Ripple Price Forecast: What’s next for XRP as SEC shifts focus from courtroom to policy?

- XRP extends trend correction toward $3.00 support as attention in the broader crypto market shifts to US inflation data.

- US SEC Chair Paul Atkins hints at a dynamic shift to policy drafting following the resolution of the Ripple lawsuit.

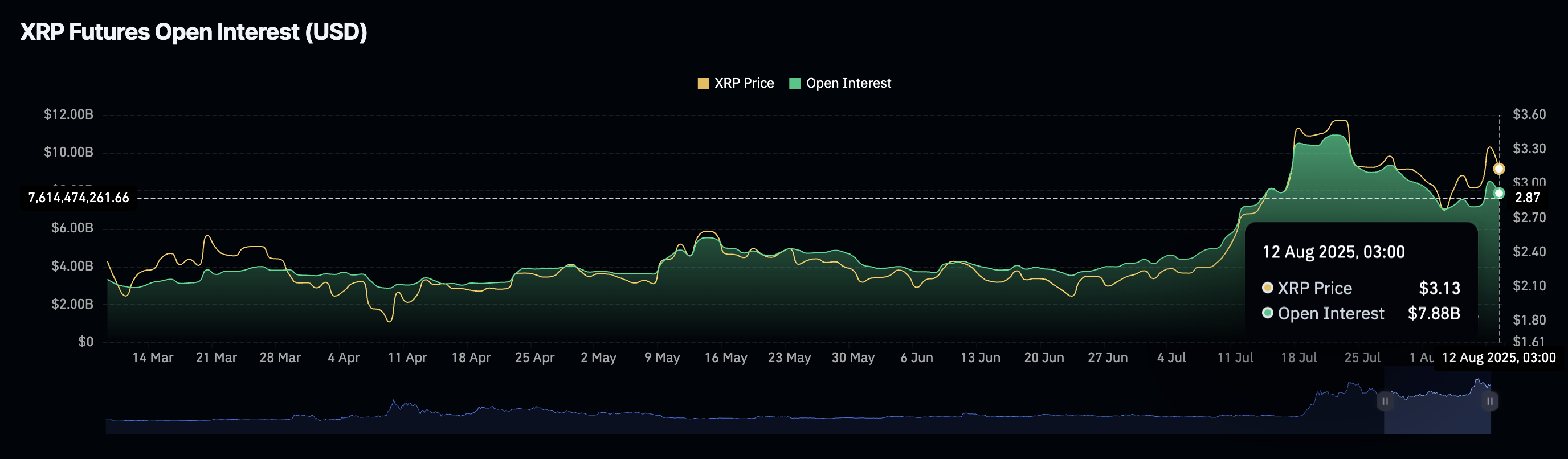

- The minor pullback in the futures Open Interest to $7.88 billion suggests declining speculative demand.

Ripple (XRP) faces a volatility spike with the price declining slightly to $3.11 on Tuesday as participants in the broader crypto market anticipate the release of United States (US) inflation data.

The cross-border money remittance token has declined nearly 8% from the previous week’s peak of $3.38 and almost 15% from its record high of $3.66 reached on July 18.

If interest in XRP falters as evidenced by weakening derivatives market indicators, the path of least resistance could remain downward, increasing the chances of the price extending the leg below the $3.00 support.

