Gold price retreats as US yields rebound ahead of jobs data

- Gold drops amid rising US Treasury yields and a stronger US Dollar.

- US equity downturn and job market worries heighten market jitters ahead of Nonfarm Payrolls.

- Fed's Goolsbee suggests cautious monetary policy, impacting gold amidst global trade tensions.

Gold price advance stalled on Thursday as United States (US) Treasury bond yields recovered, and the Greenback holds minimal gains. Traders seem to be booking profits ahead of the release of the latest US Nonfarm Payrolls report, which could spark volatility in the financial markets. XAU/USD traded at $2,852, down 0.38%.

With no clear catalyst, the market mood shifted negatively as US equity indices turned lower. Despite this, the non-yielding metal continued to trim some of its weekly gains amid increased tensions due to the trade war between China and the US.

In addition, US jobs data showed that the number of people applying for unemployment benefits rose in the week ending February 1, revealed the US Department of Labor. A Bloomberg report said the report was mainly ignored due to distortions spurred by wildfires in Los Angeles and worse weather conditions in other parts of the US.

Bullion failed to gain traction amid dovish comments by Chicago Fed President Austan Goolsbee. He said the Fed is in good shape for eventual cuts, though he added that uncertainty around Washington policies warrants a “slower approach.”

Daily digest market movers: Gold price weighed by US yields recovery

- The US Dollar Index (DXY), which tracks the buck’s performance versus a basket of six currencies, holds minimal gains of 0.06% and is at 107.68.

- The US 10-year Treasury bond yield climbs one and a half basis points, up at 4.44%.

- US real yields, which correlate inversely to Bullion prices, climb one and a half basis points from 2.01% to 2.0026%, a tailwind for XAU/USD.

- For the week ending February 1, US Initial Jobless Claims increased to 219K, up from 208K the previous week and surpassing forecasts of 213K. This rise indicates more Americans filed for unemployment benefits than expected.

- US Nonfarm Payrolls in January are expected to dip from 256K to 170K. The Unemployment Rate is projected to remain unchanged at 4.1%.

- Money market fed funds rate futures are pricing in 47.5 basis points (bps) of easing by the Federal Reserve in 2025.

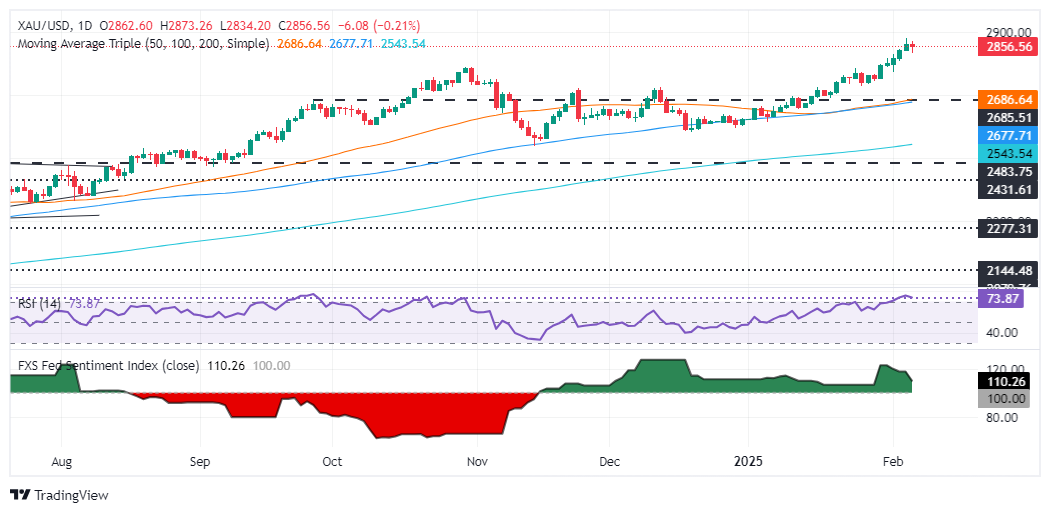

XAU/USD technical outlook: Gold price falls below $2,860

Despite dipping, the XAU/USD pair is poised to extend its rally and challenge the year-to-date (YTD) high of $2,882 ahead of $2,890. Once those two levels are cleared, the next resistance would be $2,900.

The Relative Strength Index (RSI) remains at overbought territory. Still, as previously mentioned, “it hasn’t reached the most extreme level above 80, which could pave the way for a mean-reversion trade.”

Therefore, XAU/USD fell to a daily low of $2,834, but buyers lifted Gold prices above $2,850, opening the door for further upside.

Conversely, if Bullion plunges below $2,800, immediate support would be the January 27 swing low of $2,730, followed by $2,700.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.