Gold surges as Israel-Iran tensions, renewed tariffs threats support haven flows

- Gold prices rally as tensions between Iran and Israel boost Bullion’s safe-haven appeal.

- Investors await the US PPI inflation data for more clues about the Fed’s potential rate-cut move and keep an eye on fresh tariff threats from Trump.

- XAU/USD extends gains, with prices currently testing wedge resistance near $3,380.

Gold (XAU/USD) has emerged as a key beneficiary of US Dollar (USD) weakness, a theme that is expected to drive prices on Thursday. The threat of an escalating conflict in the Middle East after reports that Israel is considering a military strike on Iran and Trump’s latest tariff threats support the precious metal, which benefits from safe-haven flows.

With prices currently hovering around the $3,380 mark, geopolitical risks and the US fundamental backdrop remain in focus.

NBC news reported, citing five people familiar with the matter, that Israel is considering taking military action against Iran in the coming days. At the same time, Trump confirmed on Wednesday that US personnel are being moved out of parts of the Middle East due to the escalating tensions between Israel and Iran. This occurs ahead of the sixth round of nuclear talks between the US and Iran, scheduled for this weekend.

Recent headlines surrounding trade also added to the sour market mood. Trump has stated that the US will set its own terms for unilateral tariffs, overshadowing the optimistic narrative surrounding the US-China “trade truce” announced on Wednesday.

Trump stated that “We will be sending out letters over the next weeks telling them what the deal is”. These comments were reported by Bloomberg on Thursday.

Looking at the economic calendar, markets prepare for the release of another important inflation print out of the United States: the Producer Price Index (PPI). After Wednesday’s downside surprise in CPI numbers, further confirmation that price pressures are easing could give further impetus to Gold.

Gold daily digest market movers: US Inflation, Fed rate expectations, and central banks' holdings of Gold

- The monthly US PPI report, released by the US Bureau of Labor Statistics, provides insight into inflation trends (price pressures) from a wholesale and business perspective. Expectations are for Headline PPI to show an annual increase of 2.6% in May, following a 2.4% in April. Core PPI, which excludes volatile goods, is expected to remain unchanged at an annual rate of 3.1% in May.

- This report follows the release of the US Consumer Price Index (CPI) on Wednesday, which showed that inflation at the consumer level continued to ease in May.

- For the Federal Reserve (Fed), softer inflation provides room for interest rate cuts, which in turn, has reduced demand for US Treasury Yields, adding additional pressure on the Greenback and supporting Gold.

- Prior to the US CPI release on Wednesday, the CME FedWatch Tool indicated that analysts were pricing in a 52% probability of a rate cut in September. However, after the release, probabilities have now increased to approximately 70%, with rates still expected to remain within the 4.25%-4.50% range at the June and July meetings.

- The European Central Bank (ECB) released its annual Monetary Euro report on Wednesday, which showed that central bank holdings were 36,000 tonnes, close to the highest levels since the Bretton Woods system. As central banks continue to increase their holdings this year, Gold prices are expected to remain stable in the near term.

