Gold steadies at $3,334 as Powell sticks to hawkish stance, US data weakens

- Gold is supported by weak US housing data and improved market mood after the Israel–Iran ceasefire.

- Powell reiterates caution on tariffs and says Fed must manage inflation risks despite signs of easing.

- New Home Sales slump 13.7% in May; traders now focus on Durable Goods and GDP data.

Gold prices remain steady during the North American session on Wednesday, rising over 0.30% as risk appetite improves due to the de-escalation and truce of the Israel-Iran conflict. Worse-than-expected housing data in the United States (US) could lead to actions by the Federal Reserve (Fed). Still, Chair Jerome Powell maintains his hawkish rhetoric, which is capping bullion's gains.

XAU/USD trades at $3,334, up 0.34% as the Greenback trims some of its earlier gains, while US equities trade with gains.

Fed Chair Jerome Powell said during his testimony before US Congress that tariffs could cause just a one-time jump in prices, but added that the risks of becoming persistent are enough for the central bank to keep interest rates unchanged.

“If it comes in quickly and it is over and done, then yes, very likely it is a one-time thing" that won't lead to more persistent inflation, Powell said. But "it is a risk we feel. As the people who are supposed to keep stable prices, we need to manage that risk. That's all we're doing.”

Boston Fed President Susan Collins echoed Powell’s words, saying that policy is appropriate, but open to lower rate cuts later this year.

Data-wise, US New Home Sales dipped in May, due to higher mortgage rates near 7%. Ahead in the week, traders will eye the release of Durable Goods Orders, Gross Domestic Product (GDP) figures, and Initial Jobless Claims prints.

Daily digest market movers: Gold price holds firm amid weak US Dollar, rising US yields

- The Gold price stabilized after falling below $3,300, following US President Donald Trump's announcement of the ceasefire agreement between Israel and Iran.

- The US 10-year Treasury note is yielding 4.31%, rising almost two basis points (bps). The US Dollar Index (DXY), which tracks the performance of the buck’s value against a basket of six peers, is also down 0.13% at 97.84.

- US New Home Sales dipped 13.7% in May, from 722,000 in April to 623,000. Analysts were expecting a decline to 693,000 units. Elevated 30-year mortgage rates, nearly 7%, are the cause of consumers refraining from buying new houses.

- Bullion is poised to extend its gains, but sudden mixed data in the US capped its advance. Worse-than-expected Consumer Confidence figures, but solid Flash PMIs, hint that the economy remains solid, albeit showing some signs of weakness. Next week, traders await the release of the Institute for Supply Management (ISM) figures for June.

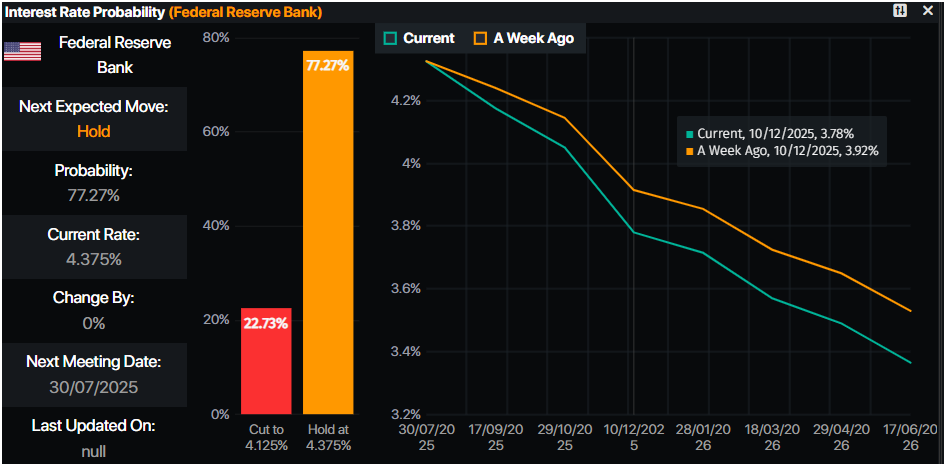

- Money markets suggest that traders are pricing in 59 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price plunges towards $3,300

The Gold price is set to consolidate near the $3,300-$3,340 range for the remainder of the day, amid a lack of catalysts. The Relative Strength Index (RSI) is bearish, trending upward, and showing mixed readings, confirming the lateral trend.

For Gold to resume its upward trend, buyers need to push prices above $3,350 and $3,450. Once surpassed, the next resistance would be $3,450, followed by $3,500. Conversely, if XAU/USD tumbles below the 50-day Simple Moving Average (SMA) at $3,317, $3,300 would be the first level of support. Next up is the May 29 low of $3,245 and $3,200.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.