Bitcoin Price Forecast: BTC heads toward $120,000 as ETF inflows return, long-term demand strengthens

- Bitcoin price extends gains on Monday after rallying more than 5% in the previous week, signaling renewed bullish momentum.

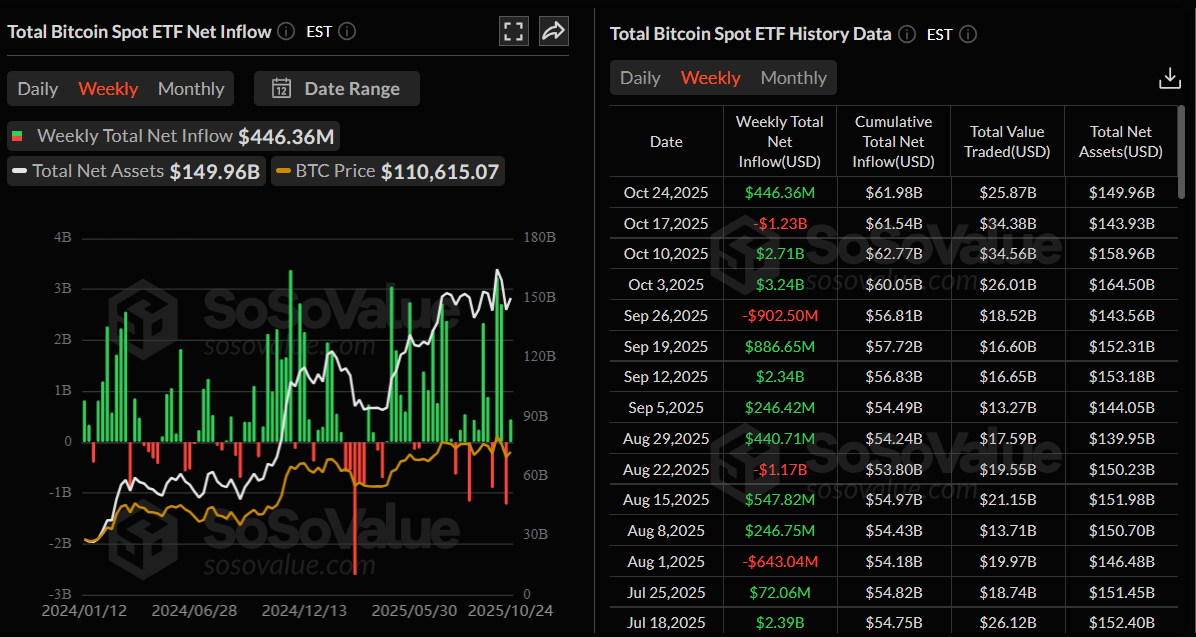

- US-listed spot Bitcoin ETFs recorded $446.36 million in inflows last week.

- On-chain data shows short-term momentum easing, but long-term structural demand remains solid.

Bitcoin (BTC) trades in green, above $115,000 at the time of writing on Monday, after rallying over 5% in the previous week. Institutional demand shows signs of strength, as spot Bitcoin Exchange Traded Funds (ETFs) record inflows of over $446 million last week. On-chain data suggests that long-term holders remain firmly positioned, providing a strength for BTC's next leg higher.

Bitcoin institutional demand returns

Bitcoin started the week with modest gains, trading above $115,000 at the time of writing and extending its gains from last week. The return of institutional demand supports this price surge. According to SoSoValue data, spot Bitcoin ETFs recorded weekly inflows of $446.36 million, reversing the prior week’s $1.23 billion outflow.

Total Bitcoin spot ETF net inflow weekly chart. Source: SoSoValue

On-chain data shows the Dolphin cohort emerges as a key Bitcoin accumulator

CryptoQuant’s weekly report highlighted that while Bitcoin’s short-term momentum is weakening, the long-term structural demand remains intact.

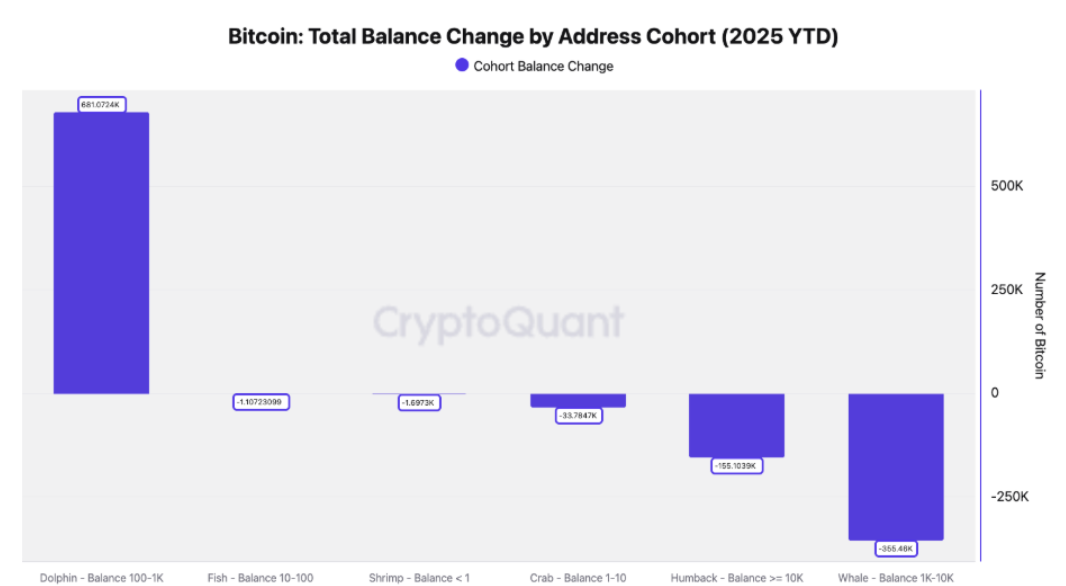

The report explains that the Dolphin cohort—comprising ETFs, corporations, and large holders—remains the anchor of this cycle’s demand structure. So far this year, the Dolphin cohort has been the primary accumulator, increasing its total balance by over 681,000 BTC, while all other address groups have seen net declines in holdings. This divergence shows that large investors and institutional entities have been absorbing supply from smaller market participants, providing a strong underlying demand base during the recent cycle.

