EUR/USD retreats on risk aversion after Israel’s attack on Iran

- The Euro pares gains as the US Dollar jumps on risk aversion.

- Israel’s attack on Iran has offset the impact of soft US inflation data.

- EUR/USD correction remains contained above previous highs.

The EUR/USD pair snaps a four-day rally on Friday, retreating from nearly four-year highs above 1.1600 to the lower range of the 1.1500s. Israel’s attack on Iran triggered a risk-averse market reaction, with investors rushing to safe assets like the US Dollar (USD).

Tensions in the Middle East are escalating after Israel struck Iran’s nuclear plants and killed several high-ranking Revolutionary Guard military officers. Iran vowed retaliation, and Tel Aviv affirmed that the attack would last several days, which threatens to ignite an already highly volatile region.

These events have provided significant support to the US Dollar, which, hitherto, was depressed at multi-year lows after US inflation figures boosted hopes that the Federal Reserve (Fed) will cut interest rates in September.

The US Producer Prices Index (PPI) data released on Thursday revealed slower-than-expected price pressures at the factory gate in May. These figures follow another moderate Consumer Price Index (CPI) increase seen earlier this week, and have eased fears of the inflationary impact of tariffs, at least for now.

In the Eurozone, final German CPI figures released on Friday revealed that inflation remained close to levels near the ECB’s 2% target. French inflation was confirmed at a subdued 0.6%, while Spanish price growth was slightly revised upwards to 2%.

Later today, the Eurozone Industrial production will be released, although the impact of the data is likely to be subdued with geopolitical tensions driving markets.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.25% | 0.29% | 0.16% | 0.12% | 0.71% | 0.85% | 0.06% | |

| EUR | -0.25% | 0.08% | -0.02% | -0.07% | 0.55% | 0.57% | -0.20% | |

| GBP | -0.29% | -0.08% | -0.18% | -0.23% | 0.39% | 0.48% | -0.26% | |

| JPY | -0.16% | 0.02% | 0.18% | -0.02% | 0.55% | 0.67% | -0.11% | |

| CAD | -0.12% | 0.07% | 0.23% | 0.02% | 0.57% | 0.74% | -0.03% | |

| AUD | -0.71% | -0.55% | -0.39% | -0.55% | -0.57% | 0.11% | -0.66% | |

| NZD | -0.85% | -0.57% | -0.48% | -0.67% | -0.74% | -0.11% | -0.75% | |

| CHF | -0.06% | 0.20% | 0.26% | 0.11% | 0.03% | 0.66% | 0.75% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Geopolitical tensions bring some life to the US Dollar

- Israel’s pounding on Tehran has given a fresh boost to the US Dollar, sending the Euro 0.7% below the multi-year highs hit on Thursday. The common currency, however, remains on track for a 1.3% weekly rally. The Greenback had tumbled through the week, weighed by the lack of details of the US-China trade deal and soft inflation data.

- Thursday’s data revealed that US PPI grew at a 0.1% monthly rate in May, below the market consensus of a 0.2% advance, and by 2.6% year-on-year, as expected. The core PPI posted another 0.1% monthly increase, well below the 0.3% expected, and 3% year-on-year. The market consensus anticipated a 3.1% reading from April’s 3.2%.

- US Consumer Prices in May moderated to a 0.1% increase from the previous month and 2.4% from the same month last year, below the market consensus of 0.2% and 2.5% increases, respectively.

- With the Federal Reserve in a blackout period ahead of next week’s meeting, these figures have heightened hopes of a rate cut in September. The CME Group’s Fed Watch tool is showing a 60% chance of a 25 basis points cut after the summer, up from nearly 50% last week.

- In Europe, European Central Bank officials keep endorsing ECB President Christine Lagarde’s hawkish stance, highlighting a monetary divergence with the US central bank that has been supporting the Euro.

- On Thursday, ECB member Isabel Schnabel observed that the Eurozone's growth outlook is "broadly stable" with inflation stabilizing at the 2% target before stating that the view that the bank's monetary cycle is coming to an end.

- German final CPI figures justified those arguments on Friday. Consumer inflation grew at a 0.1% pace in May and 2.1% year-on-year, in line with the expectations and at the same pace seen in April.

