price (CAD) / Currency Price = Pip Value / USD

5/1.3050 = 3.83 USD/pip

(3) Determine the total profit and loss of the trade:

Number of pips in profit and loss x Pip Value in USD = Trade Profit and Loss in USD

50 x 3.83 = 191.50 USD

Therefore, the trader made a profit of $191.50

Example 2 : USD/JPY (US Dollar against Japanese Yen)

A trader opened a long position (buy trade) of 50,000 dollars on the pair USD/JPY at price 123.456. Subsequently, the price dropped to 123.256, and the trader closed his trades , losing 20 pips. Assuming the traders’ base currency is denominated in USD, here are the steps to calculate the profit/loss.

(1) Determine the value of one pip based on quote price (JPY | Japanese Yen):

50,000 x 0.01 = 500 yen / pip

(2) Calculate the value of one pip by using base currency (USD | US Dollar):

500 / 123.256 = 4.057 US dollars / pip

(3) Determine the total profit and loss of the trade:

-20pip loss x 4.057USD/pip = -81.14USD

As a result, the trader lost $ 81.14.

4. FAQs about pips

#4.1 How is a pip different from a pipette?

A pipette is a fractional pip, representing a smaller unit of movement. For most currency pairs, a pipette is the fifth decimal place (0.00001), and for JPY pairs, it's the third decimal place (0.001). One pip is equivalent to 10 pipettes.

#4.2. How do fractional pips (pipettes) affect trading?

Fractional pips, or pipettes, provide additional precision in price movements. This can be useful for high-frequency trading or for managing very tight spreads. They allow traders to better fine-tune their entries and exits.

#4.3. How do pips affect my trading strategy?

Understanding pips helps traders set realistic profit targets and stop-loss levels. It also aids in risk management by allowing traders to calculate the potential impact of price movements on their trades

#4.4 What is the significance of pips in risk management?

Pips are crucial in risk management as they help traders measure potential losses or gains. By calculating the pip value and setting stop-loss and take-profit orders in terms of pips, traders can manage their risk and ensure that their trading strategies align with their risk tolerance.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.