Apple sets a string of records and soars 10% in 2 sessions: 21% correction in sight?

- Gold slides below $5,000 amid USD uptick and positive risk tone; downside seems limited

- Gold declines to near $4,850 as low liquidity, easing tensions weigh on demand

- Gold weakens as USD uptick and risk-on mood dominate ahead of FOMC Minutes

- Gold rises above $4,950 as US-Iran tensions boost safe-haven demand

- Gold drifts higher to $5,000 on heightened US-Iran tensions

- Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP face downside risk as bears regain control

Investing.com - After breaking through the $200 barrier for the first time in its history on Tuesday, on a day that saw the share price rise by more than 7%, Apple Inc (NASDAQ:AAPL) continued its record-breaking run yesterday, closing 2.86% higher at $213.07, after setting an intraday record at $220.20.

Over the last 2 sessions, Apple shares have gained more than 10%, enabling it to move back ahead of Nvidia in the ranking of the world's largest companies by market capitalisation, trailing only Microsoft (NASDAQ:MSFT) by a very narrow margin.

Apple's current bull run began on 19 April, following a low of $164. At Wednesday's close, Apple had gained almost 30% in less than two months.

It's also worth noting that Apple's share price surge over the past two days is largely the result of excitement over a number of announcements concerning the integration of AI into its devices, which could stimulate renewal and boost sales at the Apple firm.

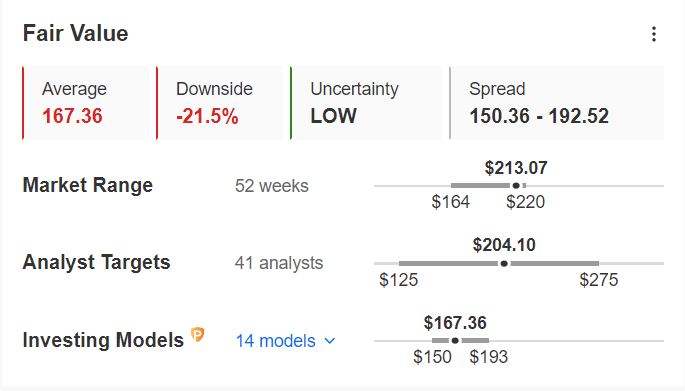

However, given the scale of the recent rise, the question arises as to whether the opportunity has already passed. On average, analysts are giving the stock a target price of $204.10, a threshold that was exceeded on Tuesday.

What's more, Fair Value, an InvestingPro proprietary indicator that synthesises several recognised financial models, values Apple at just $167.36, more than 21% below the current price.

In other words, Apple shares currently appear to be overvalued. This is also the case for many other obvious beneficiaries of AI. Nvidia is overvalued by 20% according to Fair Value, Meta (NASDAQ:META) by 7.5% and Microsoft by 11.6%.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.