Bitcoin celebrates annual Pizza Day with a new all-time high

Bitcoin (BTC) enthusiasts are celebrating Bitcoin Pizza Day with a banger. BTC made a new all-time high on Wednesday and has entered price discovery mode. The OG cryptocurrency is trading above $110,000 for the first time ever. The milestone comes as the crypto community cherishes the anniversary of the first real-world Bitcoin transaction.

Is Bitcoin now a safe-haven asset?

The Bitcoin rally to record highs comes in the midst of tectonic moves that are shuffling how traditional assets are perceived by financial markets.

US Treasury yields are on the rise, with the 30-year Treasury bond yield briefly surpassing 5% this week as Moody’s downgraded the US sovereign debt rating and the US Congress is debating a new tax bill that could shed billions in taxes and add them to the government deficit.

The correlation between Bitcoin price and the US stock markets is also on the decline. While Bitcoin was making new all-time highs, the S&P 500 lost 1.61% on Wednesday. Institutional and retail investors are increasingly viewing Bitcoin as a portfolio diversifier and a hedge against macroeconomic uncertainty.

Henry McVey, KKR’s head of global macro and asset allocation, explained earlier this week in a note that asset managers are seeing both their offensive assets (stocks) and defensive assets (government bonds) decline in value at the same time. “During risk-off days, government bonds are no longer fulfilling their role as the 'shock-absorbers' in a traditional portfolio,” McVey added.

