5 Reasons Why Bitcoin Could Hit a New All-Time High in May

Bitcoin’s (BTC) climb above $100,000 has strengthened confidence in predictions that it will set a new all-time high (ATH) soon.

Based on on-chain data, accumulation trends, and market sentiment, there are several compelling reasons to believe Bitcoin may reach a new peak. This article analyzes five key reasons supporting that prediction.

5 Reasons Driving Bitcoin Toward a New ATH in May

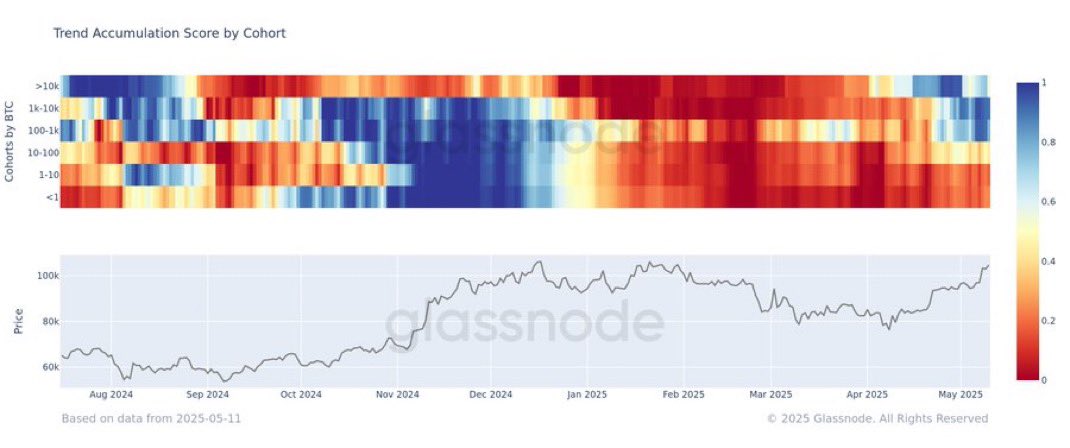

The first reason is the accumulation of whales during May. Data from Glassnode shows that wallets of all sizes are actively accumulating BTC. Glassnode’s “Trend Accumulation Score by Cohort” chart illustrates this trend.

Bitcoin Trend Accumulation Score by Cohort. Source: Glassnode

Bitcoin Trend Accumulation Score by Cohort. Source: Glassnode

In early April, accumulation was mainly limited to large whale wallets holding over 10,000 BTC. But by May, the accumulation trend had spread to smaller wallets holding between 100 and 1,000 BTC. Meanwhile, wallets holding less than 100 BTC also showed increasing accumulation activity, reflected in the fading red colors on the chart throughout May.

Additionally, Santiment reports that in the past 30 days, whale wallets have accumulated another 83,105 BTC. This accumulation has helped flip the Spot Volume Delta into positive territory, giving Bitcoin momentum to push higher.

“The aggressive accumulation from these large wallets— it may be a matter of time until Bitcoin’s coveted $110,000 all-time high level is breached, particularly after the US & China tariff pause,” Santiment predicted.

