Gold holds steady as risk sentiment improves, Fed’s Powell back in focus

- Gold remains steady as markets await the release of US New Home Sales data for additional clues of the health of the United States economy.

- Fed Chair Powell is expected to testify before the Senate Banking Committee, providing additional insight into monetary policy, inflation, and interest rates, factors that could serve as an additional catalyst for Bullion.

- XAU/USD steadies above $3,300 after a three-day losing streak, with risk appetite limiting short-term gains.

Gold (XAU/USD) is trading within a tight range on Wednesday, as markets continue to show signs of optimism following Tuesday's ceasefire between Israel and Iran.

At the time of writing, Gold is holding above $3,300 during the European session, with volatility remaining subdued. Market focus is now on key US macroeconomic releases and the second day of testimony from Federal Reserve Chair Jerome Powell.

With tensions in the Middle East appearing to remain subdued, Wednesday’s economic data releases and comments from Powell could serve as an additional catalyst for Bullion.

US New Home Sales data for May, due at 14:00 GMT, could serve as an additional catalyst for the Gold price. This report provides clues into how strongly the US housing market appears to be holding up.

Meanwhile, Jerome Powell returns to Capitol Hill to speak before the US Senate Committee on Banking, Housing, and Urban Affairs, where any shift in tone or mention of inflation risks could drive interest rate-sensitive assets, including Gold.

Daily digest market movers: Gold price drivers, Fed expectations, risks ahead

- Federal Reserve Chair Powell continues his two-day testimony to Congress on Wednesday, following his appearance before Congress the previous day, during which he answered questions on the economy, inflation, and the potential timing of rate cuts. For Gold, which moves inversely to interest rates and the US Dollar, Powell’s comments are particularly influential.

- Powell reiterated that the Fed is in "no hurry to cut rates," noting that inflation data has been uneven and that tariff-related price pressures are likely to appear in the data for June or July.

- Powell’s tone remained consistent with the June 18 Federal Open Market Committee (FOMC) meeting, where policymakers projected two rate cuts in the latter part of the year. Despite that, market participants remain divided on the timing and certainty of those cuts, with pricing still sensitive to incoming data.

- Powell also added, “If it turns out that inflation pressures do remain contained, we will get to a place where we cut rates sooner rather than later, but I wouldn’t want to point to a particular meeting.” He clarified that a meaningful deterioration in the labor market would also affect the Fed’s decision-making, but emphasized, “We don’t need to be in any rush because the economy is still strong, the labor market is strong.” This underscores the data-dependent stance, keeping Gold sensitive to incoming figures.

- US consumer confidence data released Tuesday added to that uncertainty. The Conference Board’s Consumer Confidence index fell to 93.0 in June, down from 98.4 in May. A more cautious consumer outlook could imply softer spending ahead, which may weigh on the Fed’s growth projections and influence the timing of interest rate adjustments

- Geopolitical risk has abated for now, with the Israel-Iran ceasefire holding for a second consecutive day. While the situation remains fragile, the lack of new escalations has drawn safe-haven flows away from Gold, placing more emphasis on macroeconomic and policy factors for direction.

- Looking ahead, the release of US Personal Consumption Expenditures (PCE) data, the Fed’s preferred inflation gauge, on Friday will be critical. A soft print could revive expectations for a near-term rate cut and offer a fresh tailwind for Gold.

