Gold hits a new all-time high: What does this mean for Bitcoin?

- Gold price surges to a new record high of $3,578 in early September, driven by global uncertainty and fresh US trade barriers.

- Bitcoin retests two-month lows near $107,350, extending a three-week decline from its August all-time high of $124,474.

- Gold and Bitcoin exhibit near-zero correlation in this period, which challenges the “digital gold” narrative but supports both as complementary hedges.

- FXStreet interviews several experts to get their views on Bitcoin and Gold in the current market conditions.

While Gold (XAU/USD) has climbed to a new all-time high of $3,578 in early September, Bitcoin (BTC) struggled, retesting July lows after a three-week decline, reigniting the debate about Gold’s role versus Bitcoin as a store of value. Correlation between both assets remains weak, which challenges the “digital gold” narrative but supports both as complementary hedges. To gain more insights into Gold and Bitcoin, FXStreet interviewed some experts in the crypto markets.

Gold surges to a new high of $3,578 in early September

Gold price skyrocketed, breaking April’s previous all-time high of $3,500 and setting a new high of $3,578 on Wednesday, after months of steady accumulation. Global uncertainty and the introduction of US trade barriers have primarily driven this surge in the price of the yellow metal.

XAU/USD daily chart

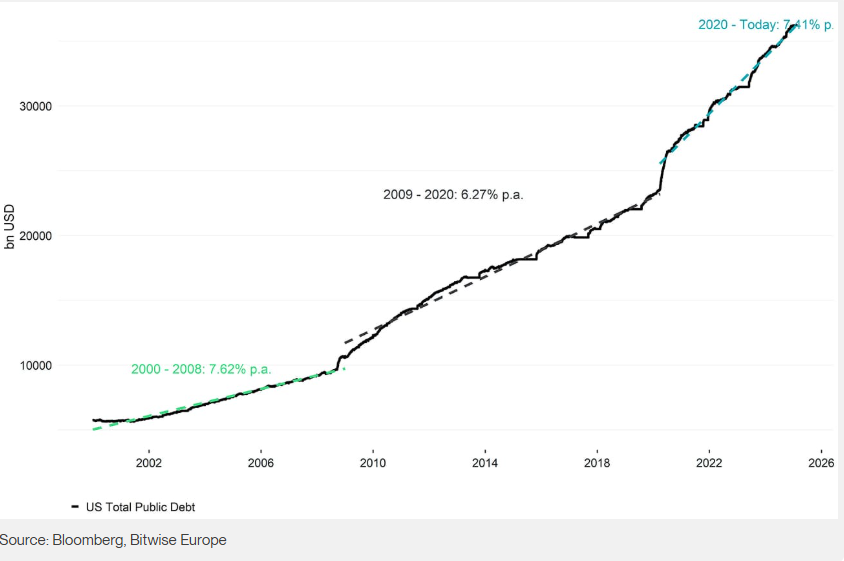

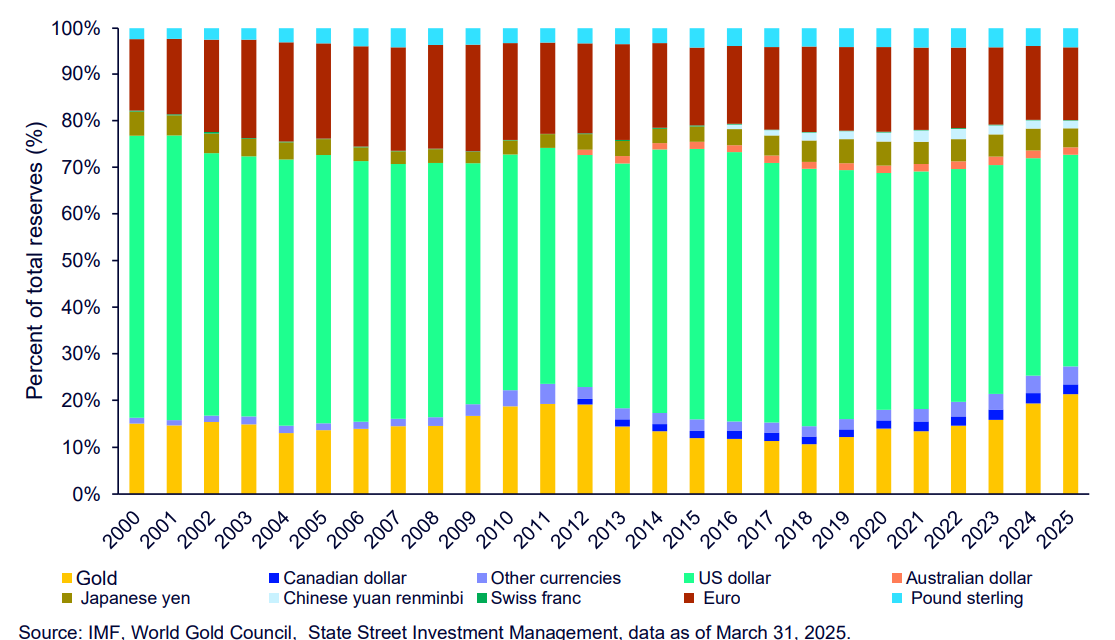

