Will Ripple (XRP) reach a $200 billion valuation if SEC approves altcoin ETFs in 2025?

- XRP price rebounded above $2.42 on Friday, posting a 28% recovery from the weekly timeframe low of $1.90.

- Analysts predict an XRP ETF could attract $5 billion in inflows, mirroring Bitcoin’s ETF impact and fueling a rally.

- XRP must break $2.99 resistance to reach $3.40, pushing its market cap toward the $200 billion milestone.

XRP price rebounded above $2.42 on Friday, marking a 28% recovery from the weekly timeframe low of $1.90. The rally was fueled by the U.S. Securities and Exchange Commission’s (SEC) confirmation of XRP ETF filings. How high can XRP price reach if altcoin ETFs are approved this year?

XRP crosses $2.4 on reports of SEC commodity classification

XRP rebounded 5% to reclaim the $2.30 support level amid reports that the SEC may classify it as a commodity in ongoing settlement discussions with Ripple Labs. This potential regulatory shift could eliminate legal uncertainties and encourage broader institutional participation.

Receent market reports show that SEC officials are evaluating whether XRP should be treated similarly to Bitcoin and Ethereum, both of which fall under commodity regulations. If XRP secures this classification, it could significantly bolster the chances of an XRP exchange-traded fund (ETF) approval.

Ripple (XRP) Price Action, March 14

Market analysts suggest that an official SEC statement confirming XRP’s commodity status could serve as a catalyst for a price rally. In the past, similar speculation drove XRP from $0.90 to $3.10 in under two months. This suggests XRP has potentially attempted another retest of the $3 level if the altcoin ETFs are approved.

When will the US SEC approve an XRP ETF?

The timeline for an XRP ETF approval depends on ongoing regulatory developments. The SEC is currently reviewing multiple crypto ETF applications, including those for Ethereum and XRP, as institutional demand for diversified digital asset exposure grows.

Industry experts anticipate that an XRP ETF could gain approval in late Q3 or early Q4 of 2025, contingent on the resolution of Ripple’s legal battle.

If Ripple successfully negotiates a settlement and XRP attains commodity status, the path to ETF approval would become significantly clearer.

The approval of spot Bitcoin ETFs in January 2024 triggered significant institutional inflows, driving BTC to new all-time highs.

A similar scenario could play out for XRP, with analysts forecasting that an XRP ETF could attract over $5 billion in inflows within its initial months.

This could propel XRP’s price toward $10 in the short term and potentially $20 in a sustained bullish cycle.

