Here is what you need to know on Thursday, August 21:

The US Dollar (USD) stays resilient against its rivals early Thursday as investors gear up for key activity data from major economies. In the European session, preliminary Manufacturing and Services Purchasing Managers' Index (PMI) data from Germany, the Eurozone and the UK will be watched closely by market participants. Later in the day, the US economic calendar will offer weekly Initial Jobless Claims, Existing Home Sales data for July and the same PMI releases.

The minutes of the Federal Reserve's (Fed) July policy meeting showed on Wednesday that almost all participants saw it appropriate to leave the policy rate unchanged. According to the publication, participants noted it would take time to have more clarity on the magnitude and persistence of higher tariffs’ effects on inflation.

The USD Index closed marginally lower on Wednesday before starting to stretch higher early Thursday. At the time of press, the index was up 0.2% on the day near 98.40. Meanwhile, United States (US) President Donald Trump called on Fed Governor Lisa Cook to resign after Bloomberg reported that the director of the Federal Housing Finance Agency is urging Attorney General Pam Bondi to investigate Cook over a pair of mortgages. Following Wednesday's mixed action in Wall Street, US stock index remain virtually unchanged in the European morning on Thursday.

US Dollar PRICE This week

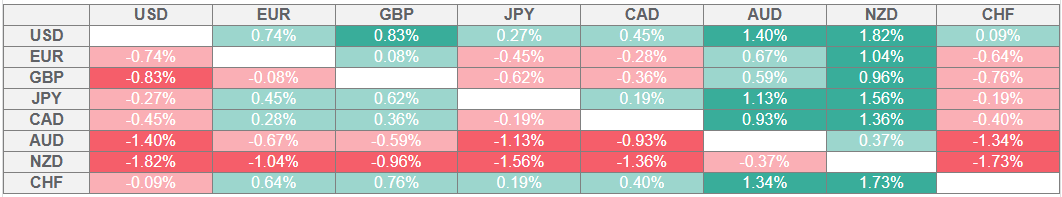

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

In the Asian session, the data from Australia showed that the S&P Global Composite PMI improved to 54.9 in early August from 53.8 in July, showing that the business activity in the private sector continued to expand at an accelerating pace. After losing about 0.3% on Wednesday, AUD/USD stays under bearish pressure and trades at its lowest level since late June at around 0.6420.

In Japan, Jibun Bank Manufacturing PMI edged higher to 49.9 in August from 48.9 in July, while the Jibun Bank Services PMI declined to 52.7 from 53.6. USD/JPY holds its ground in the European session on Thursday and clings to moderate gains above 147.50.

GBP/USD failed to benefit from the UK inflation data and closed the third consecutive day in negative territory on Wednesday. The pair continues to push lower early Thursday and trades below 1.3450.

After closing unchanged for two straight days, EUR/USD stays on the back foot in the European morning and trades below 1.1650.

Gold rose nearly 1% on Wednesday as the benchmark 10-year US Treasury bond yield turned south. XAU/USD struggles to build on its recovery gains and trades below $3,340 early Thursday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.