Gold’s resilience has led central banks to now hold more Gold than US Treasuries in their reserves for the first time since 1996. Moreover, the US public debt, as shown in the graph below, has ballooned to $36 trillion – 123% of the Gross Domestic Product (GDP) – and has been growing at an alarming 7.43% annually since April 2020, according to data from Bitwise Europe and Bloomberg.

A Bitwise Research report this week highlights that rising fiscal deficits and money supply growth rates have started to accelerate, especially after the Covid-19 crisis of 2020 necessitated an outsized fiscal and monetary response.

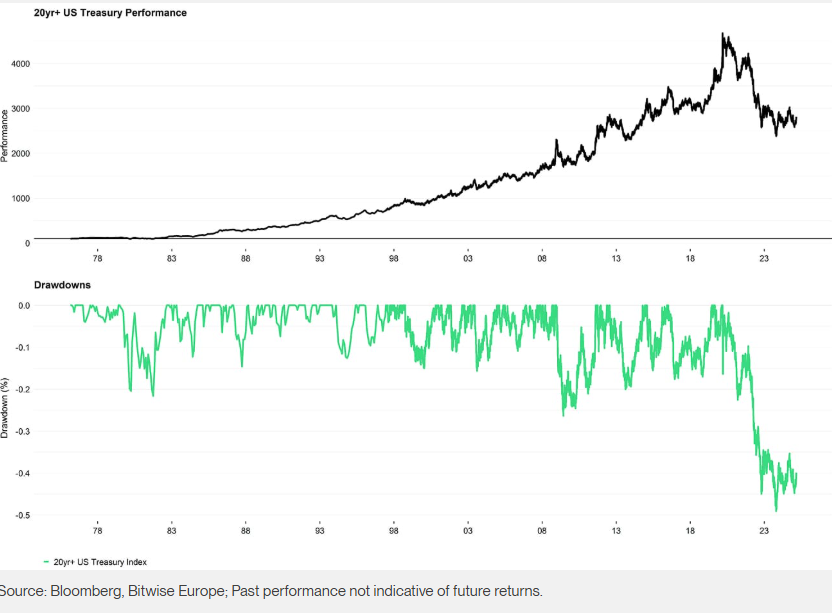

Additionally, a rise in inflation expectations and geopolitical tensions following the 2022 Russian-Ukrainian war has eroded trust in US Treasuries, resulting in their worst performance in history, underperforming Gold significantly.

Moreover, Gold’s share of Global Reserves has climbed to levels not seen in about 30 years, reaching 21% as of Q1 2025, according to State Street Investment Management. Additionally, the World Gold Council reports 26.8% as of Q2 2025. This upward trend underscores Gold’s role as a leading alternative to fiat instruments and further solidifies its case as a structural hedge in the world.

Bitcoin’s current crossroads

Gold shines while Bitcoin finds itself at a crossroads. BTC price retested its early July lows of $107,350 over the weekend, extending a three-week downtrend from its August 14 all-time high of $124,474. The sell-off in BTC has had a broad impact on the overall cryptocurrency market.

