Crypto Today: BTC at $85K, Solana hits $100B valuation, FTX sues CZ, Blackrock sets new record

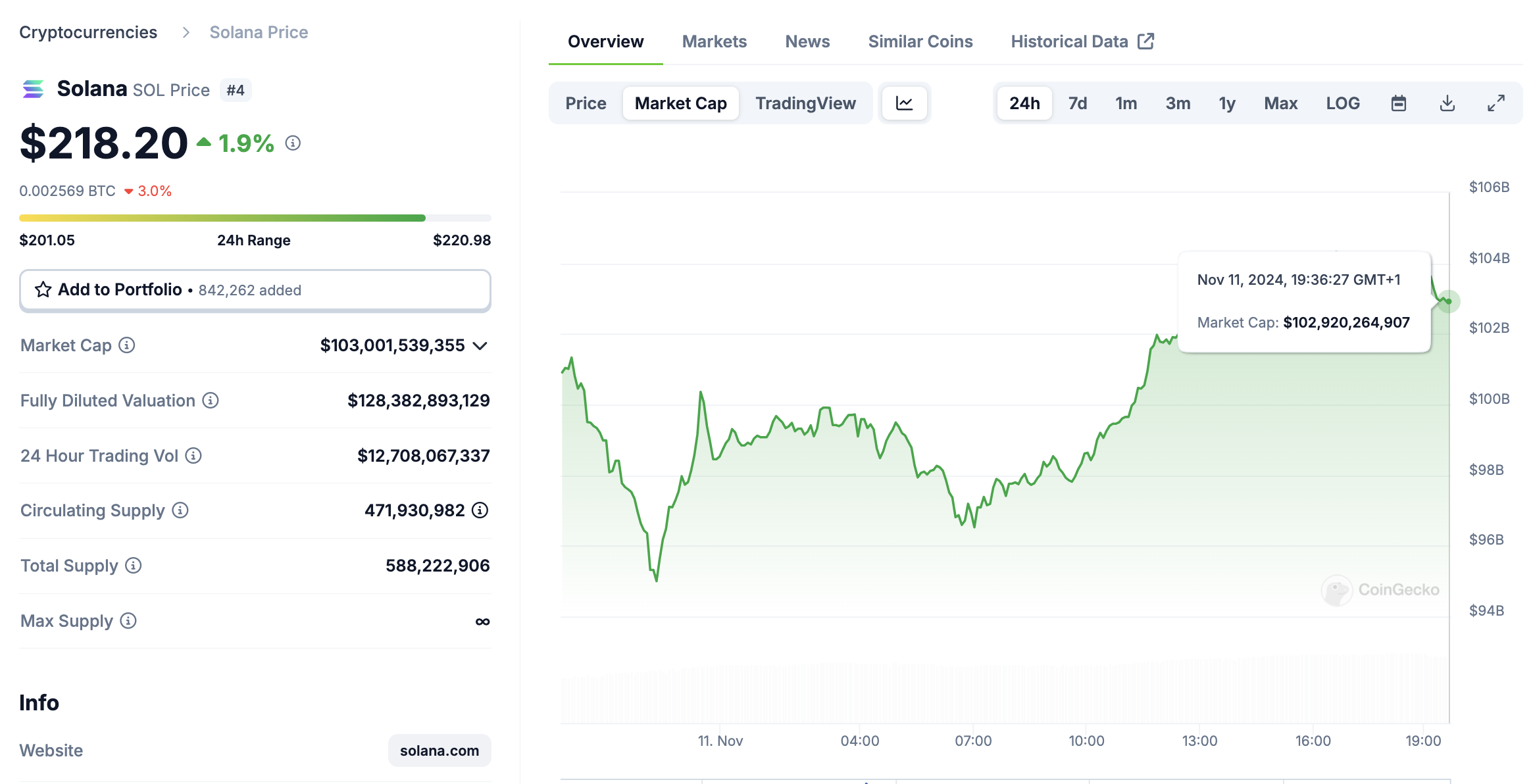

On Monday, Solana’s market capitalization crossed the $100 billion milestone as the steady memecoin demand drove the native SOL coin price above $220 for the first time since April 2024.