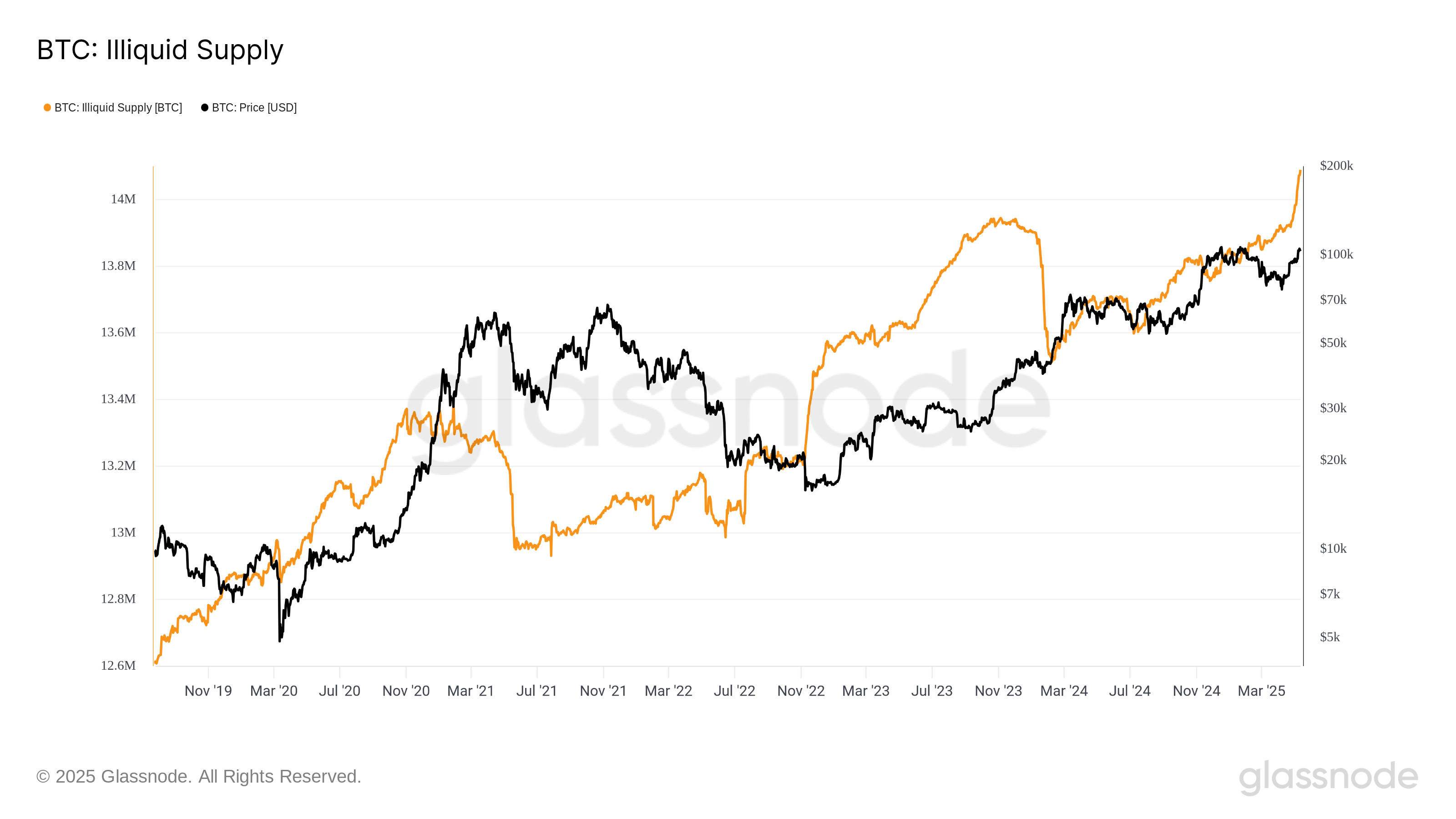

The second reason is that Bitcoin’s illiquid supply has reached a record high of 14 million BTC, which is worth over $1.4 billion.

Bitcoin Illiquid Supply. Source: Glassnode

Bitcoin Illiquid Supply. Source: Glassnode

The rise in illiquid supply indicates that long-term investors (HODLers) are holding tightly to their Bitcoin. They have no intention of selling in the short term. Consequently, this reduces the circulating supply, and as demand rises, Bitcoin’s price can break out more easily.

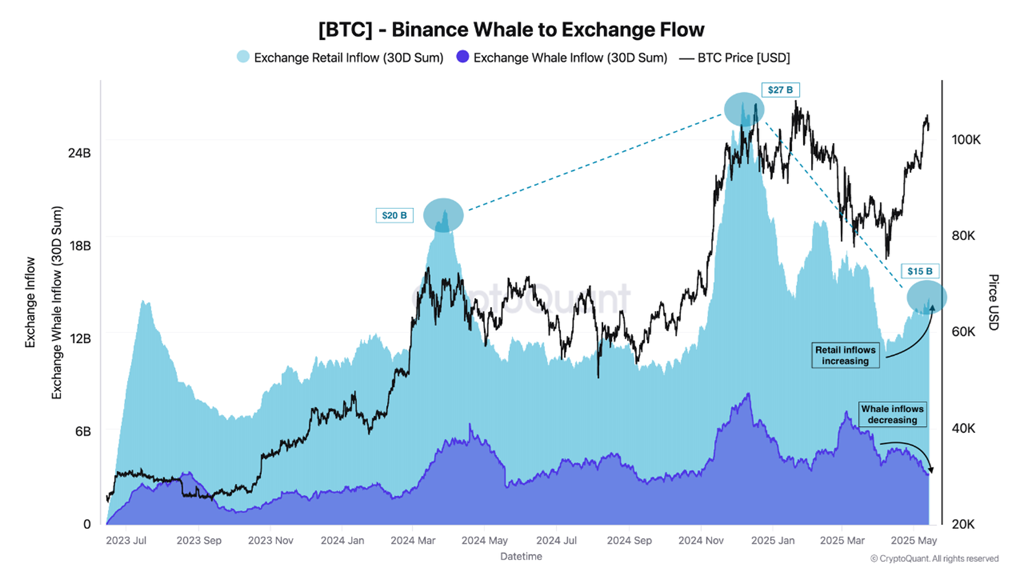

The third reason comes from small investors. Although a new wave of retail investors has yet to emerge fully, CryptoQuant reports that retail trading volume on Binance—the world’s largest crypto exchange—has started to rebound after a period of decline.