BTC/USDT daily chart

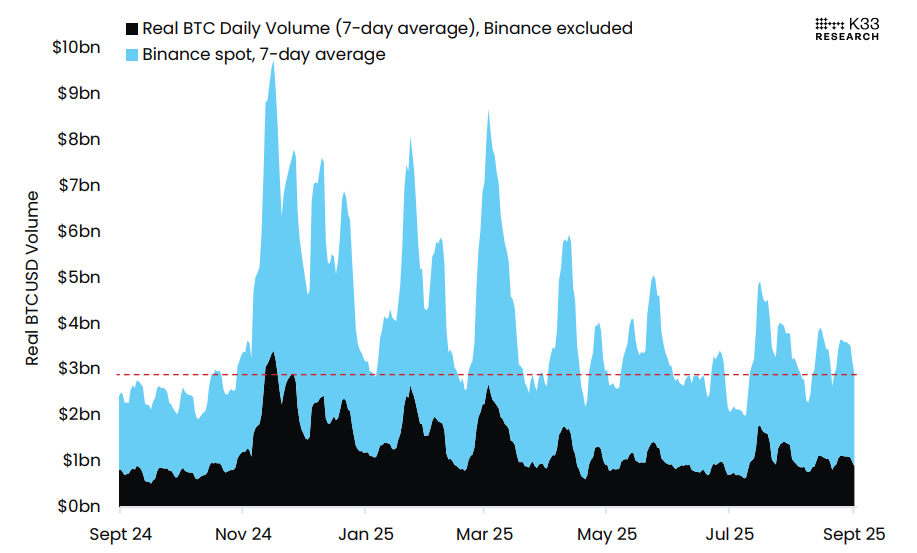

A K33 research report this week highlights that the ETH/BTC cross has now consolidated at 0.04 for the past ten trading days, with dampened Chicago Mercantile Exchange (CME) enthusiasm signaling a pause in bullish momentum in Bitcoin. Additionally, the BTC’s average daily spot trading volume also declined to $2.9 billion this week, down 20% compared to last week, as shown in the graph below.

“While trending lower, activity has been consistently high, with less weekly variance since mid-July, compared to Q2 – a sign of a vibrant spot market amidst BTC’s continued consolidation in the $110,000 range,” reports K33 analyst.

Gold and Bitcoin correlation

Examining the correlation between Gold and Bitcoin shows an interesting view. The K33 analyst explains that the current 30-day correlation between Gold and Bitcoin is 0.11, whereas the 90-day correlation is -0.09. The rolling 365-day correlation between the two assets stands at 0.026, indicating that their return profiles are largely independent of each other.

This divergence challenges the “digital gold” narrative, as Bitcoin’s price action appears increasingly independent of Gold’s, supporting the case for holding both assets as complementary hedges in uncertain macro environments.

Meanwhile, Bitcoin is increasingly being adopted as an alternative store of value, threatening to disrupt Gold technologically in the long term. Central banks are officially exploring the diversification of their reserve assets into Bitcoin, and the US and other countries are considering establishing a Strategic Bitcoin Reserve. Over the short to medium term, Gold is likely to maintain its status as the primary safe-haven asset, while the ongoing adoption and evolving character of Bitcoin make it the closest contender for that status over the long term.