BlackRock's iShares Bitcoin Trust (IBIT) surpassed the iShares Gold Trust (IAU) in assets under management.

Bitcoin price updates

- Bitcoin price surpassed $85,000 on Monday as it registered its second-largest gain of 5.91% since the US election.

- The BTC rally on Monday was driven by Microstrategy’s latest inflow of $2.03 billion, the first tranche of its $42 billion acquisition plan.

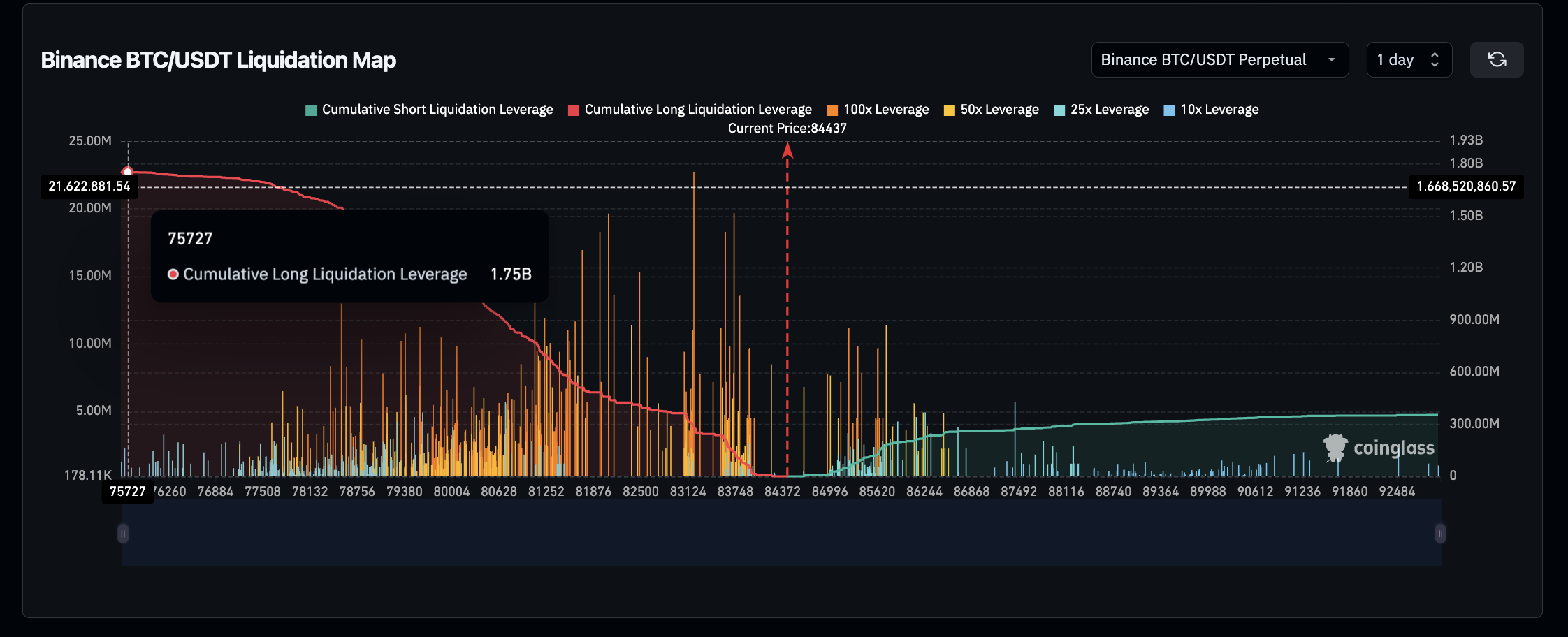

- In the derivatives markets Bitcoin bulls have mounted another $1.75 billion worth of long positions against $300 million active short positions.

