Ethereum Price Forecast: ETH bounces off $4,100 as whales show resilience

- Bitcoin Cash Unveiled: Why Did BCH Price Surpass BTC? Can it Soar to $1,000 in the Future?

- AUD/USD holds steady below 0.6650, highest since September ahead of China's trade data

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- AUD/USD sticks to gains above 0.6600, highest since late October after Aussie trade data

- AUD/USD holds steady above 0.6600; remains close to two-month high ahead of US PCE data

Ethereum whales bought over 550K ETH during the correction between Thursday and Tuesday.

Investors, spearheaded by small-scale holders, realized over $4 billion in profits during the period.

ETH bounces off the $4,100 support as it eyes a recovery of the $4,500 key level.

Ethereum (ETH) saw a 5% gain on Wednesday as large-scale holders continued accumulating the altcoin despite increased profit-taking from retailers.

Ethereum whales maintain buying pressure despite increased profit-taking

After two days of steady declines, Ethereum bounced back with gains of over 6% on Wednesday. The rise has sparked an increase in short liquidations, with positions worth over $100 million liquidated over the past 24 hours, per Coinglass data.

The move follows a large short bias in Ethereum futures net taker volume. The net short volumes have risen toward record levels seen in December before ETH registered an over 60% decline in the months that followed. While such positions put pressure on the top altcoin, they could spark a short squeeze if ETH continues its multi-month uptrend.

-1755738583042-1755738583043.png)

ETH Futures Net Taker Volume. Source: CryptoQuant

Ethereum's bounce back is also strengthened by the resilience of large-scale investors during the correction. Investors holding between 10K and 100K ETH grew their collective stash by 550K ETH over the past week despite prices dropping by 10%. However, small-scale holders showed weak hands, trimming their holdings by about 380K ETH.

The latter cohort spearheaded a profit realization of over $4 billion, per Santiment data, during the period of ETH's correction, which was triggered by a higher-than-expected inflation reading last week and de-risking ahead of Federal Reserve Chair Jerome Powell's speech at Jackson Hole.

-1755738253822-1755738253823.png)

ETH Balance by Holder Value. Source: CryptoQuant

"After such a strong pump, the market was understandably more fatigued and conservative, so locking in profits before a major Fed speech isn't surprising. In crypto terms, a 4–5% retracement is hardly alarming," Nicolai Sondergaard, Research Analyst at Nansen, told FXStreet in an email on Wednesday.

In addition to the buy-the-dip whale attitude, continued accumulation from digital asset treasuries (DATs) also helped in keeping prices afloat during the correction. These firms, led by BitMine Immersion and SharpLink Gaming, collectively bought about 520K ETH last week, per data from the StrategicETHReserve.xyz.

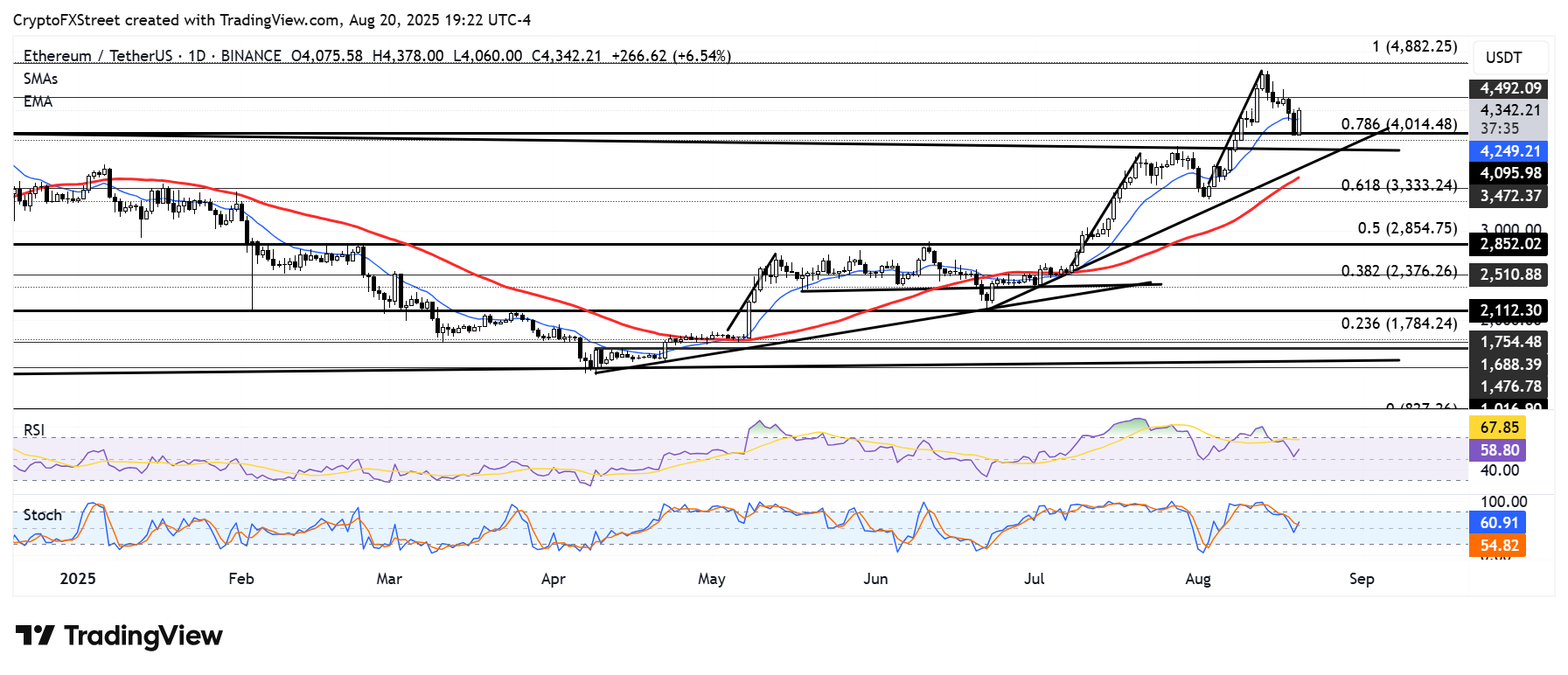

Ethereum Price Forecast: ETH bulls defend support near $4,100

Ethereum halted the bearish run on Wednesday, recording a 6% rise as bulls returned to defend the support near $4,100.

ETH/USDT daily chart

If ETH continues to rise and recovers the $4,500 key level, it could retest its all-time high resistance at $4,868. A new all-time high could validate another bullish pennant pattern for the top altcoin high.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are back above their neutral levels, indicating a resumption of dominant bullish momentum.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.