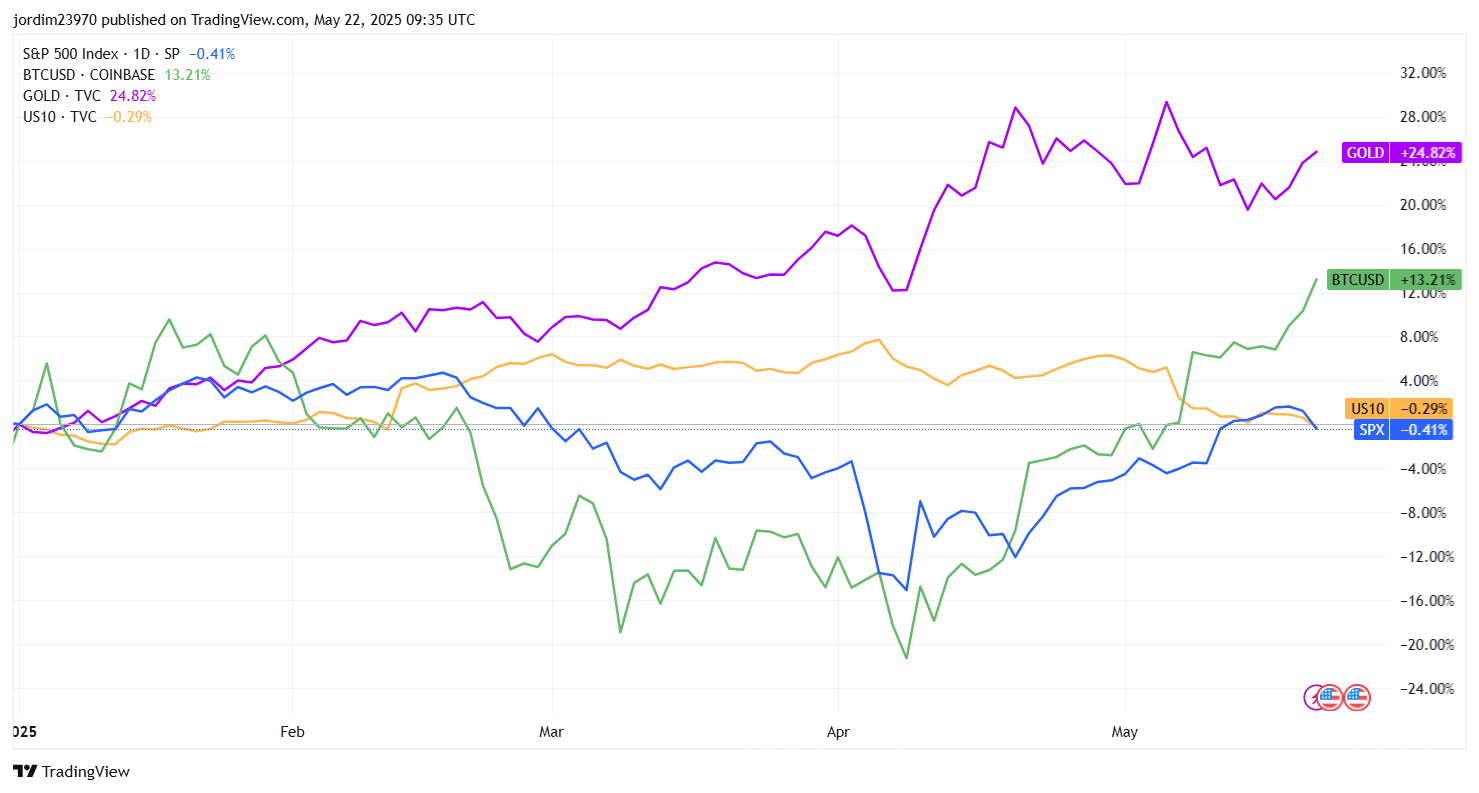

Year-to-date performance of Bitcoin, Gold, S&P 500 and US 10-Year Treasury bonds

BTC has decisively outperformed major US equities in 2025. The biggest cryptocurrency is currently up 18% year-to-date, while the S&P 500 closed trading on Wednesday at 5844.61, 0.41% short of its opening levels for 2025. Gold, the most classic safe-haven, has also hit new all-time highs this year above $3,200 per troy ounce, and is rallying again after a brief retracement.

How high can Bitcoin go?

The latest all-time high fuels the debate over Bitcoin’s long-term potential. The list of skyrocketing price predictions is no longer limited to cryptocurrency enthusiasts and long-term HODLers. Institutional analysts and asset managers are also joining the party.

Geoff Kendrick, Head of Digital Assets at Standard Chartered, published a projection on Tuesday saying that Bitcoin could reach $500,000 by 2029. Kendrick points to growing institutional and government interest, especially via indirect exposure through vehicles like MicroStrategy: "The quarterly 13F data (which gauges future demand for Bitcoin from institutions) is the best test of our thesis that BTC will attract new institutional buyer types as the market matures, helping the price reach our $500,000 target level,” Kendrick said.

"We believe that in some cases, MSTR holdings by government entities reflect a desire to gain Bitcoin exposure where local regulations do not allow direct BTC holdings,” he added. Kendrick had already projected a BTC $200,000 price target for the end of 2025 in February.

Cathie Wood’s ARK Invest also published highly ambitious price targets for Bitcoin in April. David Puell, a Research Trading Analyst at the investment firm, set a base case target of $710,000 for Bitcoin by the end of 2030, with a bull case as high as $1.5 million or more.

-1747909549209.png)

ARK Invest’s Bitcoin price target model

ARK’s price models consider adoption by institutional investors, Bitcoin’s role as digital gold, safe-haven demand in emerging markets, and growing use in on-chain financial services. According to Puell, institutional investment is the largest driver in their bull scenario, with Bitcoin potentially capturing a significant share of the global market portfolio and Gold’s market cap.

What is Bitcoin Pizza Day?

Every May 22, Bitcoin enthusiasts celebrate the first purchase of a real-world product with BTC. On this day in 2010, Laszlo Hanyecz, a programmer and early bitcoiner based in Florida, made history by buying two Papa John’s pizzas for 10,000 BTC.

Hanyecz explained to CBS News’ popular TV show 60 Minutes five years ago how that historical transaction happened. He posted a question on the Bitcoin forum: “If anybody is interested, I am offering 10,000 BTC in exchange for some pizza.” Then, somebody picked that offer, ordered and paid for the pizza with his credit card, and got the bitcoins from Hanyecz, who received the pizza at his house in return.

That transaction, worth about $25 at the time, forever established Bitcoin as more than just a digital curiosity, validating its potential as a medium of exchange with real-world value.

Bitcoin Pizza Day has since become a legendary event in crypto culture, celebrated every year around the world. Every year on May 22, Bitcoin enthusiasts meet in community events to eat some pizza. It serves as a reminder of both Bitcoin’s humble beginnings, its astonishing journey to mainstream adoption, and its current success as an investment and trading asset.

How much would those two pizzas be worth today?

If Laszlo Hanyecz had held onto his 10,000 BTC, those two pizzas would now be worth a whopping $1.1 billion at the current price of $110,000 per Bitcoin.

With that amount, Hanyecz could purchase today some of the most unique real estate properties like Ken Griffin’s mansion in Florida (allegedly the world’s most expensive house), “The Streets of Monaco”, the world’s largest yacht, or US sports franchises like the Miami Marlins of Major League Baseball.

What was once a $25 pizza order could now match the economic scale of some of the most exclusive assets in the world. Still, Hanyecz has never regretted the transaction.

“People laugh at that, but at the time, it was not worth anything,” he said.