The Tariff Window Is Open — And So Is a Rally Opportunity

TradingKey - Markets got a shot of optimism this week following a surprise move by the U.S. and China: Both sides agreed to cut tariffs and head back to the negotiating table, setting up a highly anticipated 90-day window for trade talks. Investors cheered the news — easing trade tensions helped lift equities and reignited risk appetite.

According to the agreement, the U.S. will lower tariffs on select Chinese goods from 145% to 30%. In return, China is set to reduce retaliatory tariffs on American products from 125% to 10%. The move eased fears of an escalation into a full-blown trade war.

Richard de Chazal, strategist at William Blair, called the three-month tariff relief plan (running through August 14) “an encouraging signal.” Morgan Stanley’s Chief China Economist, Robin Xing, expects the temporary window to trigger a short-term boom in trade activity as companies rush to front-load shipments and take advantage of lower duties — something we’ve already seen hints of earlier this year.

“The tariff pause breaks a downward spiral,” Xing said, “and gives both countries room to breathe.”

Logistics Industry Sees Green Shoots

Flexport, a global digital freight platform, reported that by the end of April, order cancellation rates had soared to 50% due to U.S.-China trade tensions. The Port of Los Angeles, a key gateway for Asian—particularly Chinese—goods, estimated that inbound container volume could decline 30% year-over-year during the week ending May 3.

However, with tariff cuts now in effect, shipping demand is rebounding rapidly. Flexport founder and CEO Ryan Petersen posted on social media that ocean freight orders from China to the U.S. surged 35% on the day the agreement was signed. “Suppressed demand is now releasing in waves,” Petersen added, warning of an imminent shortage in shipping capacity.

AP Moller-Maersk CEO Vincent Clerc, on the company’s Q1 earnings call, also warned of a “catch-up effect” should the trade environment stabilize, with Chinese export demand expected to sharply rise.

Small Parcel Tariff Relief Fuels E-Commerce and Ad Growth

The latest tariff revisions include a significant cut in levies on low-value Chinese goods entering the U.S.—now reduced from 120–145% to a more manageable 54–120% range. This development benefits e-commerce giants like Amazon (AMZN) and Meta Platforms (META), which are integral to digital retail ecosystems.

Back in April, an executive order under the Trump administration suspended the U.S. de minimis threshold for parcels from mainland China and Hong Kong. Beginning May 2, those shipments became subject to steep import duties, sharply increasing costs for online retailers.

These rules especially impacted platforms like Temu and Shein, which rely heavily on direct shipping of low-cost goods to American consumers. Amazon, which has increasingly embraced a similar model with programs like "Amazon Haul," also faced margin pressure under the former tariff regime.

U.S. Customs data shows that in 2023, 1.4 billion parcels from China entered under de minimis rules—up drastically from 140 million in 2013.

Source: BBC

The impact is already visible in advertising dynamics. Mike Ryan, Head of Ecommerce Intelligence at Smarter Ecommerce, noted on LinkedIn that Temu halted all Google Shopping ads in the U.S. starting April 9. According to Sensor Tower, Temu’s average daily ad spend across Facebook, Instagram, and YouTube fell 31% in a two-week period ending April 13, while Shein scaled back ads by 19% over the same timeframe.

Meta’s CFO Susan Li confirmed the trend in a recent earnings call, citing declining ad spending from Asian cross-border e-commerce exporters. Pinterest (PINS) also referred to shrinking campaign volume from the segment in its latest updates.

While Shein and Temu may restore over 80% of their peak advertising investment, structural factors such as market inertia, entrenched user habits, and evolving competition may prevent a full return to 2024 levels.

While Shein and Temu may restore over 80% of their peak advertising investment, structural factors such as market inertia, entrenched user habits, and evolving competition may prevent a full return to 2024 levels."

Supply Relief Buys Time for Tech to Regain Momentum

The easing of U.S.-China tariffs is especially welcome news for the technology sector, as it temporarily relieves tensions surrounding supply chain disruptions. Apple (AAPL), which manufactures roughly 90% of its iPhones in China, had previously warned of a potential $900 million rise in quarterly costs due to continued tariff pressures. The latest policy shift offers a crucial breather, with Apple’s stock rebounding this week.