Binance Whale to Exchange Flow. Source: Cryptoquant

Binance Whale to Exchange Flow. Source: Cryptoquant

Additionally, Carmelo Alemán, an analyst at CryptoQuant, also observed that while retail volume hasn’t spiked yet, it has shown positive signs.

“In the coming months, as retail participation increases, we can expect to see growth in Active Addresses, UTXO Count, and metrics like New Addresses and Transfer Volume, reflecting the sustained expansion of the crypto ecosystem,” Alemán predicted.

The fourth reason analysts are closely watching is the correlation between Bitcoin’s price and the global M2 money supply.

According to crypto expert Colin Talks Crypto, the growth in M2— a measure of the money supply from central banks like the Fed, ECB, and BoJ—has accurately predicted Bitcoin’s rise from $76,000 to $105,000 since April 8. Based on this trend, Colin forecasts Bitcoin could reach $120,000 in May.

“Bitcoin is still right on track with Global M2. $120,000+ by the end of May?” Colin said.

Global M2 Vs BTC. Source: Colin Talks on X

Global M2 Vs BTC. Source: Colin Talks on X

This correlation isn’t new. Historically, Bitcoin tends to benefit and rise sharply when global liquidity increases. Given the current macroeconomic conditions, expanding the money supply may continue to fuel Bitcoin’s growth.

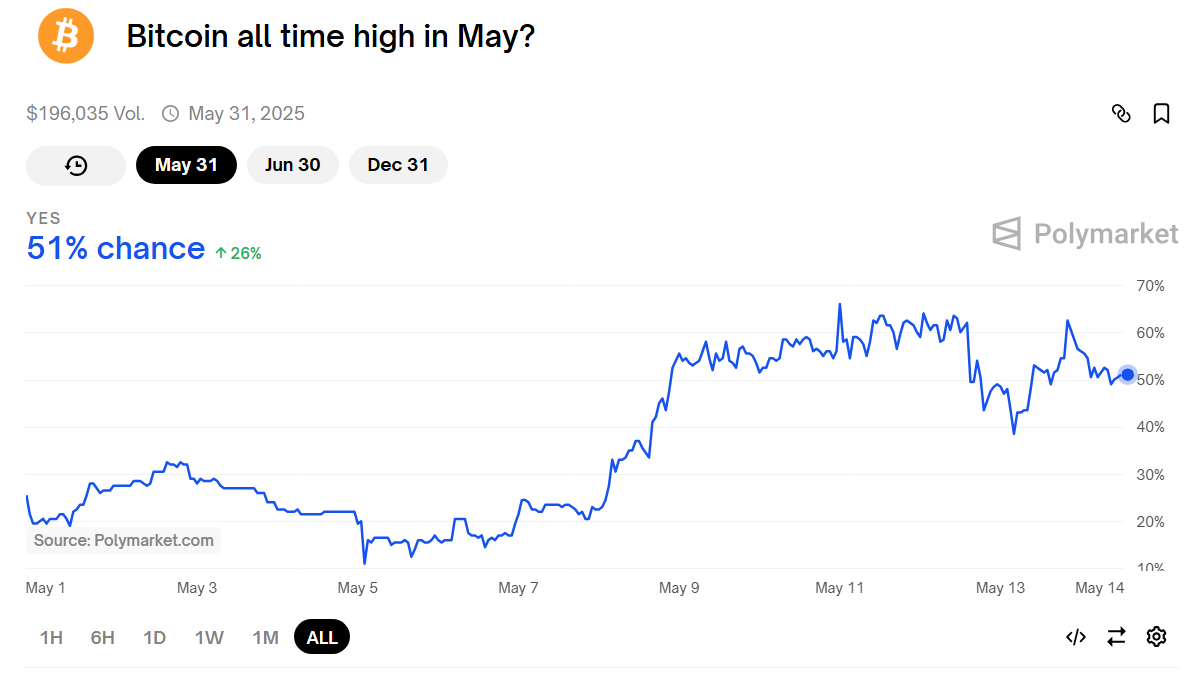

Finally, prediction market Polymarket shows that the probability of Bitcoin reaching a new ATH in May has risen from 11% to 60%, currently at 51%. Polymarket allows users to bet on future events, and this shift reflects growing optimism in the community.

“Bitcoin all time high in May?” Prediction Market. Source: Polymarket.

“Bitcoin all time high in May?” Prediction Market. Source: Polymarket.

As confidence in Bitcoin’s upward potential grows, it could trigger a FOMO (fear of missing out) effect. This may attract more investors and push prices even higher.

In fact, Bitcoin has already hit new ATHs in countries like Turkey and Argentina, where local currencies have depreciated sharply. Experts like billionaire Tim Draper predict Bitcoin will hit $250,000 by the end of 2025. Besides, Standard Chartered forecasts Bitcoin could reach $120,000 in Q2.