Bitcoin Price Forecast: BTC bulls target $100,000 as market sentiment improves

- Bitcoin price hovers around $95,000 on Wednesday, after surging 4.51% and closing above a key resistance zone the previous day.

- Risk-on sentiment strengthens due to softer-than-expected US core CPI, driving a rally in risky assets.

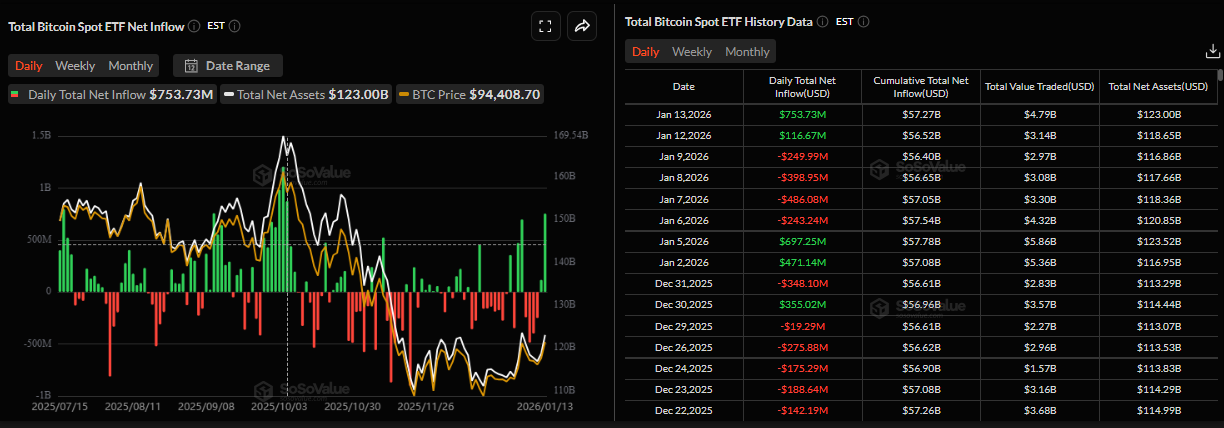

- US-listed spot ETFs record an inflow of over $750 million on Tuesday, the highest in a single day since October 6.

Bitcoin (BTC) price is trading around $95,000 on Wednesday after rallying over 4.5% and closing above a key resistance zone the previous day. Improving risk appetite, fueled by softer-than-expected US inflation data on Tuesday, triggered demand for risk assets. Institutional demand also strengthens, as spot Bitcoin Exchange-Traded Funds (ETFs) recorded their highest single-day inflows in three months, further suggesting a bullish narrative for the Crypto King.

Macroeconomics data boost risk-on sentiment

The US Bureau of Labor Statistics (BLS) released data on Tuesday showing that the US Consumer Price Index (CPI) rose 2.7% YoY in December. This figure followed 2.7% in November and matched the market consensus. However, the core CPI, which excludes Food and Energy prices, increased by 2.6% YoY in December, which was softer than the 2.7% expected. Meanwhile, the headline and core CPI rose by 0.3% and 0.2%, respectively, on a monthly basis.

The softer-than-expected US core CPI strengthens risk-on sentiment, with US equities hitting a new record high and risky assets such as BTC reaching a daily high of $96,495, the highest level since November 17.

Market participants now await the November US Retail Sales report and the US Producer Price Index (PPI) reports for October and November. Any surprises or divergence from expected outcomes would alter the likelihood of influencing the Fed’s interest rate path, introducing fresh volatility in risky assets such as Bitcoin.

-1768388526419-1768388526421.png)

Highest single-day inflow in three months

Institutional demand has continued to strengthen this week. SoSoValue data show that Bitcoin spot ETFs recorded inflows of $753.73 million on Tuesday, the highest single-day inflow since October 6. If this inflow continues, BTC could extend its ongoing rally.

Will BTC catch up to the S&P 500?

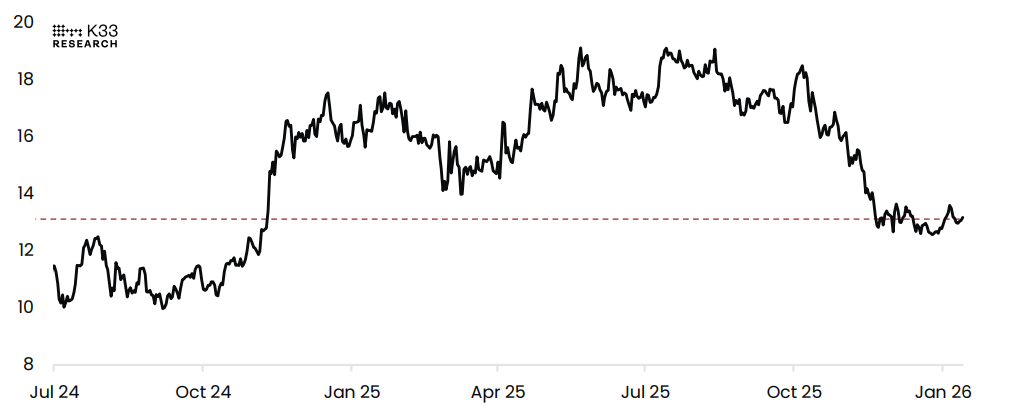

The K33 Research report on Tuesday highlighted several market-moving events on the horizon, primarily related to tariffs, Fed independence, and crypto regulation.

The analyst explained that Bitcoin’s price has remained largely stagnant even as the S&P 500 continues to rally, weighing on BTC’s relative performance versus equities. With the BTC/SPX ratio locked in a three-month consolidation, as shown in the chart below, these upcoming events could act as catalysts for a sharp directional move.

Bitcoin Price Forecast: BTC bulls aiming for $100K

Bitcoin price found support around a previously broken upper consolidation zone at $90,000 on January 8 and recovered slightly through Monday. On Tuesday, BTC rose more than 4% and closed above the 61.8% Fibonacci retracement level (from the April low of $74,508 to October’s all-time high of $126,199) at $94,253. As of Wednesday, BTC is trading around $95,000.

If BTC continues its rally, it could extend the surge toward the key psychological $100,000 level.

The Relative Strength Index (RSI) on the daily chart is 65, above the neutral level of 50 and trending upward, indicating bullish momentum gaining traction. Moreover, the Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover that remains intact, with rising green histogram bars above the neutral level, further supporting the positive outlook.

On the other hand, if BTC faces a correction, it could extend the decline toward the key support at $94,253 and the 50-day Exponential Moving Average (EMA) at $91,858.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.