Bitcoin Price Forecast: BTC holds near $122,000 as ETF inflows rise, Powell speech eyed

- Bitcoin price hovers around $122,000 on Thursday after reaching a new all-time high of $126,199 earlier this week.

- US-listed spot Bitcoin ETFs record $440.73 million inflow, continuing the positive streak since September 29.

- Investors await Fed Chair Powell’s speech for rate-cut cues and a fresh impetus to riskier assets such as BTC.

Bitcoin (BTC) price hovers steadily around $122,000 at the time of writing on Thursday, after reaching a new all-time high of $126,199 earlier this week. Strong inflows of Exchange-Traded Funds (ETFs) continued to support Bitcoin’s demand. Meanwhile, traders turned their attention to Fed Chair Jerome Powell’s upcoming speech for signals on potential interest rate cuts and market direction.

Bitcoin traders await Fed Chair Powell speech

Bitcoin price started the week on a positive note, reaching a new all-time high of $126,199 on Monday. However, BTC experienced a 2.67% pullback on Tuesday, as holders realized some gains – this has already been explained in the previous report.

On Wednesday, Bitcoin recovered slightly, closing above $123,300, as the Minutes from the Federal Reserve’s September meeting indicated near unanimity among participants to lower interest rates over the remainder of the year, amid concerns about labor market risks. Policymakers, however, remained split on whether there should be one or two additional rate reductions before the year-end. This dovish stance triggered a slight risk-on sentiment, which helped BTC to recover.

Meanwhile, the Israel-Hamas ceasefire and hostage agreement announced this Thursday eases some of the geopolitical tensions, supproting Bitcoin's recovery.

Market participants await Fed Chair Jerome Powell’s speech later in the day for cues about further monetary easing and a fresh impetus to riskier assets such as BTC.

