Berkshire EPS misses estimates as insurance losses, mixed results weigh on Q3

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises above $4,950 as US-Iran tensions boost safe-haven demand

- Gold drifts higher to $5,000 on heightened US-Iran tensions

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Silver Price Forecast: XAG/USD rises to near $78.00 on safe-haven demand

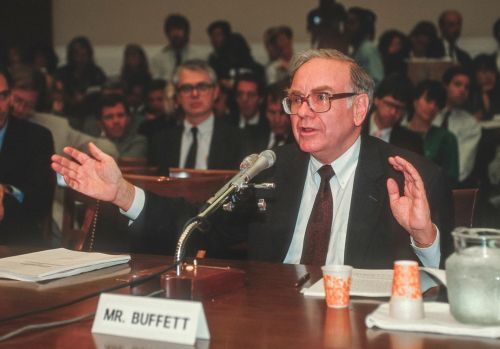

Investing.com -- Berkshire Hathaway's third-quarter results fell short of analyst expectations, with EPS underperforming consensus projections.

The company’s EPS of $4.68 consensus estimates of $4.89. “BRK posted below-expected 3Q24 EPS as catastrophe losses and unfavorable prior year development in a BHPG subsidiary weighed on insurance earnings,” said analysts at TD Cowen in a note.

Operating income for "A" shares was reported at $7,023, below the UBS estimate of $8,652, while "B" shares came in at $4.68 versus the expected $5.77.

This miss was largely driven by mixed results in the insurance sector, with GEICO performing better than expected, yet offset by disappointing figures from the BHPG and the Reinsurance Group (NYSE:RGA).

In particular, BHPG saw nearly $800 million in adverse reserve development for prior years, which added roughly 17 percentage points to its combined ratio, a metric of underwriting profitability.

Total catastrophe losses for the quarter amounted to $720 million, all attributed to Hurricane Helene, which was below the UBS forecast of $1 billion in losses.

Breaking down these losses, GEICO incurred $260 million, the Reinsurance Group $380 million, and BH Primary $80 million.

Despite these setbacks, GEICO saw an improvement in its underlying loss ratio, with an 8.5 percentage point year-over-year reduction, outperforming UBS’s expected improvement of 1.7 points.

Non-insurance segments also faced challenges. Berkshire’s railroad business, BNSF, fell short of UBS’s income estimate by 4%, impacted by lower revenue per car due to changes in fuel surcharges and business mix.

The energy unit, Berkshire Hathaway (NYSE:BRKa) Energy, similarly missed operating income forecasts due to weaker revenue growth.

TD Cowen flagged that BHPG’s premium revenue increased slightly to $5.1 billion, just below the $5.2 billion target.

The property and casualty combined ratio, a measure of underwriting profitability, deteriorated to 114.7% compared to last year’s 88.5%, and was substantially higher than the 98.0% ratio anticipated by analysts.

Catastrophe losses related to Hurricane Helene reached $565 million, surpassing expectations.

Despite setbacks in the insurance segment, Berkshire’s cash reserves grew to $325.2 billion as it continued reducing its holdings in Apple (NASDAQ:AAPL). However, these mixed results could position Berkshire's stock to underperform compared to industry peers in the near term, as per TD Cowen.

“We modestly lowered our share buyback assumption for 4Q24 ($1.1b vs. $2.6bb previously) given where BRK's shares are trading relative to intrinsic value,” said analysts at UBS in a note.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.