Bitcoin Liquidation Map, November 11 2024 | Source: Coinglass

Bitcoin long positions outpaced active short contracts by nearly 82%, signaling overwhelming expectations of further upside despite setting new all-time highs in each of the last six trading days.

Solana, Dogecoin, Ethereum market updates

Bullish tailwinds from the US Federal Reserve’s 25-basis-point interest rate cut on November 7 has triggered renewed corporate demand, driving the crypto market rally into its second week.

On Monday, Solana’s market capitalization crossed the $100 billion milestone as the steady memecoin demand drove the native SOL coin price above $220 for the first time since April 2024.

Solana Market Cap Crosses $100B | November 11 2024 | Source: CoinmarketCap

Following the latest rally, Solana has now surpassed XRP’s market valuation, leapfrogging the Ripple-backed coin to become the third-largest cryptocurrency.

- Dogecoin price advanced above $0.30 on Monday, bringing its 7-day time frame gains above the 100% mark. Likewise, Tesla (TSLA) also hit a 3-year peak of $340 per share, as assets linked to Elon Musk enter a bullish breakout following Trump’s victory at the November 5 poll.

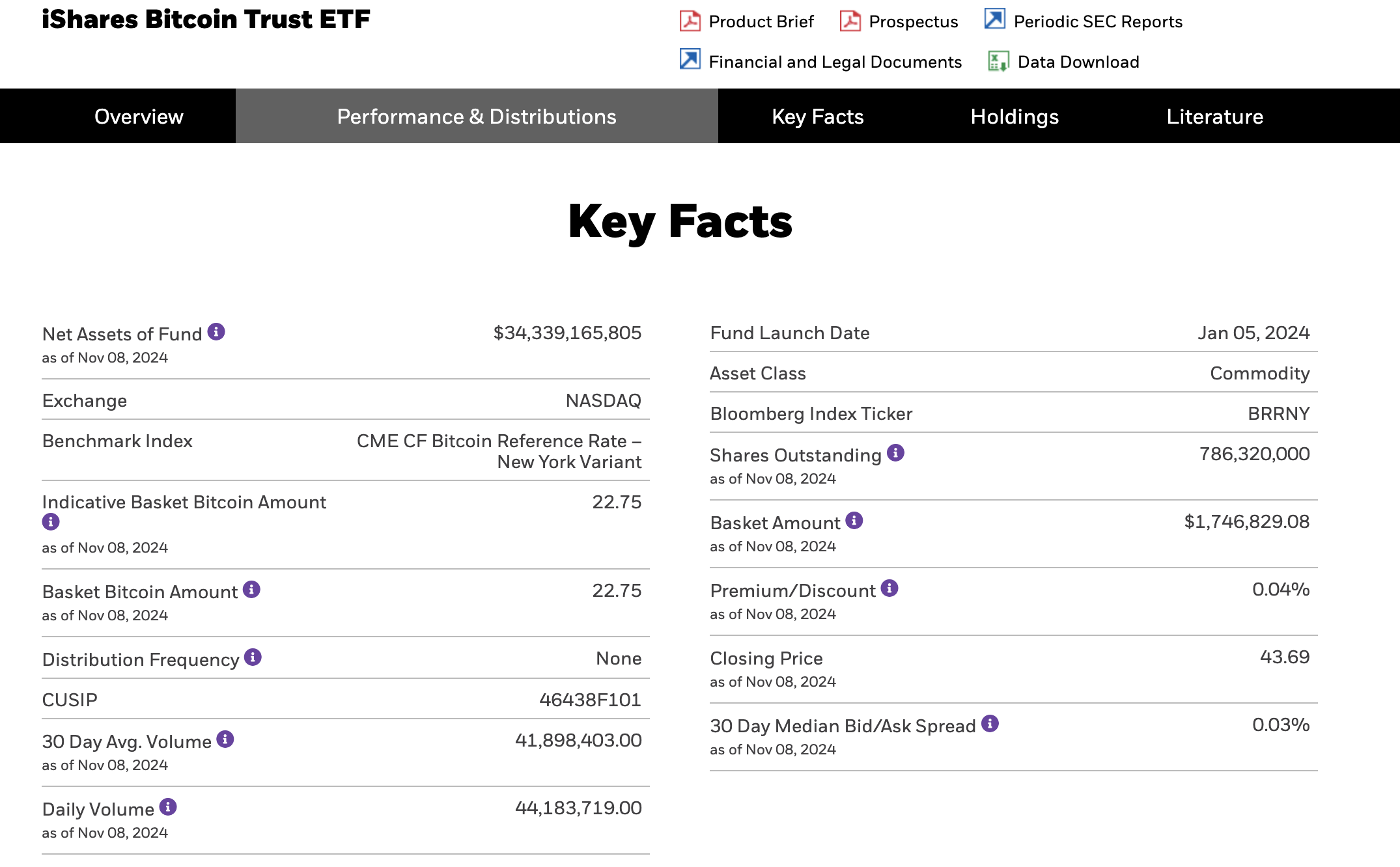

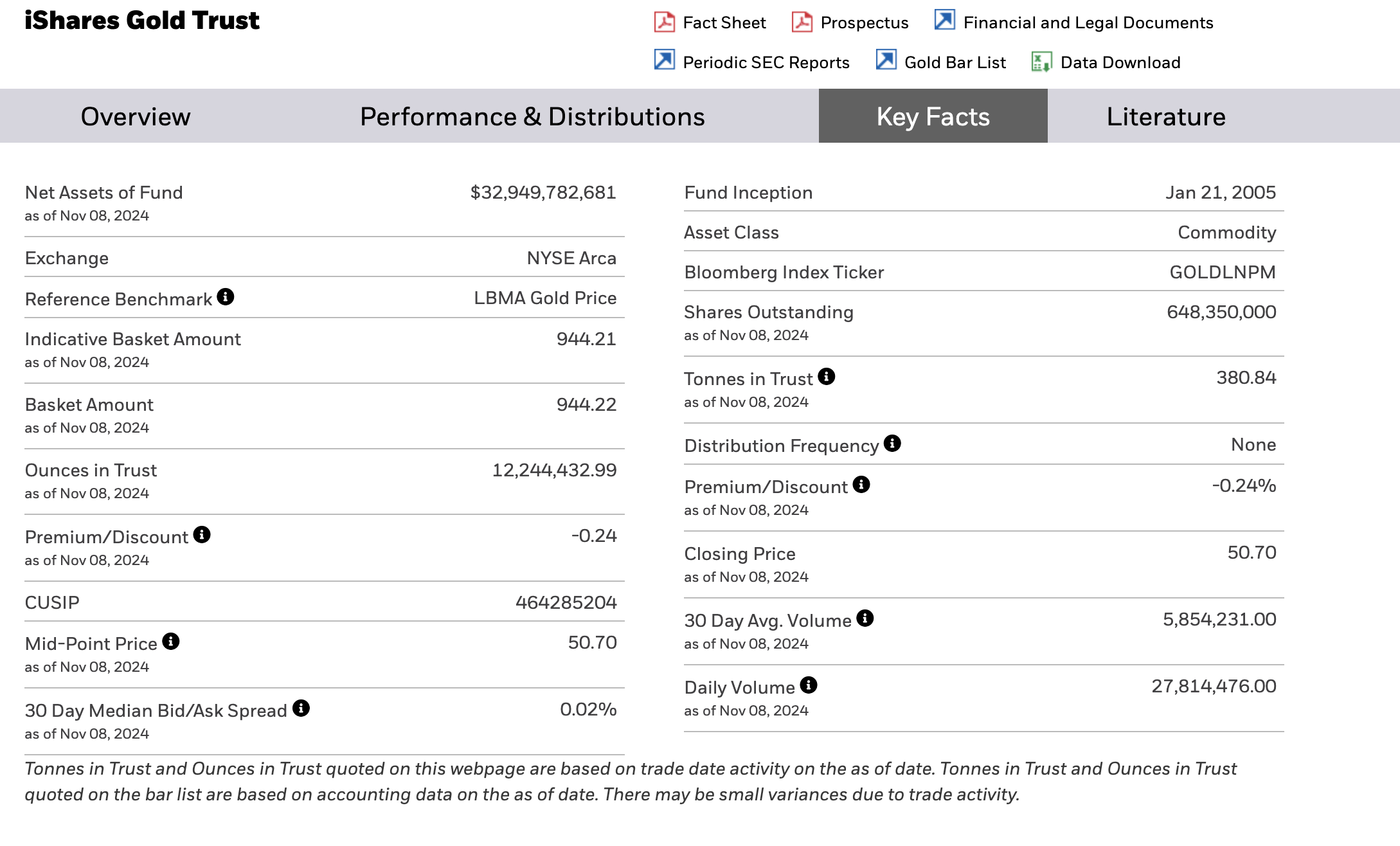

Chart of the day: Blackrock’s IBIT Bitcoin ETF has surpassed its Gold ETF

BlackRock's iShares Bitcoin Trust (IBIT) surpassed the iShares Gold Trust (IAU) in assets under management. According to Blackrock’s official data chart depicted below, IBIT now holds approximately $33.1 billion, edging out IAU, which currently manages about $32.9 billion.

iShares Bitcoin Trust ETF (IBIT) trading data | Source: Blackrock.com

iShares Gold Trust ETF (IAU) trading data | Source: Blackrock.com

iShares Gold Trust ETF (IAU) trading data | Source: Blackrock.com

Launched in January 2024, IBIT rapidly attracted $10 billion in AUM within just two months — a feat that took the first Gold ETF nearly two years to reach.

Strong demand from both institutional traders after Trump’s win, alongside the US Fed's 25 bps rate cut are two major catalysts that have fueled interest in Blackrock’s IBIT ETF fund in the past week.

Blackrock’s BTC ETF surpassing its Gold counterpart affirms the narrative that Bitcoin now ranks higher on corporate investors' scale of preference.

This could trigger a major paradigm shift if the Trump administration yields a favorable regulatory landscape for cryptocurrencies in 2025, as widely anticipated.

Market updates

- Amid curtailed inflation pressure, the Bank of England and US Federal Reserve both announced 25 bps rate cuts, which has further intensified the post-election buying pressure across risk asset markets this week.

