The Australian Dollar remains subdued following the release of RBA Meeting Minutes on Tuesday.

Most RBA members believed it was prudent to wait for confirmation of inflation slowdown before proceeding with further easing.

Market caution deepened amid escalating uncertainty over tariffs and growing concerns about the Fed’s independence.

The Australian Dollar (AUD) edges lower against the US Dollar (USD) on Tuesday after two days of losses. The AUD/USD pair remains subdued following the release of the Reserve Bank of Australia’s (RBA) Meeting Minutes.

The RBA Minutes of its July monetary policy meeting highlighted that the board agreed further rate cuts warranted over time, with attention centered on timing and extent of easing. The majority believed to await confirmation on inflation slowdown before easing. Most members felt cutting rates three times in four meetings would not be "Cautious and gradual.”

Traders are awaiting further trade development between the United States (US) and China. China could finalize a long-term tariff agreement with the US ahead of the August 12 deadline. US Commerce Secretary Howard Lutnick stated unequivocally in a televised interview, “That’s a hard deadline, so on August 1, the new tariff rates will come in. Nothing stops countries from talking to us after August 1, but they’re going to start paying the tariffs on August 1.”

The People’s Bank of China (PBoC) decided on Monday to leave its one- and five-year Loan Prime Rates (LPRs) unchanged at 3.00% and 3.50%, respectively. It is important to note that any change in the Chinese economy could impact the Australian Dollar as China and Australia are close trade partners.

Australian Dollar declines as US Dollar recovers its recent losses

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is holding ground after losing more than 0.50% in the previous session and trading at around 97.90 at the time of writing. Traders adopt caution amid rising uncertainty over impending tariffs and increasing worries about the Federal Reserve's (Fed) independence.

A White House official said that US President Donald Trump is likely to fire Fed Chairman Jerome Powell soon. However, Trump denied it in a Truth Social post on Sunday, calling it “typically untruthful.”

Republican Congresswoman Anna Paulina Luna has formally accused the Fed Chair Powell of committing perjury on two separate occasions, both stemming from discussions about the Fed's long-scheduled renovations to its head offices in Washington, DC

The University of Michigan’s (UoM) preliminary Consumer Sentiment Index for July climbed to 61.8 from 60.7 in June, beating expectations of 61.5. Both the Current Conditions and Expectations components improved, reflecting cautious optimism among US households.

FOMC Governor Adriana Kugler said that the US central bank should not lower interest rates "for some time" since the effects of Trump administration tariffs are starting to show up in consumer prices. Kugler added that restrictive monetary policy is essential to keep inflationary psychology in line.

San Francisco Fed President Mary Daly said last week that expecting two rate cuts this year is a "reasonable" outlook, while warning against waiting too long. Daly added that rates will eventually settle at 3% or higher, which is higher than the pre-pandemic neutral rate.

Fed Governor Christopher Waller said that he believes that the US central bank should reduce its interest rate target at the July meeting, citing mounting economic risks. Waller added that delaying cuts runs the risk of needing more aggressive action later.

China's Commerce Minister Wang Wentao said on Friday that the economic and trade relations with the United States have gone through storms, but remain important to each other. Wentao also stated that Mutual benefit is the essence of US-China commercial ties. Geneva agreement, London framework effectively stabilised commercial ties, cooled down tensions, he added.

China’s economy expanded at an annual rate of 5.2% in the second quarter, compared to a 5.4% growth in the first quarter and the expected 5.1% growth. Meanwhile, the Chinese Gross Domestic Product (GDP) rate rose 1.1% in Q2, against the market consensus of a 0.9% increase. Moreover, Retail Sales increased by 4.8% YoY in June, against the 5.6% expected and 6.4% prior, while Industrial Production came in at 6.8%, against the 5.6% expected.

Australian Dollar trades near 0.6500, nine-day EMA acts as initial barrier

The AUD/USD pair is trading around 0.6520 on Tuesday. The daily chart’s technical analysis suggested a prevailing bullish bias as the pair remains within the ascending channel pattern. The 14-day Relative Strength Index (RSI) hovers around the 50 mark, suggesting a neutral bias is active. The pair remains slightly below the nine-day Exponential Moving Average (EMA), indicating that short-term price momentum is weaker.

On the downside, the primary support appears at the 50-day EMA of 0.6493. A break below this level would dampen the short-term price momentum and prompt the AUD/USD pair to target the ascending channel’s lower boundary around 0.6470, aligned with the three-week low at 0.6454, which was recorded on July 17.

The AUD/USD pair is testing the immediate barrier at the nine-day EMA of 0.6524. A break above this level could strengthen the short-term price momentum and support the pair to approach the eight-month high of 0.6595, which was reached on July 11.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

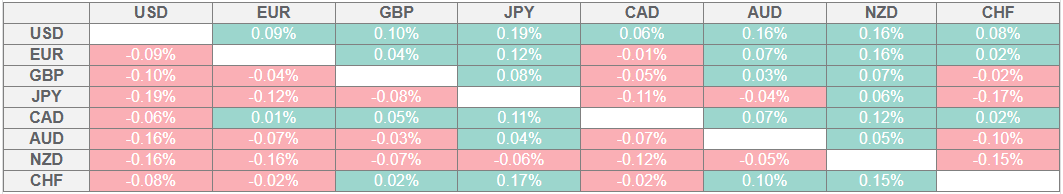

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.