Bitcoin Price Forecast: BTC edges below $124,000 after hitting record highs

- Bitcoin price edges slightly down on Tuesday after hitting a new all-time high of $126,199 the previous day.

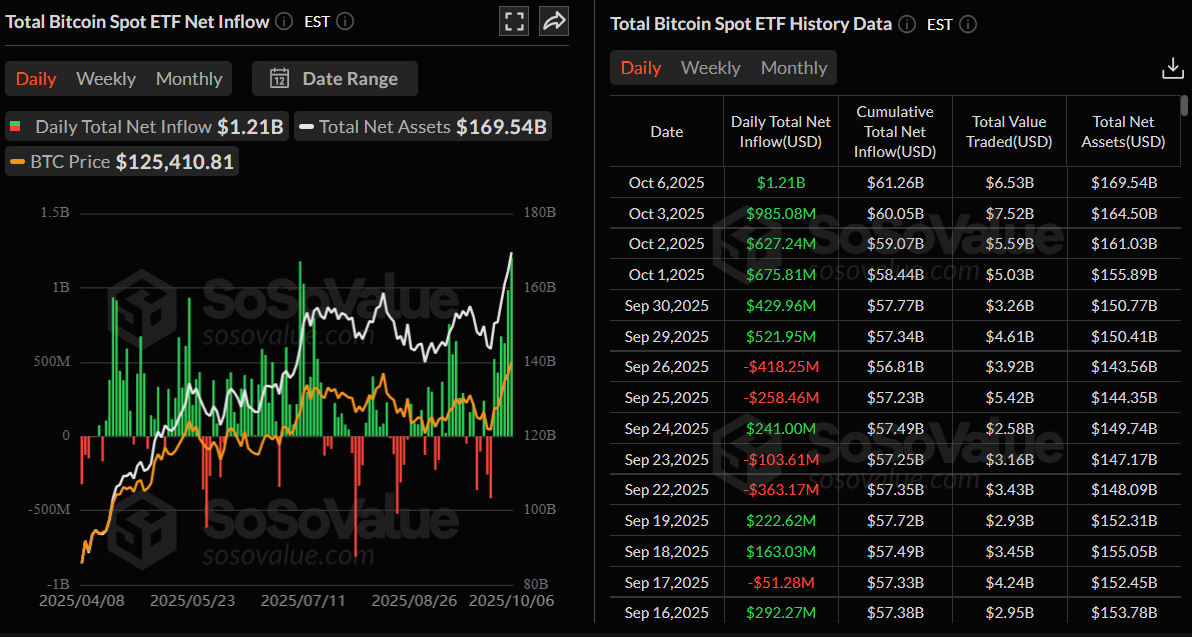

- US-listed spot ETFs recorded an inflow of $1.21 billion on Monday, keeping the streak of positive flows since September 29.

- Traders should be cautious as minor corrections are possible, but the broader context remains favourable for a bullish fourth quarter.

Bitcoin (BTC) trades below $124,000 on Tuesday after notching a new all-time high of $126,199 in the previous day. Strong inflows into US-listed spot Bitcoin Exchange Traded Funds (ETFs) continue to underpin demand. Meanwhile, analysts caution that minor pullbacks are possible, even as the broader outlook for the fourth quarter remains bullish.

Bitcoin institutional demand strengthens

According to SoSoValue data (chart below), institutional demand started the week on a positive note, as Bitcoin spot ETFs recorded a total of $1.21 billion on Monday, continuing their six-day streak since September 29. Moreover, in the previous week, ETF flows recorded net inflows of $3.24 billion, their largest in 2025 and the second-largest on record.

Citadel founder Ken Griffin told Bloomberg on Monday that investors are turning to Gold, Silver, and Bitcoin in a “debasement trade,” seeking assets seen as safer than the US Dollar — a shift he called “really concerning.”

He warned of “substantial asset inflation away from the Dollar” as investors move to de-Dollarize and reduce exposure to US sovereign risk.

Some holders are realizing profits

Bitcoin’s on-chain metrics indicate that BTC holders are booking some profits as the cryptocurrency hits record highs, according to Santiments’ Network Realized Profit/Loss (NPL), which computes a daily network-level Return On Investment (ROI) based on the coin’s on-chain transaction volume. Strong spikes in a coin’s NPL indicate that its holders are, on average, selling their bags at a significant profit. On the other hand, strong dips imply that the coin’s holders are, on average, realizing losses, suggesting panic sell-offs and investor capitulation.

The metric showed multiple spikes on Sunday and Monday, indicating that holders are, on average, selling their bags at a significant profit and increasing the selling pressure.

[14-1759827745888-1759827745889.04.20, 07 Oct, 2025].png)

BTC NPL chart. Source: Santiment

Bitfinex analyst told FXStreet, “Owing to its strong correlation with traditional finance, the broader liquidity cycle, and options market seasonality, the cryptocurrency market has historically tended to rally in October following weak Septembers.”

The analyst continued that historically, October, known colloquially as “Uptoberˮ, has delivered positive returns in nine of the past eleven years, averaging gains of roughly 21%. Q4 has also consistently been Bitcoinʼs strongest quarter, with average returns of nearly 80%. While minor corrections remain possible, the broader context continues to favour a bullish fourth quarter. The setup remains favourable for several reasons: a dovish Federal Reserve stance, easing US inflation, renewed ETF inflows, and stable on-chain support. All of them suggest the corrective phase is likely behind us.

Bitcoin Price Forecast: BTC hits new record high of $126,199

Bitcoin price started the week on a positive note, hitting a new all-time high of $126,199 on Monday after surging more than 10% in the previous week. At the time of writing on Tuesday, it trades slightly down at around $123,811.

If BTC continues its upward trend, it could extend the rally toward the key psychological level at $130,000.

However, the Relative Strength Index (RSI) on the daily reads 69 after declining from the overbought conditions on Monday. It points downward, indicating a potential slowdown in bullish momentum and the likelihood of short-term consolidation.

BTC/USDT daily chart

However, if BTC faces a correction, it could extend the decline toward the key support at $120,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.