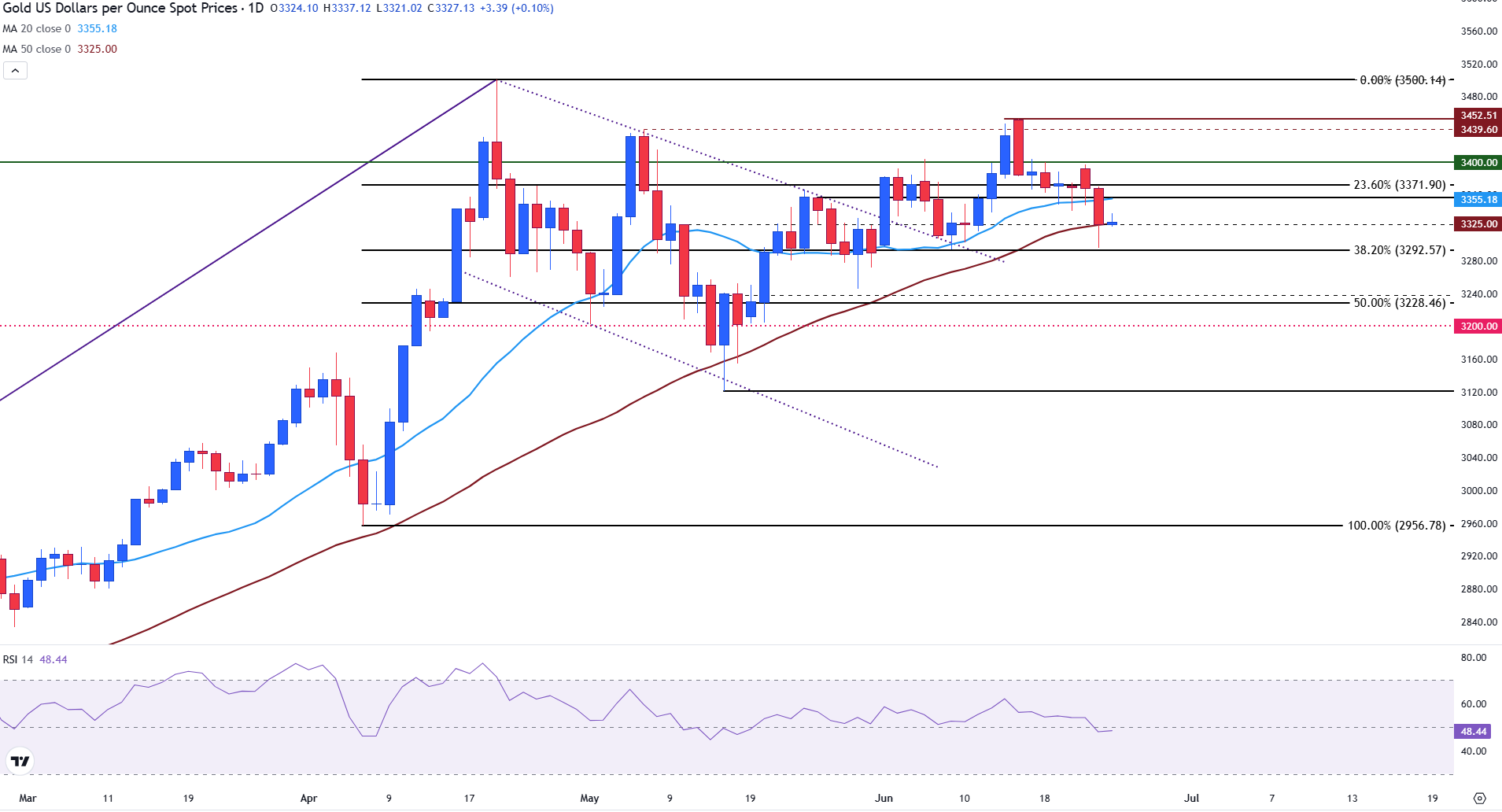

Gold technical analysis: XAU/USD clings to the 50-day SMA above $3,300

Gold price is currently trading above the key psychological support level of $3,300, with the Relative Strength Index (RSI) indicator flattening near the 50 mark on the daily chart, suggesting a lack of momentum and indecision among traders.

At the time of writing, XAU/USD has steadied around the 50-day Simple Moving Average (SMA) at $3,325.

Gold (XAU/USD) daily chart

For the price to extend its recovery, a move above the 20-day SMA at $3,355 is required. If bulls succeed in clearing this barrier, the next level of resistance will likely reside at the $3,400 psychological level.

However, if risk appetite improves, demand for safe havens could continue to decline in the short term. If the Gold price faces a deeper pullback below the $3,300 round level, the midpoint of the rally from the April 7 low to the April 22 high (the 50% Fibonacci retracement level) could come into play as support at $3,228.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.