Institutional demand continues to strengthen

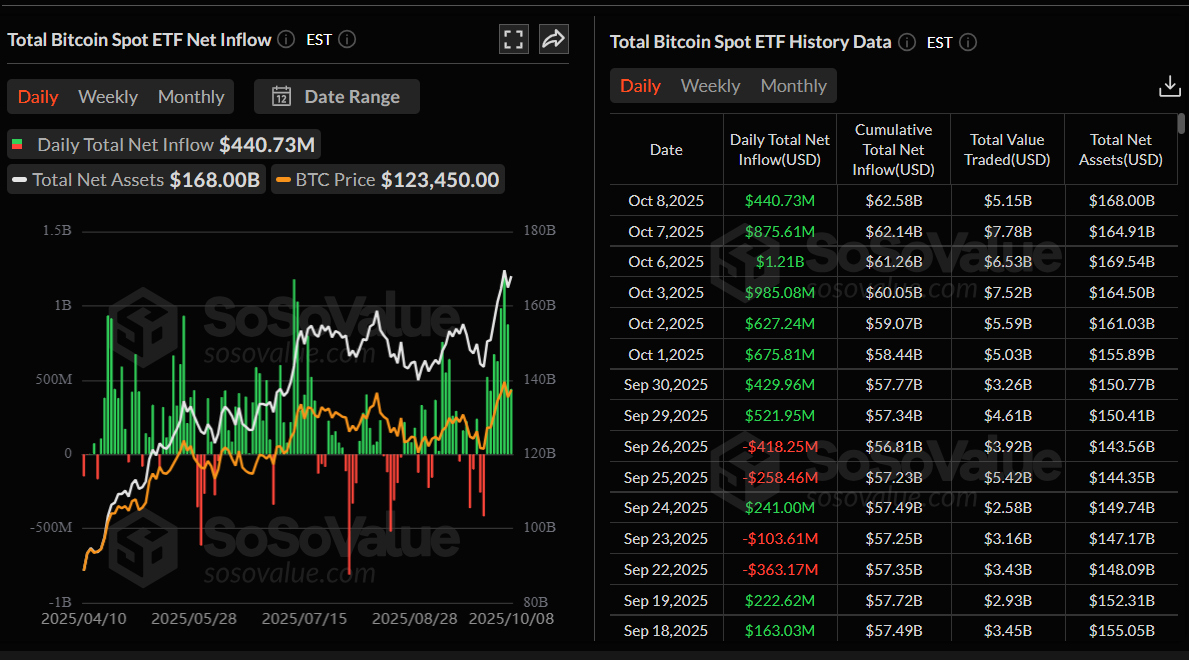

Bitcoin’s institutional demand continues to strengthen so far this week. According to SoSoValue data (chart below), Bitcoin spot ETFs recorded an inflow of $440.73 million on Wednesday, continuing their streak of inflows since September 29.

Total Bitcoin spot ETF net inflow chart. Source: SoSoValue

DDC Enterprise Limited (DDC), a publicly listed company pioneering Bitcoin treasury adoption, announced on Wednesday the completion of a $124 million equity financing round, led by PAG Pegasus Fund and Mulana Investment Management. The proceeds will be used to advance the company’s Bitcoin treasury strategy. To date, DDC has accumulated a total of 1,058 BTC.

Profit-taking remains low after reaching all-time highs

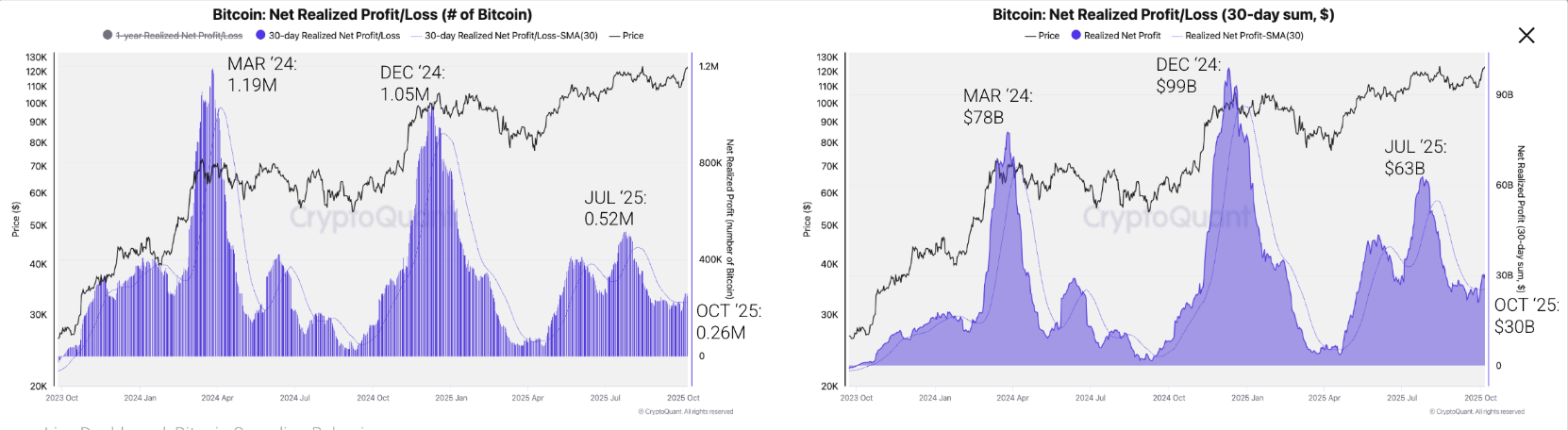

CryptoQuant's report on Wednesday highlighted that profit-taking activity remains at relatively low levels after Bitcoin reached a new all-time high of $126,199 on Monday, suggesting that BTC may continue to rally and that a top is still not on the horizon.

The chart below shows that the total net realized profits of Bitcoin holders over the last 30 days stand at 0.26 million BTC on Wednesday, equivalent to a $30 billion profit. This level is 50% below July’s previous peak of 0.53 million BTC or $63 billion profit, and far from the March and December 2024 levels of $78 and $99 billion profits, respectively.

“Low levels of profit-taking indicate that market participants are not selling heavily and that the price rally may continue ahead,” said CryptoQuant’s analyst.