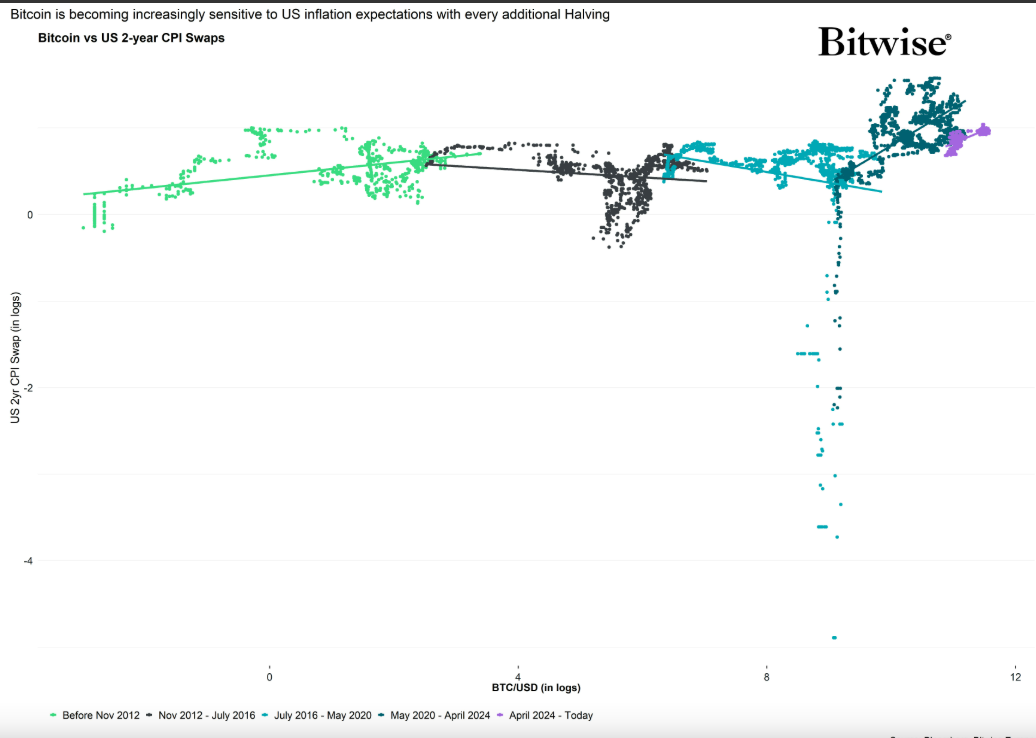

Moreover, there is an increasing sensitivity of Bitcoin’s price to market-based US inflation expectations, accompanied by a growing scarcity level. Bitcoin is becoming increasingly sensitive to US inflation expectations with every additional Halving, as shown in the graph below.

Therefore, it is also not surprising that Bitcoin tends to cycle with the ebbs and flows of global money supply expansion and contraction.

In fact, due to its absolute scarcity and low supply growth relative to fiat currencies, “Bitcoin may be the best barometer for global monetary dilution that we have,” says Bitwise analyst.

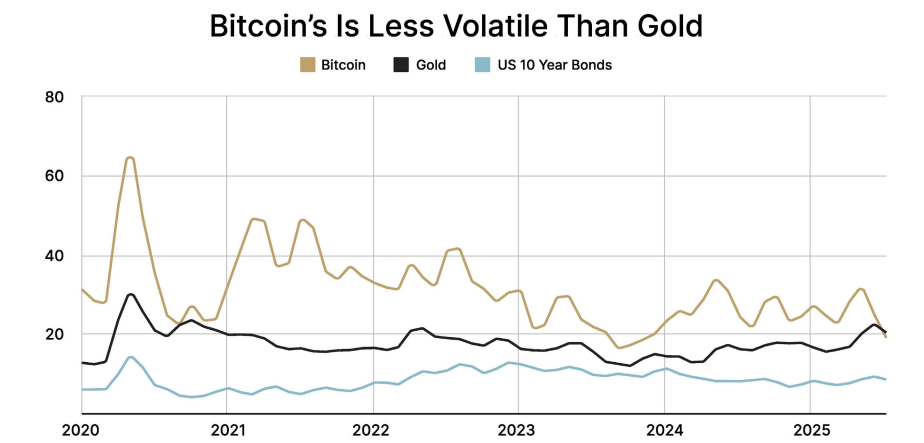

In terms of volatility, the River research chart below shows that Bitcoin's volatility has steadily declined over time, now similar to that of Gold and many Stocks. Many still view Bitcoin's volatility as a disqualifying factor and will continue to operate under that past perception for some time. However, businesses that scale their allocations to match their risk appetite do not need to be concerned.