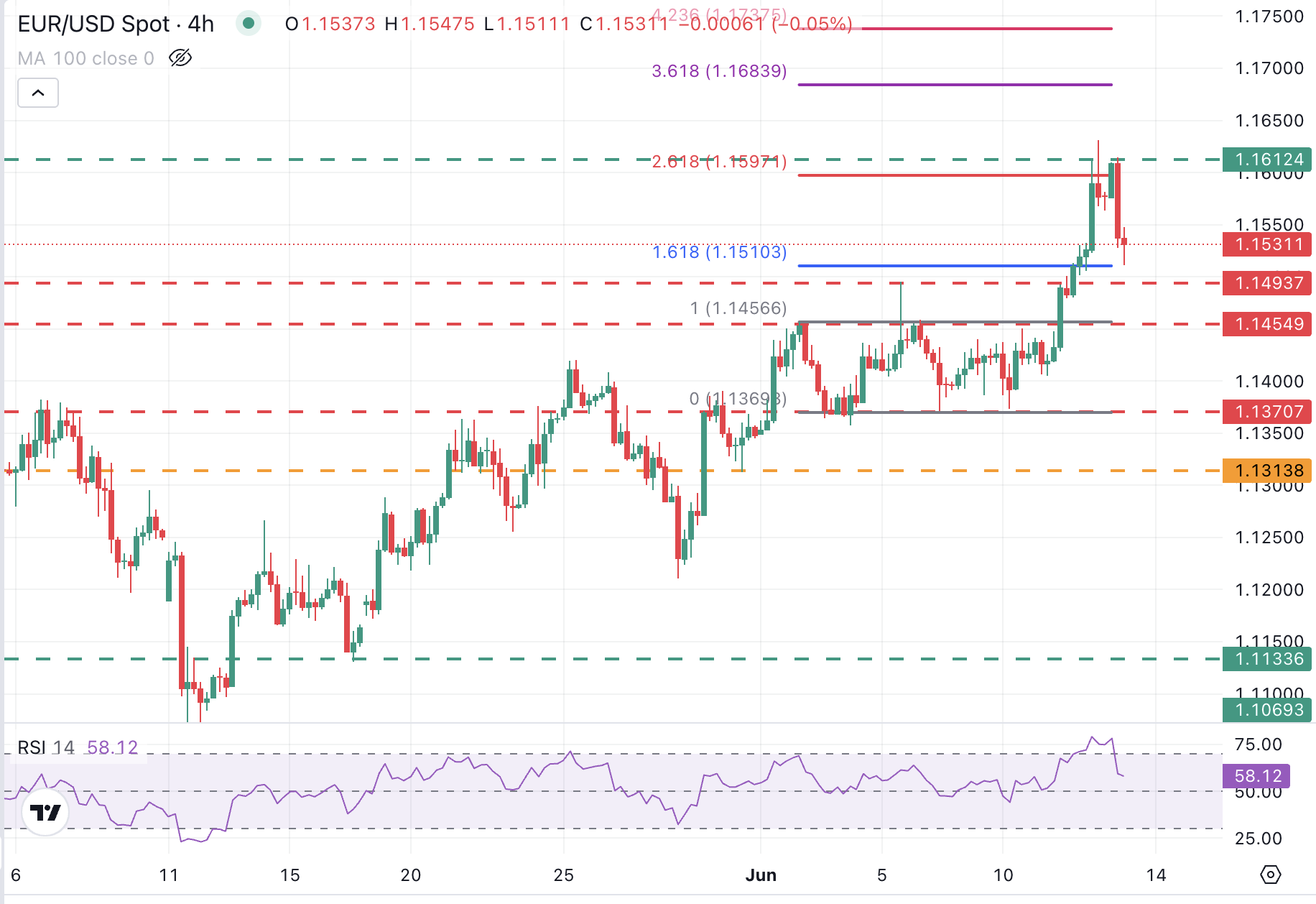

Technical analysis: EUR/USD on bearish correction with support at 1.1500

EUR/USD has been rejected at the 1.1600 area and is correcting lower. The broader trend, however, remains positive, with the pair posting higher highs and higher lows, and with the 4-hour RSI still at levels above 50, which reflects a mild bullish momentum.

The pair is likely to find support between the June 5 high, at 1.1495, and the 1.1500 psychological level if the dust from the Israel-Iran conflict settles. Below here, the next support is 1.1460, which broadly aligns with the highs from June 2 and 10. Further decline beyond this level would put the bullish trend into question.

On the upside, resistances are at 1.1612 (intra-day high) and then probably at 1.1685, the 361.8% Fibonacci extension of early June’s trading range.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.