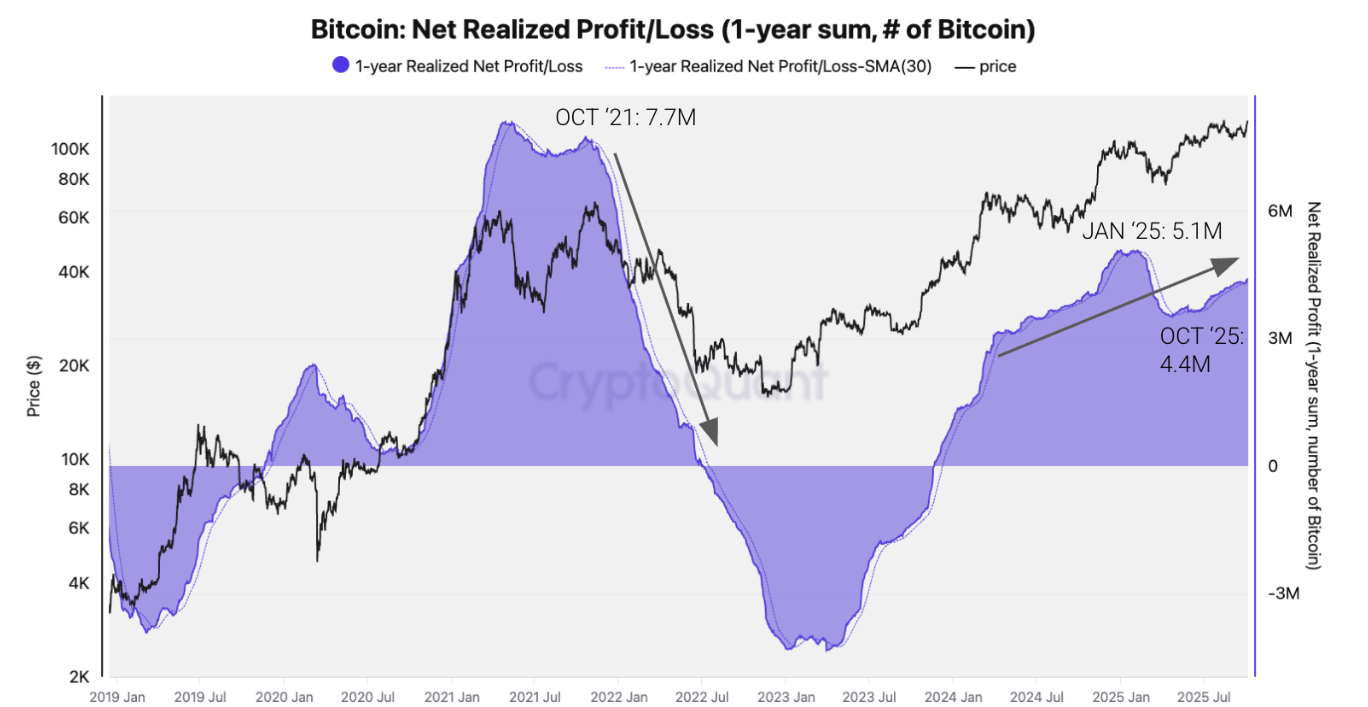

The report further explains that there are still no signs of a price peak as profit-taking momentum remains positive. On an annual basis, on-chain data indicate that net realized profits continue to trend upward, which supports higher prices. Prices peaked in December 2021 as the annual growth of realized profits started to stall.