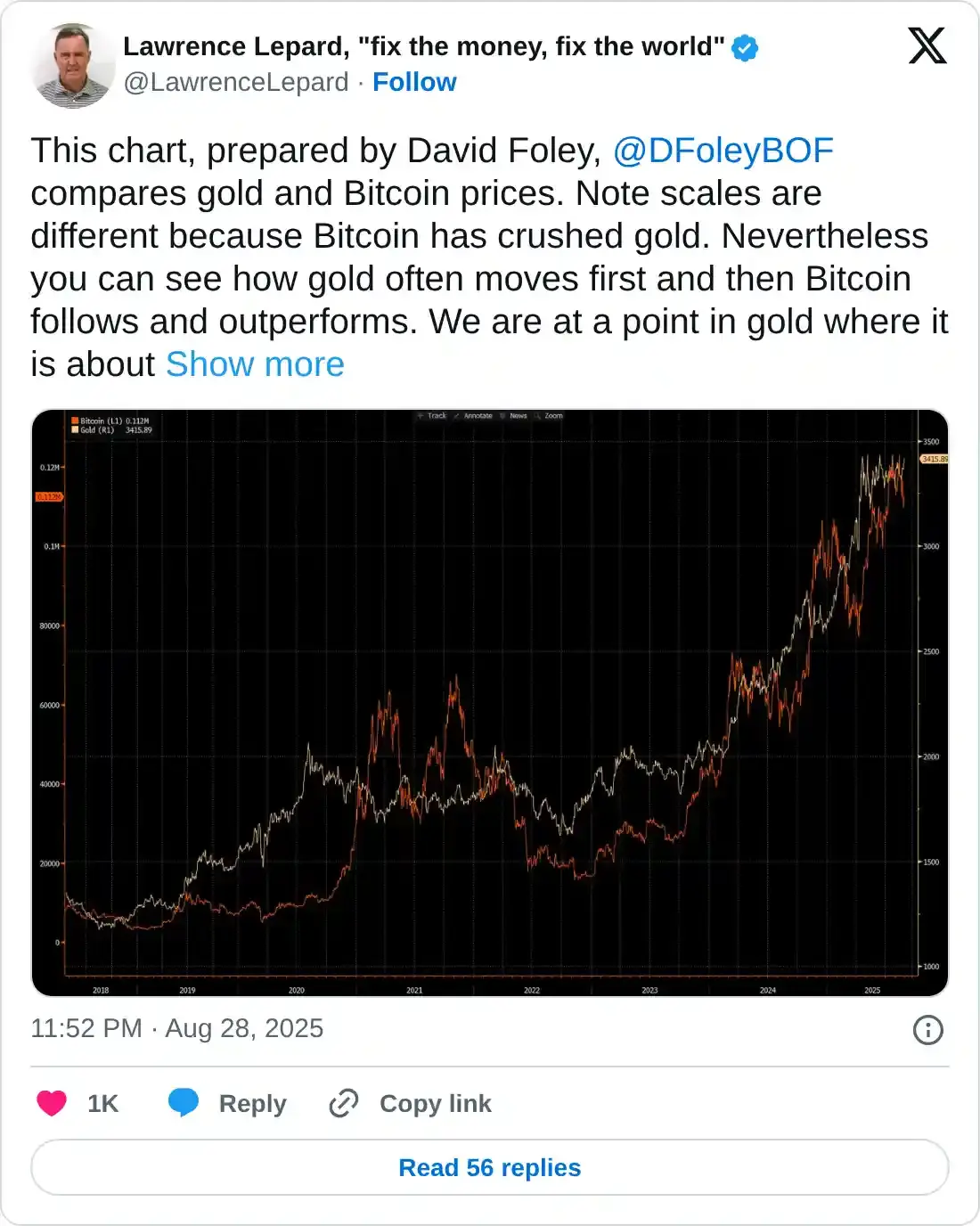

A Historical pattern: Gold leads, Bitcoin follows

According to David Foley, Co-Founder and Managing Partner of the Bitcoin Opportunity Fund, Gold often moves first, with Bitcoin later following and eventually outperforming. This was seen in early 2025, when Gold hit a new all-time high in April, while BTC lagged, only to mirror the move and reach fresh highs in Q2.

Expert insights on Gold and Bitcoin

To gain further insight, FXStreet interviewed experts in the cryptocurrency markets. Their answers are stated below:

Billy Luedtk, Founder of Intuition

Q: How do you see the rising popularity of Gold as a safe haven influencing the perception and adoption of Bitcoin in the current economic climate?

Gold’s resurgence validates a very old instinct: in times of uncertainty, people gravitate toward scarce, non-sovereign assets. That trend helps Bitcoin, because it reinforces the narrative that trust in fiat systems is weakening. Every time gold reclaims attention, it reminds the world that “outside money” has value and Bitcoin is the most modern, liquid, and programmable form of outside money. Gold strengthens the frame; Bitcoin expands it.

Q: What are the key factors that could determine whether Bitcoin follows a similar upward trend as Gold during times of global financial uncertainty?

A few things matter most:

-Liquidity & adoption: whether Bitcoin continues to deepen in institutional and retail market depth.

-Narrative alignment: if the story of Bitcoin as “digital gold” maintains credibility, especially when central banks print aggressively or geopolitical tensions rise.