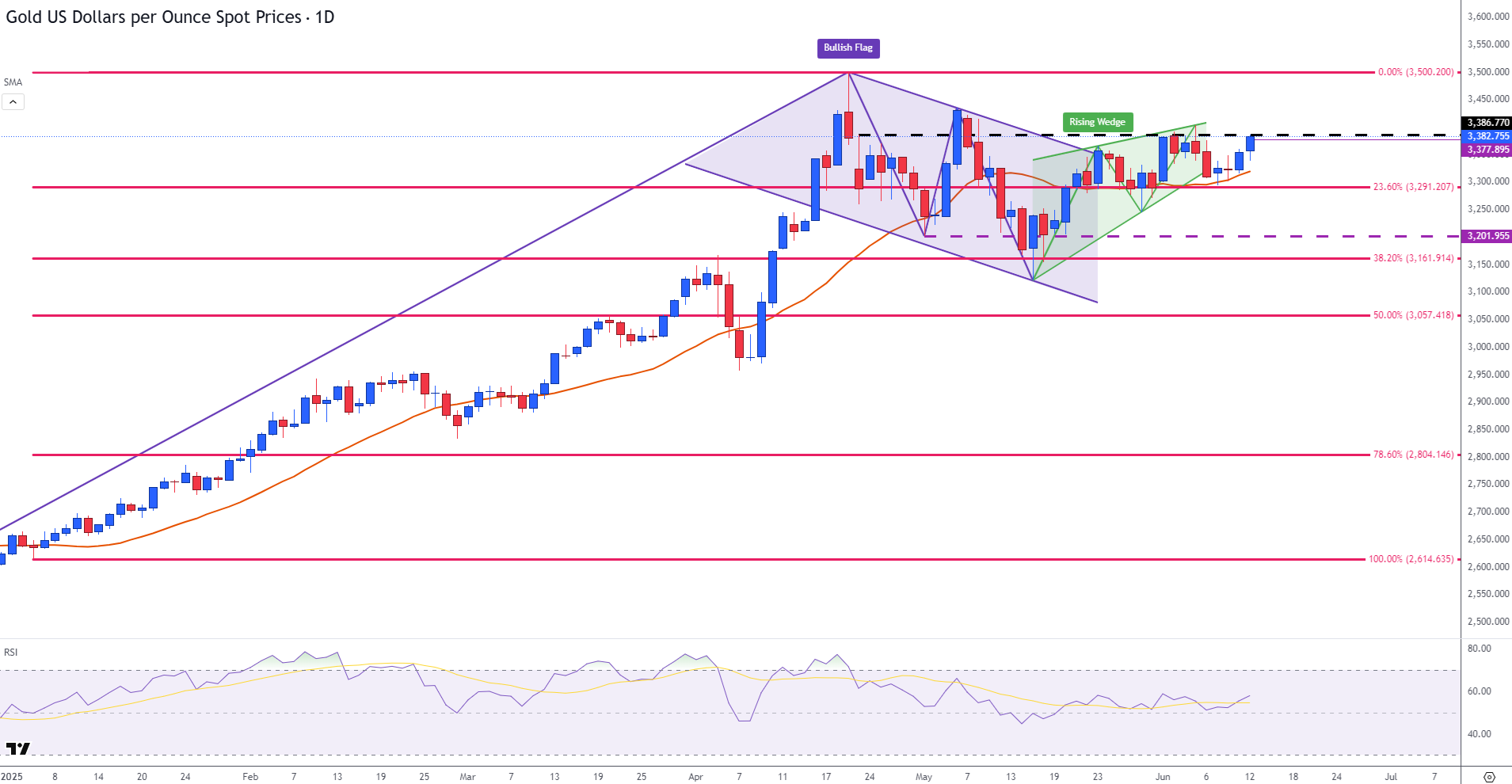

Gold (XAU/USD) technical analysis: Bullish bias holds above $3,350

From a technical standpoint, Gold prices are testing the resistance zone of $3,380 at the time of writing, a level that aligns with the upper bound of the rising wedge formation. This technical chart pattern, which formed on the daily chart, emerged after prices rebounded from the mid-May low near $3,320.

With a move above this zone opening the door for last week’s high around the psychological level of $3,400, the April ATH of $3,500 could come back in sight.

Gold (XAU/USD) daily chart

Meanwhile, the Relative Strength Index (RSI) stands at 57 and points upwards, indicating a bullish bias. On the downside, the $3,350 psychological level, which has provided support throughout the week, remains intact. Below that is the 23.6% Fibonacci retracement of the January-April high at around $3,291.

For bearish momentum to gain traction, a breach of this zone may pave the way for the next big psychological level of $3,200.

Economic Indicator

Producer Price Index ex Food & Energy (YoY)

The Producer Price Index ex Food & energy released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Those volatile products such as food and energy are excluded in order to capture an accurate calculation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Next release: Thu Jun 12, 2025 12:30

Frequency: Monthly

Consensus: 3.1%

Previous: 3.1%

Source: US Bureau of Labor Statistics

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.