Bitcoin Net Realized Profit/Loss (1-year sum) chart. Source: CryptoQuant

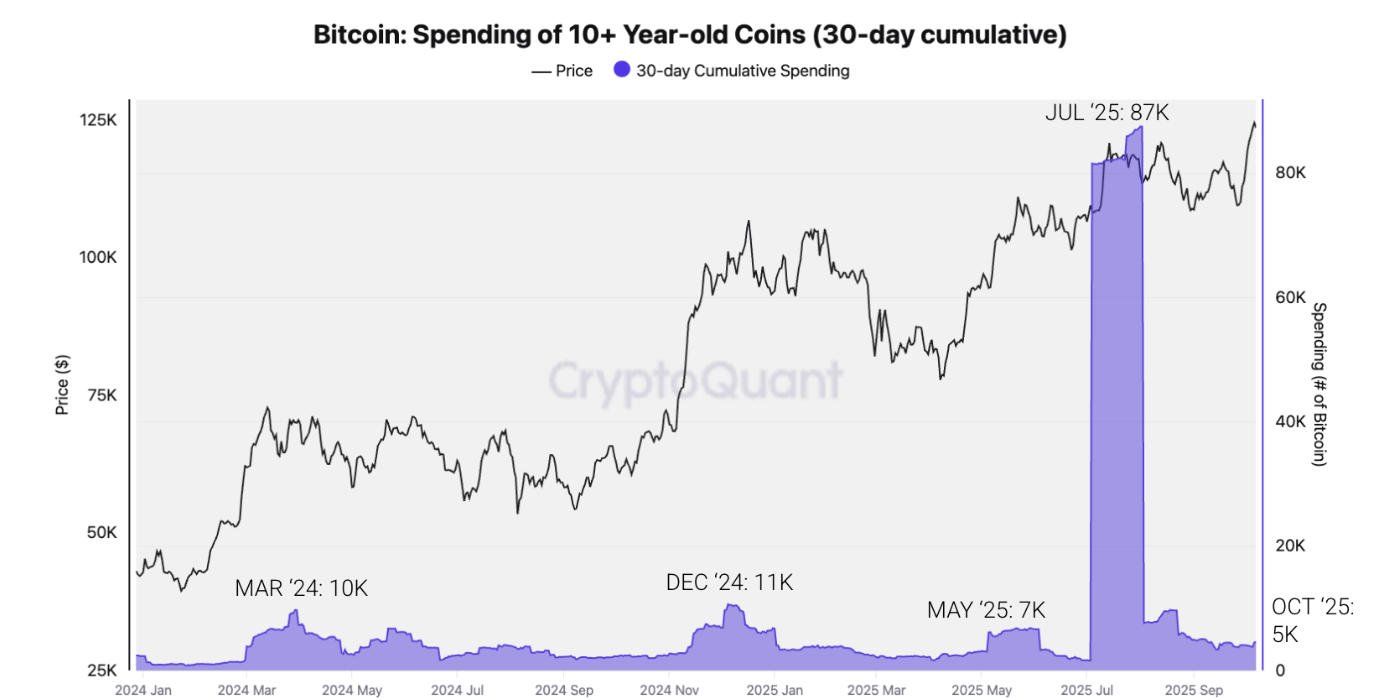

Moreover, selling activity from Bitcoin “OGs” also remains relatively low. Bitcoin's spending of 10+ year-old coins in the last 30 days stood at 5,000 on Wednesday – half of the expenditure seen in previous price peaks in March and December 2024, 29% below May’s 2025 top, and 94% lower than the July highs. High selling activity from Bitcoin OGs typically accompanies price tops.

Bitcoin spending of 40+ year old coins (30-day cumulative) chart Source: CryptoQuant

Bitcoin Price Forecast: BTC faces slight rejection after record highs

Bitcoin price broke above the $120,000 resistance level on October 2 and rose 3.43% over the next four days, reaching a new all-time high of $126,199 on Monday. However, BTC faced a slight rejection the next day and recovered slightly on Wednesday. At the time of writing, BTC edges slightly down to around $121,600.

If BTC continues its correction and closes below $120,000, it could extend the decline toward the next daily support level at $116,000.

The Relative Strength Index (RSI) on the daily chart reads 59 after falling from the overbought conditions on Monday, indicating a potential slowdown in bullish momentum and the likelihood of short-term consolidation. However, the Moving Average Convergence Divergence (MACD) indicator showed a bullish crossover last week that still holds and supports the bullish view.

BTC/USDT daily chart

However, if BTC maintains its upward momentum, it could extend the rally toward the record high of $126,199.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.