AMD Reports Record Q4 Revenue, Shares Plunge 9% on Data Center Miss

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

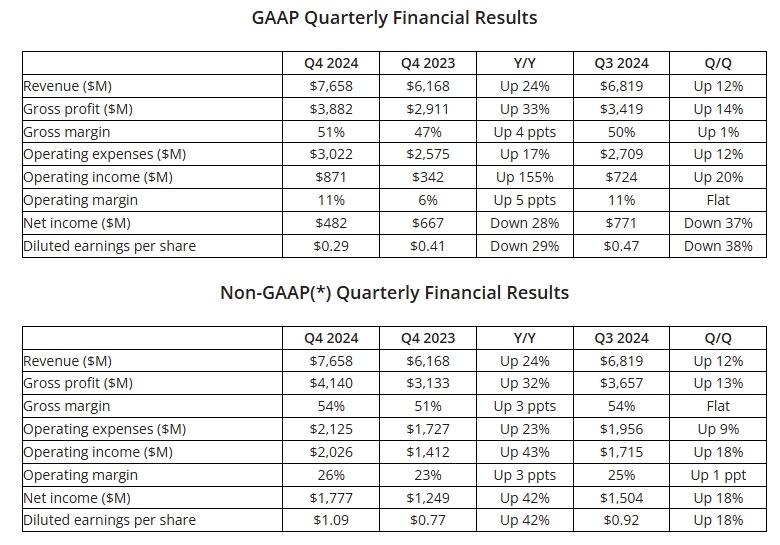

AMD, a global semiconductor giant, saw its stock price fluctuate dramatically after releasing its Q4 2024 earnings report, despite surpassing consensus estimates on both the top and bottom lines. The primary concern was the underperformance of its highly anticipated data center business.

On February 4, AMD announced its fourth-quarter results, with both total revenue and net profit reaching record highs and exceeding expectations.

- Earnings per share (EPS): $1.09 (adjusted) vs. $1.08 expected

- Revenue: $7.66 billion vs. $7.53 billion expected

[AMD Q4 2024 Earnings Report, Source: AMD]

By segment, the Data Center and Client businesses, which include PC chips, achieved mid-to-high double-digit percentage growth year-over-year and set new records. However, the Gaming and Embedded segments experienced double-digit percentage declines.

AMD CEO Dr. Lisa Su stated, "2024 was a transformative year for AMD as we delivered record annual revenue and strong earnings growth."

Looking ahead to 2025, AMD expects to achieve strong double-digit revenue and EPS growth.

Data Center Falls Short?

Following the earnings release, AMD's stock initially surged 5% in after-hours trading but later dropped 9%, largely due to a data center revenue miss, which raised concerns about the company’s AI monetization capabilities.

Su noted that with the accelerated adoption of EPYC processors, the company's annual data center revenue nearly doubled, and it generated over $5 billion in revenue from AMD Instinct accelerators.

Despite falling short of Wall Street expectations, Q4 data center revenue still grew approximately 70% year-over-year, driven primarily by Instinct GPUs and EPYC CPUs, which compete directly with Intel’s processors.

Su emphasized AMD’s unique position in AI computing, stating, "We are the only provider with the breadth of products and software expertise needed to power AI across servers, edge devices, and PCs."

She added, "We believe this places AMD on a steep long-term growth trajectory, led by the rapid scaling of our data center AI franchise—from more than $5 billion in revenue in 2024 to tens of billions of dollars annually in the coming years."

Is AMD Stock Still Worth Investing In?

The global semiconductor industry is dominated by three giants: NVIDIA, AMD, and Intel. Over the past year, NVIDIA—widely seen as the biggest winner in AI—saw its stock surge 80%, while AMD declined more than 30%, and Intel dropped over 50%.

Ahead of AMD's Q4 earnings report, several investment banks, including Cantor Fitzgerald, Bank of America, HSBC, and Goldman Sachs, lowered their price targets for AMD, citing concerns over slowing data center revenue growth and increasing pressure on its AI GPU market share.

TradingKey Equity team believes AMD did a particularly good job with cost control and margin expansion. Gross Margins inch up for a fourth consecutive quarter reaching 51%, with management expecting them to be around 54% this year.

Additionally, operating expenses are declining as percentage of revenue, boosting the operating margin to nearly 14% versus 6% same quarter last year.

The bad news for AMD was the fact that the Data Center business performance was rather unsatisfactory with $3.86 billion of revenue reported versus the expected $4.14 billion – a 7% shortfall. Other segments also performed quite mixed – with good performance in the client growth (PC-related business) but weak performance in the embedded segment (EV-related business).

We think investors still consider Nvidia as a benchmark for AMD’s performance, and at this stage it is hard to see AMD narrowing the gap with NVDA anytime soon, that is why stock has been on a constant decline over the past one year, retreating nearly 50% from the peak in March 2024.

From a value investing perspective, AMD is already not as expensive with an adjusted PE ratio at 45x and large room for growth, but we would like to see more positive signs before we become more bullish on the stock.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.