Ripple Price Forecast: XRP advances as whales step up accumulation amid renewed risk-on sentiment

- XRP eyes a short-term breakout above $2.50, supported by improving sentiment in the broader crypto market.

- Wallets holding between 10 million and 100 million XRP are accumulating tokens, signaling an increasing risk appetite.

- Retail demand for XRP remains significantly subdued, with the Open Interest falling to $3.67 billion.

Ripple (XRP) is trading slightly below $2.50 at the time of writing on Thursday, after marking an intraday high at $2.52 buoyed by positive sentiment in the broader cryptocurrency market.

Bullish sentiment is poised to recover after United States (US) President Donald Trump signed legislation that ended the longest government shutdown in the country's history.

Trump said that the US "can never let this happen again," adding, "This is no way to run a country." XRP, Bitcoin (BTC), Ethereum (ETH), and other risk assets are edging higher as investors respond positively to the news.

Whales increase exposure, bolstering XRP's bullish outlook

Large volume holders of XRP have, since the October 10 deleveraging event, which wiped out over $19 billion in crypto assets in a single day, increased their risk appetite.

Santiment data shows that wallets holding between 10 million XRP and 100 million XRP have grown to account for 13.43% of the total supply from 12.25% on October 10.

The steady accumulation suggests that investors are confident in XRP's ability to recover, while the larger ecosystem expands through adoption. Higher demand predisposes XRP for a steady uptrend as available supply shrinks.

[14-1763040373954-1763040373955.45.44, 13 Nov, 2025].png)

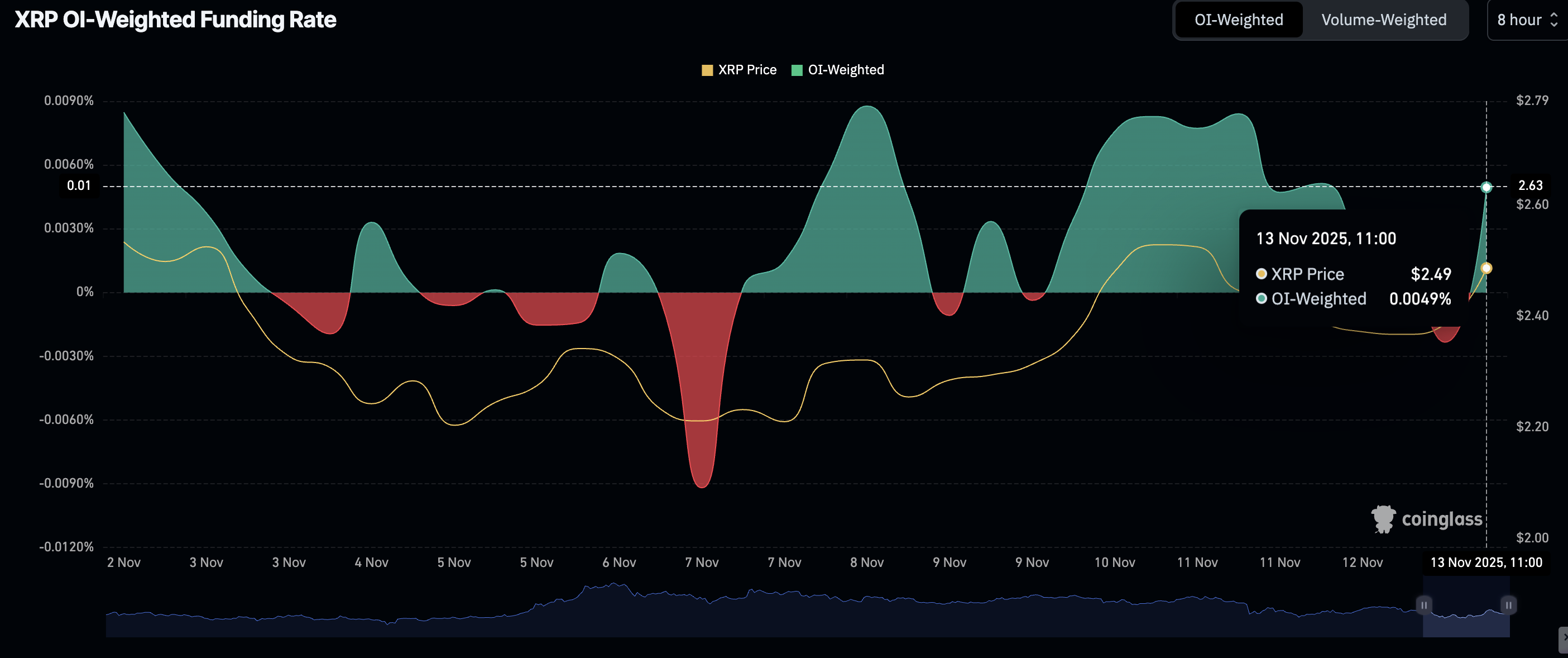

However, retail demand for XRP has not recovered since mid-October, characterised by a weak derivatives market. CoinGlass data shows the futures Open Interest (OI) averaging $3.67 billion on Thursday, down from $3.95 billion on Wednesday and $4.11 billion on Tuesday.

A steady increase in OI is required to support XRP's short-term recovery, indicating that investors have confidence in the token and the ecosystem and are willing to increase their risk exposure.

However, the OI-Weighted Funding Rate metric is at 0.0049%, up from -0.0023% earlier in the day, suggesting that traders are starting to pile into long positions amid emerging opportunities.

Technical outlook: XRP eyes recovery momentum in the short-term

XRP is trading above $2.40 at the time of writing on Thursday, supported by steady demand from large-volume holders and improving sentiment in the broader cryptocurrency market.

A buy signal maintained by the Moving Average Convergence Divergence (MACD) indicator since Monday underpins XRP's short-term bullish outlook. If the blue MACD line holds above the red signal line as the indicator generally rises, risk appetite will increase, driving risk exposure.

The Relative Strength Index (RSI) is at 51, indicating a bullish signal and an increased likelihood of a sustained uptrend. Key areas of interest for traders include the 50-day Exponential Moving Average (EMA) at $2.54, the 200-day EMA at $2.57 and the 100-day EMA at $2.64, all of which highlight vital resistance levels.

Still, the SuperTrend indicator remains above XRP's price, pointing to persistent overhead pressure. This tool uses the Average True Range (ATR) to measure market volatility; a sell signal prompts investors to cut exposure, further adding to selling pressure. Early profit-taking may dampen the uptrend, triggering a sell-off toward $2.24, a support tested on Sunday, and $2.07, tested on November 4.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.