Tesla (TSLA) also stands to benefit. The company’s battery ecosystem relies on Chinese suppliers like CATL and BYD, and its Shanghai Gigafactory plays a key role in maintaining cost competitiveness. Amid an aggressive global EV price war, elevated tariffs would have directly eaten into profitability. Reuters reported that Tesla will begin sourcing components from China and shipping them to the U.S. for CyberCab and Semi truck production—highlighting how tariff relief is influencing sourcing strategy.

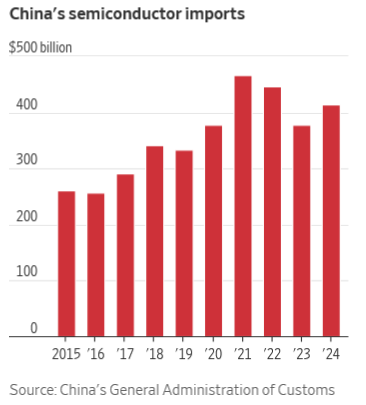

While NVIDIA (NVDA)’s high-end AI chips, like the H20 series, are still subject to export controls, the tariff exemption on consumer electronics and semiconductor equipment eases concerns of a broader “tech decoupling” scenario. The GPU leader has also announced a 10–15% price increase across its product lineup to offset cost burdens stemming from production shifts and geopolitical volatility.

Daniel Ives, Global Head of Tech Research at Wedbush Securities, commented, “As the U.S.-China deal framework progresses, we see a clear foundation for tech stocks to potentially hit all-time highs in 2025.” He emphasized that upcoming trade talks will be a critical market catalyst.

However, export restrictions remain a structural threat for NVIDIA. The company’s VP Ned Finkle recently warned: “These controls don’t deter threats—they undermine U.S. tech leadership.” With China contributing 20–30% of NVIDIA’s total revenue, and bans on high-end chips like the H20 already causing estimated quarterly revenue losses north of $5.5 billion, the strategic implications are significant.

Source: WSJ

Meanwhile, Chinese tech firms are accelerating efforts to localize AI infrastructure. Huawei’s Ascend 910B chip now delivers 80% of NVIDIA’s A100 performance at a lower cost. Tech giants like Baidu and Alibaba are preparing to shift workloads to domestic solutions, posing a long-term substitution risk.

China Signals Go-Ahead for Boeing Deliveries

The U.S.-China trade thaw brought an unexpected but positive development for Boeing (BA), as sources told Bloomberg that Chinese authorities have greenlit domestic airlines to resume receiving Boeing aircraft. Actual delivery timelines and volumes will be left to commercial negotiations.

Earlier, Chinese carriers refused to accept Boeing 737 Max aircraft, forcing planes to be reassigned to buyers in India, Malaysia, and the Middle East. With new deliveries to China now back on the table, this marks a strategic turning point.

China is a key growth market for Boeing. In 2023, deliveries to China accounted for one-fifth of the company’s global volume. This shift underscores that, despite persistent political tensions, the U.S. and China retain scope for economic cooperation.

Should visa policies and outbound travel restrictions ease in the near term, U.S. airlines may also revisit code-sharing and alliance arrangements with their Chinese counterparts.

Here Are US Stocks to Watch

Shipping & Logistics

- FedEx (FDX): Global shipping & logistics

- UPS (UPS): Parcel delivery & supply chain services

Semiconductors

- NVIDIA (NVDA): AI & GPU powerhouse

- TSMC (TSMC): World’s largest chip foundry

Retail & E-Commerce

- Amazon (AMZN): Global e-commerce & cloud giant

Auto & Components

- Tesla (TSLA): EV manufacturing & autonomous tech

Industrial Equipment

- Caterpillar (CAT): Heavy equipment leader

- Deere (DE): Ag & construction machinery

Consumer Tech

- Apple (AAPL): Smartphones & hardware ecosystem

Airlines & Aerospace

- Delta (DAL): Major U.S. airline

- Boeing (BA): Aircraft manufacturer

China Tech Plays

- Alibaba (BABA): E-commerce & cloud infrastructure

- Pinduoduo (PDD): Social commerce & Temu operator

Digital Advertising

- Alphabet (GOOGL): Search, YouTube & ad ecosystem

- Meta Platforms (META): Social media & ad revenue leader