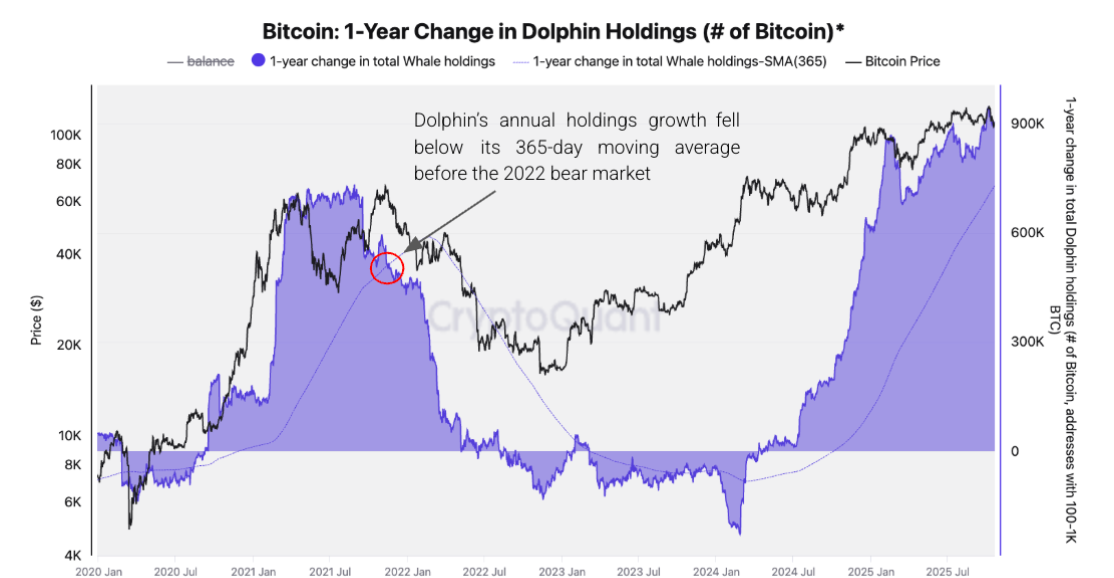

The graph below shows that historically, the end of a Bitcoin bull cycle has coincided with a decline in the annual growth rate of Dolphin holdings. During the 2021 peak, the cohort’s annual growth fell below its 365-day moving average, signaling a reversal in demand and a subsequent price correction.

In contrast, the current data show that the 1-year growth in Dolphin balances remains above its 365-day moving average, indicating that long-term accumulation remains intact. This suggests that the structural demand from key entities—such as ETFs and corporate treasuries—has not yet deteriorated, and the market may still be in the late stages of a bull cycle rather than at its conclusion.

Some other signs of optimism

Apart from the return of institutional demand and rising accumulation in the Dolphin cohort, signs of easing trade tensions between the US and China further boosted investors' appetite for riskier assets such as Bitcoin.

On Sunday, top Chinese and US economic officials agreed on the framework of a potential trade deal to be discussed when US President Donald Trump and Chinese President Xi Jinping meet later this week. US Treasury Secretary Scott Bessent said that discussions on the sidelines of the Association of Southeast Asian Nations (ASEAN) Summit in Kuala Lumpur had eliminated the threat of 100% tariffs on Chinese imports, set to take effect on November 1.

This helps calm investor nerves and eases concerns over a further escalation in trade tensions between the world’s two largest economies, boosting risk-on sentiment and allowing Bitcoin to extend its gains.

Japan’s first yen-denominated stablecoin

JPYC Inc. announced the official launch of its yen-denominated stablecoin, JPYC, on Monday, along with the release of its dedicated issuance and redemption platform, JPYC EX.

This stablecoin is pegged 1:1 to the Japanese yen and fully backed by bank deposits and government bonds. Initial support includes issuance on the Avalanche (AVAX), Ethereum (ETH), and Polygon (POL) blockchains.

The launch of stablecoins in Japan supports a bullish outlook for the long term, as stablecoins often serve as gateways to cryptocurrencies and help drive broader acceptance and adoption.

Bitcoin Price Forecast: BTC bulls aiming for $120,000

Bitcoin price found support around the 61.8% Fibonacci retracement level (drawn from the April low of $74,508 to the record high of $126,199) at $106,453 on Wednesday. BTC rose 6.57% in the next four days and closed above the 50-day Exponential Moving Average (EMA) at $113,402. At the time of writing on Monday, BTC trades above $115,000, nearing the key resistance at $115,137.

If BTC closes above the 78.6% Fibonacci retracement at $115,137, it could extend the rally toward the psychologically important $120,000 level.

The Relative Strength Index (RSI) on the daily chart reads 55, above the neutral level of 50, indicating bullish momentum gaining traction. Additionally, the Moving Average Convergence Divergence (MACD) showed a bullish crossover on Sunday, providing a buy signal and further supporting the bullish view.

BTC/USDT daily chart

On the other hand, if BTC faces rejection from the $115,137 level, it could extend the decline toward the 50-day EMA at $113,402.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.