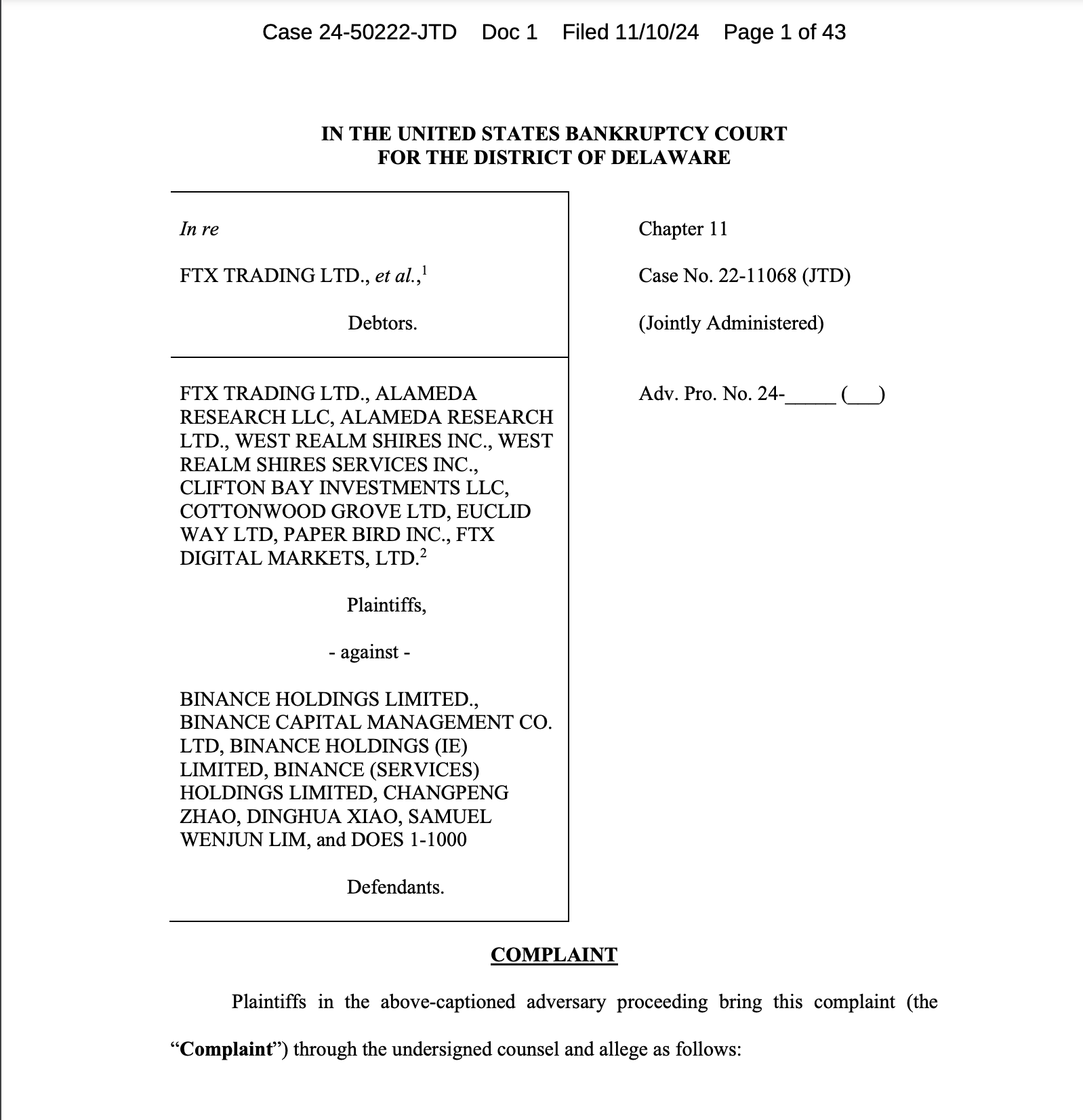

- Defunct cryptocurrency exchange FTX is suing Binance and its former CEO Changpeng Zhao, alleging the fraudulent transfer of $1.8 billion by FTX management to Binance and its executives.

FTX lawsuit filing against Binance and Changpeng Zhao | Source: US Bankruptcy court, district of Delaware.

"By this lawsuit, the Plaintiffs seek to recover, for the benefit of FTX’s creditors, at least $1.76 billion that was fraudulently transferred to Binance and its executives at the FTX creditors’ expense, as well as compensatory and punitive damages to be determined at trial,"

- FTX estate administrator, November 10, 2024.

At press time on November 11, CZ was yet to issue a public response on the lawsuit. However, a Binance spokesperson has labeled it “meritless” vowing that the exchange will vigorously defend the case in court, per Reuters report.

- Speaking to Bloomberg on Monday November 11, Metafide CEO, Frank Spicer stated that despite hitting new all time-highs in each of the last four days, the Bitcoin rally still has more upside potential.

“I would say that the (Bitcoin) markets still have a (long) way to go because what you are seeing right now is primarily institutional driven buying that has been driving up the buying pressure, but retail hasn't come back in.

If you look at the size of the buyorders that are coming in, they are all fairly large.You're not seeing drips and drabs.

you would and you're not seeing your Uber driver checking their portfolio as you're driving around now.

When that returns, I think that the market can go considerably higher.”- Metafide CEO, Frank Spicer.