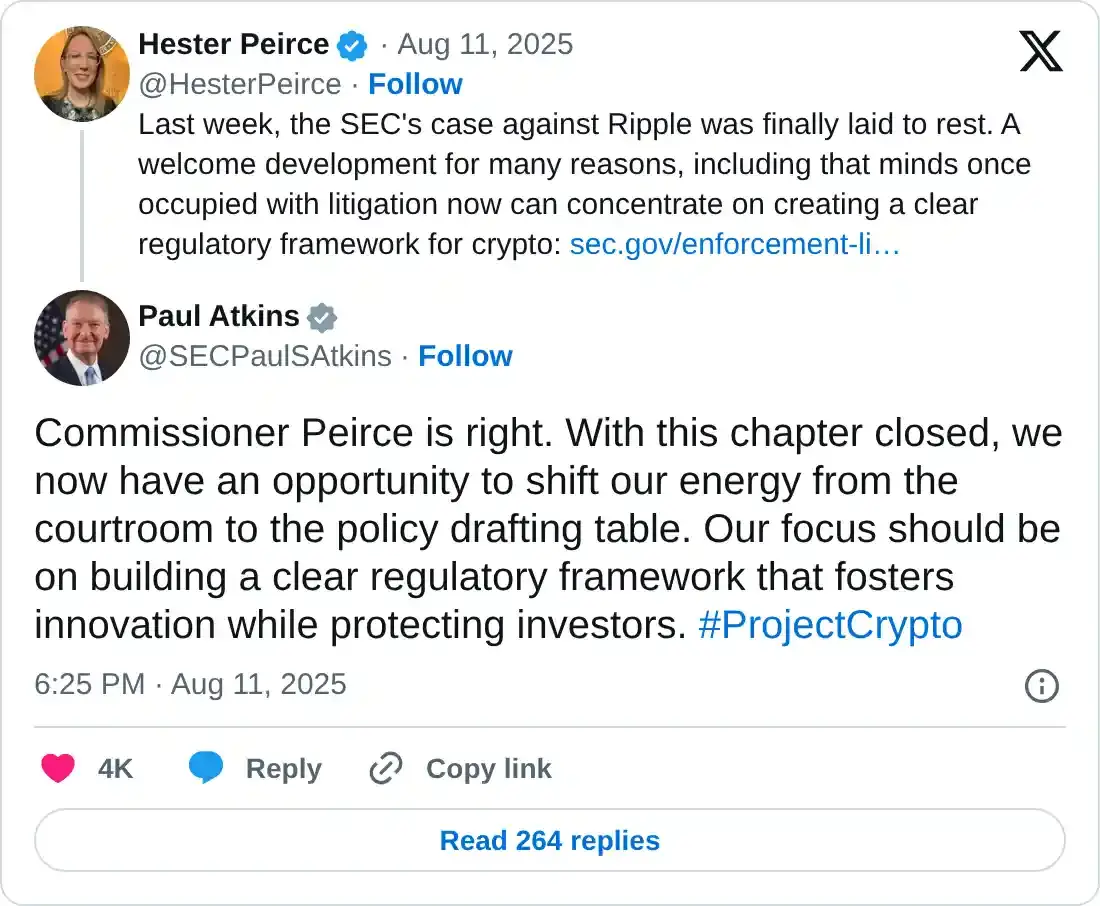

US SEC focus shifts to policy

The United States (US) Securities & Exchange Commission’s (SEC) Chair, Paul Atkins, has hinted at the agency’s next phase, following the resolution of the lawsuit against Ripple.

Atkins insinuated that the SEC will now focus on policy drafting, agreeing with Commissioner Hester Peirce, who said in an X post that the resources that the litigation had occupied “now can concentrate on creating a clear regulatory framework for crypto.”

The SEC Commissioners voted in favour of dropping the lawsuit against Ripple, paving the way for the agreed $50 million settlement. Both parties jointly filed to drop appeals last week.

XRP reacted positively to the lawsuit resolution on Friday, increasing above support at $3.00 to $3.38. The resistance at $3.40 was tested but not broken, subsequently delaying an anticipated breakout toward its record high.

The SEC sued Ripple in 2020, alleging that the company sold unregistered securities in violation of US securities laws.

A landmark ruling in 2023 found that the programmatic sale of XRP on third-party platforms like Binance and Coinbase did not constitute unregistered securities. Still, the court found Ripple answerable for direct sales to institutions.

As the regulatory environment in the US improves, Ripple is expanding its infrastructure to support the tokenization of real-world assets, stablecoin payments via RLUSD, while building utility for XRP with its flagship products: On Demand Liquidity (ODL) and Ripple Payments.

Technical outlook: XRP holds support as open interest declines

XRP price holds above support at $3.00, reflecting low sentiment in the broader cryptocurrency market ahead of the release of US Consumer Price Index (CPI) data. Market participants anticipate a spike in volatility, with the current decline in price likely to persist if inflation data fails to come out favourably.

Still, a reversal could ensue if the inflation meets expectations or declines, affirming the expectations of the first rate cut this year in September when Federal Reserve (Fed) officials meet.

The futures Open Interest (OI) edges lower on Tuesday following a brief rebound to $8.5 billion on Friday. CoinGlass data shows the OI, which refers to the notional value of outstanding futures or options contracts, averaging $7.9 billion at the time of writing. Should the decline persist, it would indicate low interest in XRP as fewer traders leverage long positions. This could dampen recovery, favouring a bearish bias trend.

XRP Futures Open Interest data | Source: CoinGlass

XRP’s technical structure still upholds a bullish outlook based on the upward trending 50-day Exponential Moving Average (EMA) at $2.89, the 100-day EMA at $2.67 and the 200-day EMA at $2.40. If the trend correction accelerates below the support at $3.00, these levels would help to absorb the selling pressure.

XRP/USDT daily chart

Still, a rebound could ensue above support at $3.00 in upcoming sessions if sentiment improves in the broader crypto market. Key levels of interest for traders include the resistance at $3.40 and the record high of $3.66.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.