Ripple Price Forecast: XRP shows signs of exhaustion as focus shifts to Trump tariffs impact

- XRP recovery rejected below $3.32 resistance, reflecting volatility and possible risk-off sentiment in the broader crypto market.

- Reciprocal tariffs are set to take effect on Friday for countries yet to ink trade deals with the US.

- XRP's technical structure leans bearish on Thursday, underpinned by a MACD sell signal while the RSI descends.

Ripple (XRP) price is on the back foot, retracing slightly to trade at $3.09 on Thursday. An attempt to break above resistance at $3.32 failed, reflecting low demand retail and a shift in market sentiment, following Wednesday's United States (US) Federal Reserve (Fed) interest rate decision.

Fed Chair Jerome Powell's remarks left investors with more questions than answers as the central bank took a hawkish stance on interest rate cuts. Powell insists that the regulator will continue with its wait-and-see approach as it monitors incoming data amid the perceived impact of higher tariffs coming into effect on Friday.

XRP struggles above support amid tariff impact concerns

President Donald Trump's tariff deadline is nearing, with countries without signed trade deals facing higher export duties starting Friday. According to CNBC, the White House has fallen short of its goal to ink over 200 trade deals, managing only eight, including a major agreement with the European Union (EU) earlier this week.

Trade talks with China are still ongoing with little sign of a trade deal in the near term. High-stakes negotiations between the two economic giants have frequently hit roadblocks, particularly with recent discussions in Stockholm, ending without a truce. The current truce is set to expire on August 12.

Investors in the cryptocurrency market remain on the edge, considering the sell-off that followed President Trump's April 2 "Liberation Day tariff announcement. With no sign of another extension, traders are bracing for a potential volatility spike heading into the weekend.

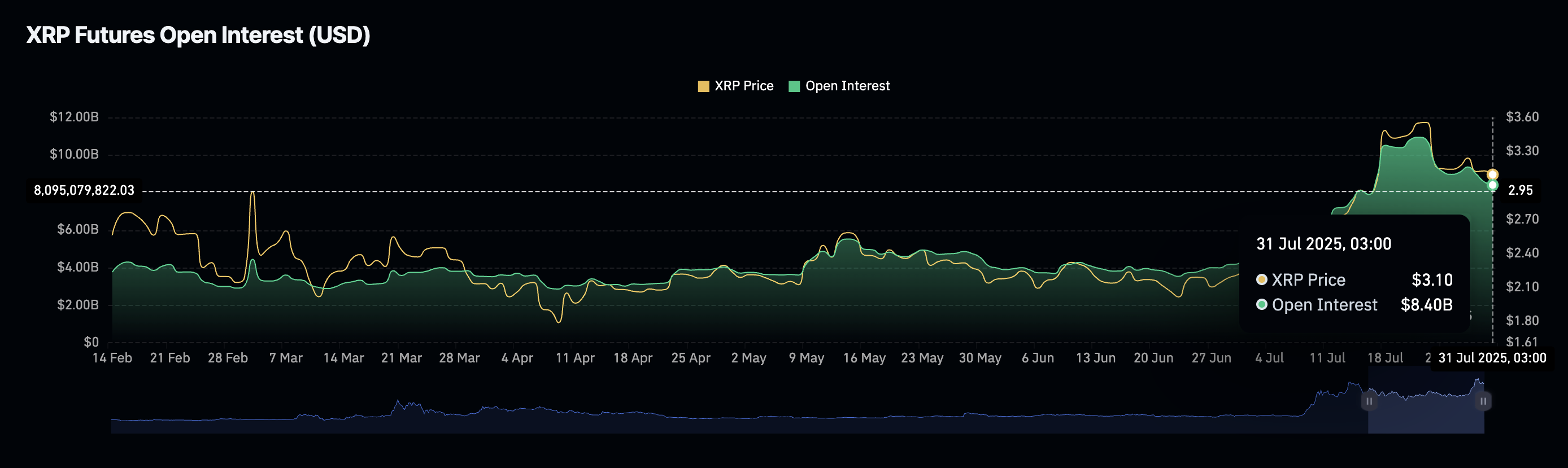

Interest in XRP has faltered since its record high of $3.66, reached on July 18. According to CoinGlass, the futures Open Interest (OI) averaged $8.4 billion on Thursday, down 23% from its yearly peak level of $10.94 billion, recorded on July 22.

Since OI represents the notional value of outstanding futures or options contracts, a persistent decline means a lack of conviction in the token's ability to sustain the uptrend. Moreover, there is an overall decrease in leveraged long positions, leaving XRP susceptible to rising supply as profit activities surge amid a reduction in buying pressure.

XRP Futures Open Interest | Source: CoinGlass

Technical outlook: XRP bulls defend $3.00 support

XRP price holds above support at $3.00 at the time of writing on Thursday as bulls move swiftly to prevent further decline. The token's technical picture on the daily chart below leans bearish, characterized by a sell signal triggered by the Moving Average Convergence Divergence (MACD) indicator on Friday.

If investors reduce exposure due to the MACD indicator descending toward the mean line and the blue line remaining below the red signal line, selling pressure could overwhelm demand, which has significantly shrunk as evidenced by the Relative Strength Index (RSI) extending the decline toward the midline.

XRP/USDT daily chart

Key areas of interest for traders are the support at $3.00 and, by extension, the level of $2.95, which was tested on Thursday. The 50-day Exponential Moving Average (EMA) at $2.77 is in line to provide support in the event selling pressure intensifies. Still, a recovery could be established above support at $3.00, bringing the next key hurdle at $3.32 and the record high of $3.66 in the bullish scope.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.