-Market infrastructure: ETFs, custody, derivatives, and regulatory clarity that make it easier to allocate.

-Correlation shifts: if Bitcoin proves uncorrelated to risk assets during stress, it will earn its place alongside Gold.

Q: In your opinion, how might the long-term roles of Gold and Bitcoin as stores of value evolve, given their differing characteristics?

Gold will remain the conservative anchor, a physical, millennia-tested hedge that is trusted but static. Bitcoin, by contrast, is dynamic: it inherits scarcity but adds portability, divisibility, programmability, and the ability to integrate into digital economies and AI-driven systems. Over decades, I think Gold holds its role for central banks and legacy institutions, while Bitcoin increasingly becomes the “native collateral” of the digital era, the hedge that powers new financial rails.

Vikrant Sharma, CEO/Founder of Cake Wallet

Q: In your opinion, how might the long-term roles of Gold and Bitcoin as stores of value evolve, given their differing characteristics?

I frankly don't see Gold competing on the same scale as Bitcoin long term. Bitcoin's absolute scarcity of 21 million coins versus Gold's practically unknown true supply creates a clear winner in the scarcity argument. Besides, Bitcoin mining is permissionless and anyone can join the network, while gold mining is subject to regulations that require permits, environmental assessments, and compliance with numerous restrictions. You can sell Bitcoin around-the-clock, transfer it globally in minutes, and carry billions of dollars in Bitcoin in your head by learning a seed phrase. Every transaction involving gold needs physical handling, verification, transportation, and substantial fees.

Bitcoin is the clear choice as we enter a future where AI agents will conduct business online with both humans and one another. AI agents will never use physical Gold for transactions as they need to transact instantly and trustlessly. The $24 trillion market capitalisation of Gold will eventually lose ground to Bitcoin, while Gold will continue to be relevant mainly because of custom and central bank inertia.

Q: How do you see the rising popularity of Gold as a safe haven influencing the perception and adoption of Bitcoin in the current economic climate?

Gold's growing appeal as a safe haven, in my opinion, is supporting Bitcoin's investment thesis rather than competing with it. It validates the central claim that investors require alternatives to fiat money. This makes it possible for Bitcoin to be viewed as the "digital gold," a technological interpretation of the same idea. However, confidence in reported reserves is a key component, and there may be large differences between reported and actual holdings if there is ever a true audit of the world's gold reserves. Given that Bitcoin's supply can be transparently verified on the blockchain at any time, this could significantly change the safe haven narrative in favor of the cryptocurrency.

Q: How do you think broader economic trends, such as changes in global monetary policies, might impact the future relationship between Gold and Bitcoin?

Both assets should benefit, the wild card is still a possible audit of gold reserves; if there are concerns about reported versus actual holdings, it could lead to a crisis of confidence and send Bitcoin skyrocketing as the only genuinely verifiable store of value. You can audit the entire supply of Bitcoin in a matter of seconds; try auditing gold vaults all over the world. Because of its risk asset correlation, monetary tightening might put short-term pressure on Bitcoin more than gold, but long-term quantitative easing would greatly increase that correlation. Besides, an entirely new dimension is added by the rise of AI-driven economies. AI agents will require native digital currency in order to conduct transactions as they develop into economic actors. Instead of dealing with physical delivery or gold vaults, these agents will use Bitcoin to conduct instantaneous, programmable, and trustless transactions. Gold just cannot keep up with the enormous demand this creates. Short-term movements in gold may indicate the direction of Bitcoin, but in the long run, Bitcoin is the clear winner due to its verifiability, absolute scarcity, and native compatibility with digital and AI economies. How soon the shift will occur is more important than whether Bitcoin will overtake gold.

Bitfinex Analysts

Gold’s record run this year, driven by central bank accumulation and heightened safe-haven demand, has reinforced the investment case for scarce, non-sovereign assets. This dynamic has indirectly strengthened Bitcoin’s institutional narrative, even as near-term capital flows continue to favor Gold’s perceived stability. Whether Bitcoin tracks Gold higher during periods of market stress will depend on several factors: the direction of the US dollar and real yields, the expansion of new access points such as ETFs and retirement accounts, and the market’s capacity to absorb liquidity shocks without triggering forced deleveraging.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.