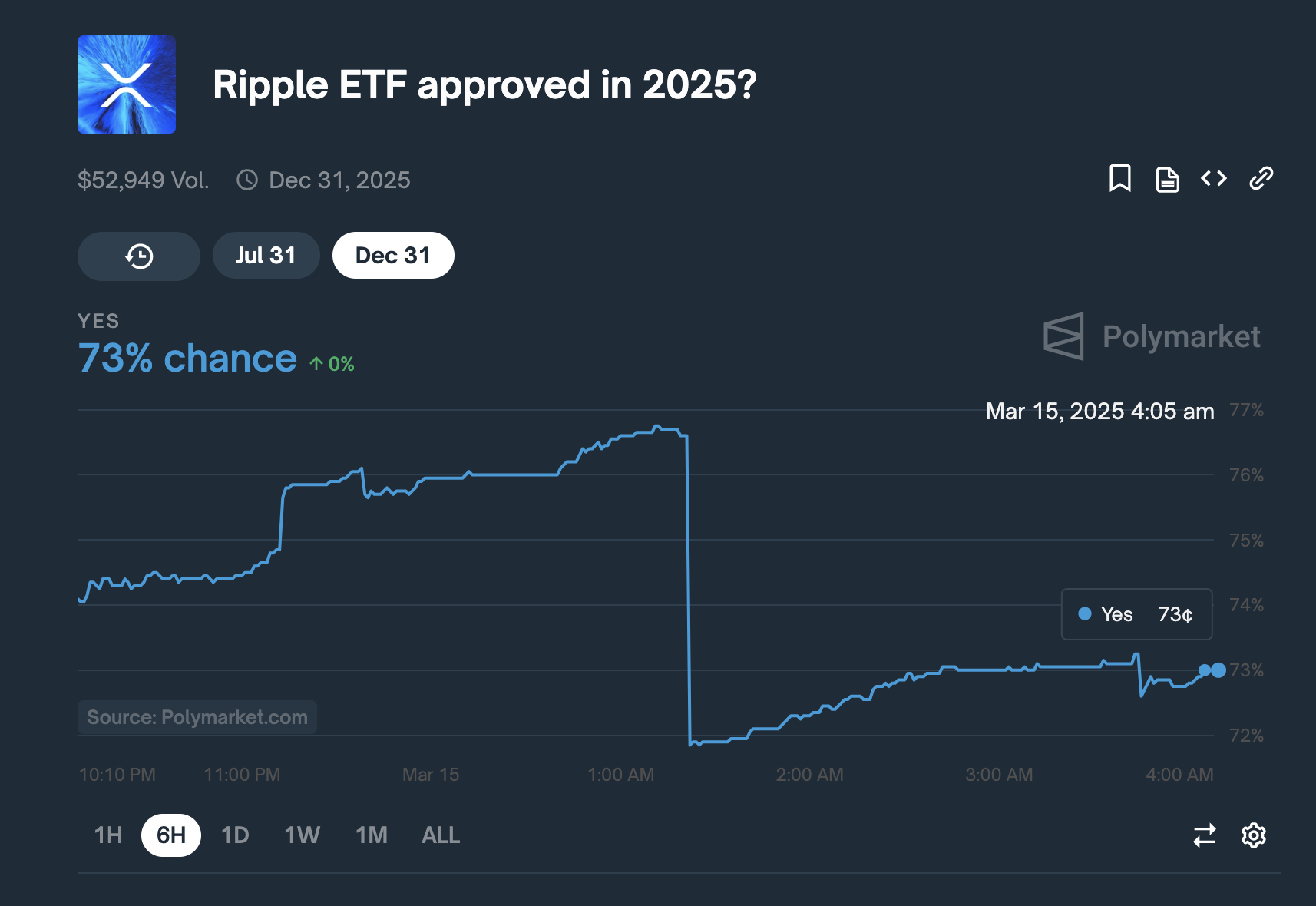

XRP ETF approval odds, March 15 2025 | Source: Polymarket

XRP ETF approval odds, March 15 2025 | Source: Polymarket

As institutional interest and regulatory momentum build, XRP remains a leading contender for ETF approval. Key upcoming catalysts include further court rulings in the Ripple vs. SEC case and statements from SEC officials regarding the regulatory landscape for crypto-based ETFs.

The SEC’s recent leadership changes have resulted in the rollback of several regulatory actions, including the dismissal of charges against Coinbase, Robinhood, Ripple (XRP), and Uniswap. This policy shift has increased the probability of multiple altcoin ETF approvals, further driving institutional interest.

According to Polymarket data, traders currently assign a 73% probability to XRP ETF approval. Similar probabilities apply to other altcoins with pending ETF applications.

XRP Price Forecast: $200 billion market cap break out ahead?

At press time, XRP is consolidating above $2.40 with a market capitalization of $140 billion, down from its recent high of $3.10.

For Ripple to reach a $200 billion valuation, XRP would need to surpass $3.40—a level that may be attainable if ETF approvals materialize and institutional demand matches up to levels seen when Bitcoin derivatives were approved in early 2024.

XRP price is rebounding from recent lows, currently trading around $2.42, as bullish momentum gains traction.

After booking nearly 28% gains over the past four days, insights from technical indicators suggest more upside ahead.

The Donchian Channel (DC) upper band at $2.99 remains the primary resistance level, while the mid-band at $2.44 is acting as a short-term pivot point.

A decisive break above this level could trigger further upside toward the $2.60-$2.80 range.

XRP Price Forecast | XRPUSD

The Relative Strength Index (RSI) has climbed to 50.89, crossing above the signal line at 47.64, suggesting strengthening bullish momentum.

This shift in RSI structure aligns with the increase in trading volume, which has exceeded 1.13 billion, reflecting growing investor interest.

If RSI continues to rise toward the 55-60 zone, it could confirm sustained buying pressure, pushing XRP towards the $2.99 resistance.

On the bearish side, failure to hold the $2.30 support could invalidate the current recovery, exposing XRP to a potential pullback toward $1.90.

However, with volume increasing and RSI reclaiming neutral territory, the bias leans bullish.

If price action sustains above $2.44, XRP could extend its rally toward $2.80, with a breakout above $2.99 opening the door for a retest of $3.40, which could effectively catapult Ripple’s valuation above the $200 billion milestone